Mounting Israel-Iran Conflict Amps Up Geopolitical Market Risks

Financial markets are set to reopen Monday with investors squarely focused on escalating geopolitical tensions as Israel and Iran continue to bombard each other with no sign of a pause.

Israel on Sunday reported new missile attacks from Iran, and said it was carrying out simultaneous strikes on Tehran, as the two countries faced off for a third day in what is fast becoming the longtime adversaries’ most serious entanglement yet.

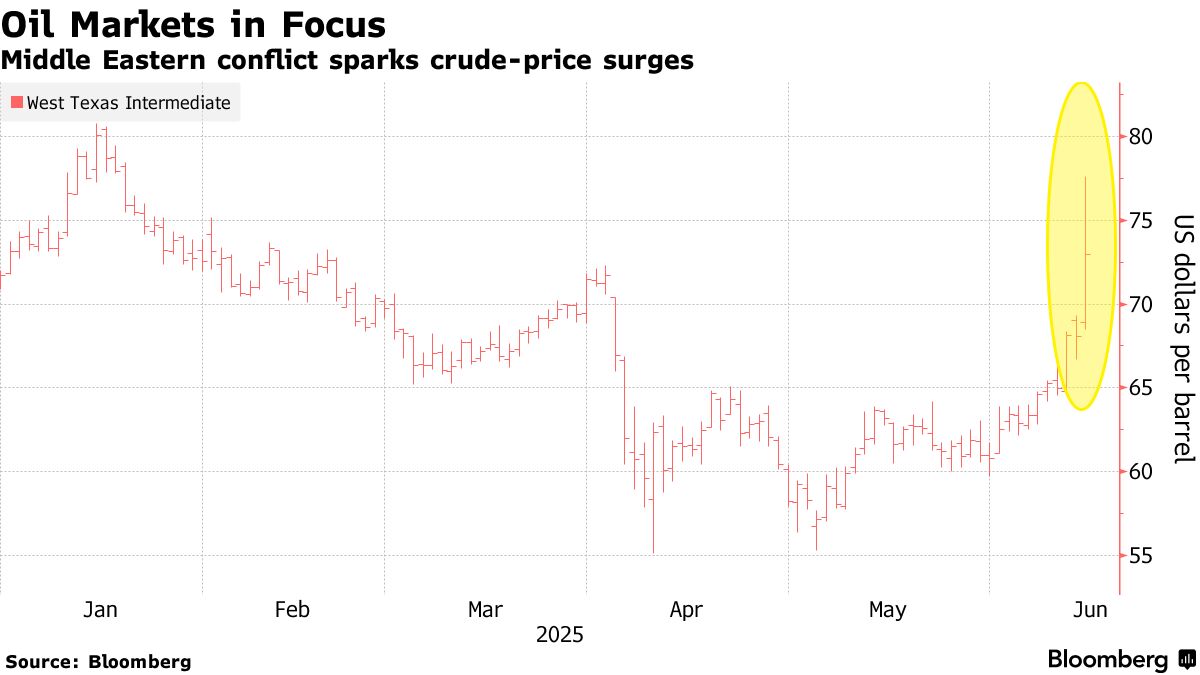

The biggest market reaction so far has been in oil, with crude prices surging more than 7% on Friday on concerns the conflict might widen to cause disruptions in a key oil-producing region. Traditional haven assets such as gold and the dollar rose, although fresh inflation fears undermined Treasuries . Bitcoin edged higher as of late morning in New York on Sunday.

Some investors ended last week choosing to wait to gauge how long the tensions would last, mindful of similar standoffs between the two nations that eventually de-escalated. Still, the extension of the conflict and intensity of the current hostilities is likely to cast a shadow over risk assets on Monday. Already, the MSCI World Index of developed-market equities fell the most since April on Friday following Israel’s initial air strikes on Iran.

“This is a significant escalation, to the point where these nations are at war,” said Michael O’Rourke , chief market strategist at JonesTrading. “The ramifications will be larger and last longer,” with weakness in equity markets likely, especially after recent gains, he said.

Regional Risks

In the region, most slumped on Sunday, with Egypt’s main gauge tumbling by the most in 13 months and Saudi Arabia’s touching its lowest since October 2023 in intraday trading. Israel’s equity benchmark erased its losses as military supplier Elbit Systems Ltd. rallied.

Traders are weighing the fresh geopolitical risks at a time when they are also grappling with destabilized global trade relationships, the prospect of new tariffs from US President Donald Trump , economic cross-currents, the ongoing conflict between Russia and Ukraine and rising political tensions in the US amid protests.

“Unless oil stays elevated and drives inflation higher, this is more likely a pause than a panic as other narratives are driving the market,” said Dave Mazza , chief executive officer, Roundhill Investments. “It may present a buying opportunity, but with markets having rallied sharply off recent lows, gains from here will be harder to come by.”

Following are comments from strategists and analysts on how they expect investors to respond on Monday:

George Saravelos , global head of FX strategy at Deutsche Bank AG

Wolf von Rotberg , equity strategist at Bank J. Safra Sarasin

Hasnain Malik , strategist at Tellimer

Martin Bercetche , founder at Frontier Road Ltd.

Alexandre Hezez , chief investment officer at Group Richelieu

Gilles Guibout , head of European equities at AXA IM

Christopher Dembik , senior investment adviser at Pictet Asset Management

Anthony Benichou , cross-asset sales trader at Liquidnet Alpha

Andrea Tueni , head of sales trading at Saxo Banque France

Arthur Jurus , head of investment office at Oddo BHF Switzerland

Raphael Thuin , head of capital-market strategies at Tikehau Capital

Dennis Debusschere , founder of 22V Research

Doug Ramsey , chief investment officer at the Leuthold Group

Steve Sosnick , chief strategist at Interactive Brokers

Vincent Juvyns , chief investment strategist at ING