Yuan May Extend Drop Versus Peers as Beijing Seeks Exports Boost

China’s desire to boost exports at a time of global trade turmoil means the yuan now looks set to weaken against most major currencies. One possible exception: the dollar.

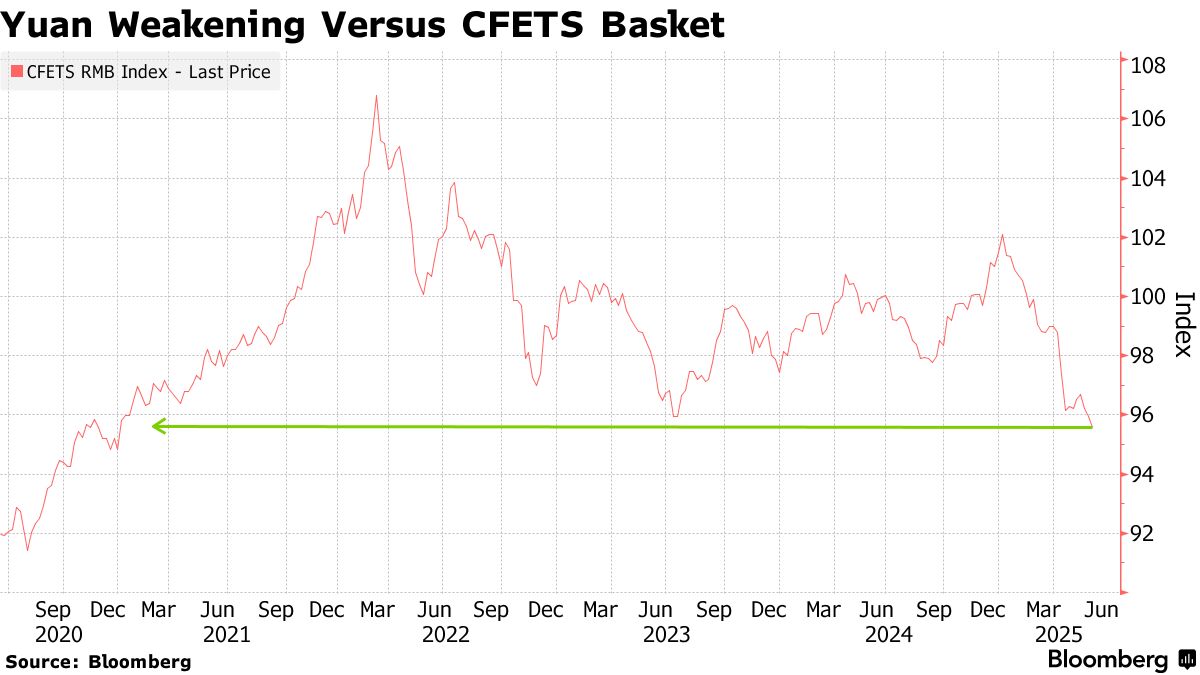

The yuan may fall as much as 3% in the short term versus an official currency basket, according to Oversea-Chinese Banking Corp., while TD Securities sees a drop nearer to 4%. The basket, tracked by the CFETS RMB Index , measures the yuan’s performance against the currencies of 25 major trading partners, including the dollar. It slipped to the lowest level since 2020 this month.

The People’s Bank of China has kept the yuan’s moves against the dollar relatively steady through its daily fixing. The diverging strategies may suggest authorities are allowing the yuan to weaken against other currencies, rather than the dollar, to preserve competitiveness and cushion its export sector during ongoing trade negotiations with the administration of US President Donald Trump.

“The selloff in the CFETS was driven by a weaker yuan against the likes of the ruble, euro and Korean won,” said Alex Loo , a macro strategist at TD Securities. “The CFETS drop could extend, and we may revisit the 2019-2020 lows close to 92 as China may allow the CNY to gradually depreciate against major pairs to bolster exports.”

Still, some analysts are cautious about the likelihood of China allowing a further depreciation in the yuan beyond its already weak levels against peers. Complaints from non-US countries for goods-dumping and the limited boost for exports may deter Beijing from taking such a strategy.

“China also has a long-term objective of making the yuan more usable, more acceptable internationally to raise the status of the renminbi,” said Ding Shuang , chief economist for Greater China and North Asia at Standard Chartered. The weakening may cause other countries to follow suit, leading to competitive devaluation that will be no good for any country, Ding added.

China’s central bank has its currency against the dollar, a move seen by markets as a show of good will amid trade talks with Washington and to avoid the label of a foreign-exchange . The PBOC has maintained the daily fixing rates for the yuan in a tight range since mid-May.

“This continues to suggest that a softer dollar allows for yuan softness to play out against other regional FX,” said Christopher Wong , a senior foreign-exchange strategist at OCBC. “This trend of a softer dollar means softer CFETS can continue.”

Falling Exports

In May, China’s exports grew just 4.8% year-over-year, forecasts of 6%, with shipments to the US recording their steepest drop since 2020 despite a trade truce agreed last month.

With export momentum fading, markets are turning their attention to key domestic economic indicators such as retail sales and industrial output due Monday to assess whether other parts of the economy can offset the weakness. A downside surprise may intensify reliance on external demand, reinforcing the need for a more competitive yuan.

“The CFETS Index is broadly tracking the US dollar,” said Khoon Goh , head of Asia research, Australia & New Zealand Banking Group. “Near-term we could see the index fall further, as the Chinese authorities would want to maintain a competitive exchange rate to help support exports.”

This week’s main economic events: