BofA Touts Hedges as Emerging Markets Shrug Off Middle East Risks

Currency bets across Europe, Middle East and Africa offer the best hedges against a rebound in the US dollar as investors grow complacent about risks from escalating geopolitical tensions, says.

“We are concerned that markets underestimate the risks from the Iran situation,” David Hauner , head of global emerging markets fixed-income strategy, wrote in a note. “If energy prices spike materially, the crowded USD short position is likely to be vulnerable, and with it positioning across EM.”

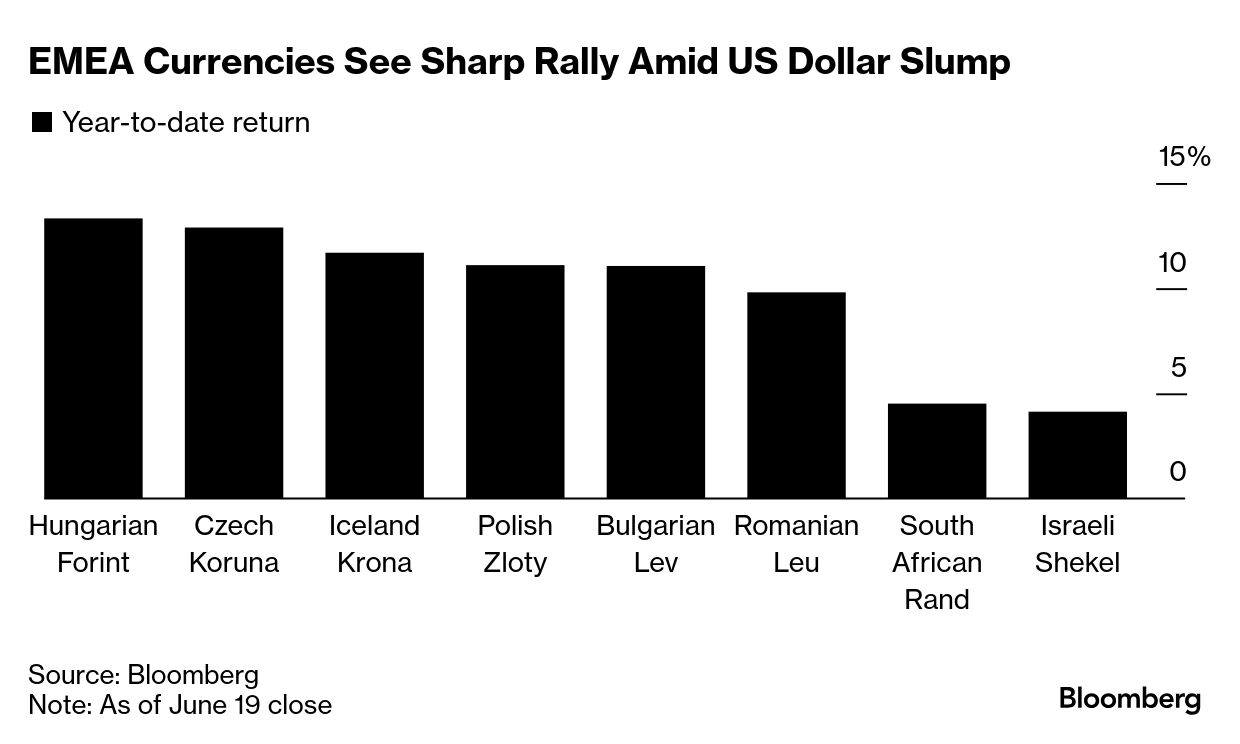

The Wall Street bank, which has been negative on the US dollar and bullish on emerging markets since mid-January, sees room for a greenback bounce in the short term as liquidity worsens going into the summer. Bracing for declines in the Hungarian forint versus the dollar or betting against the South African rand stand out as the best protections, Hauner said, adding that the two names are some of the most crowded developing currencies.

A gauge of emerging-market currencies is up more than 6% this year, with money managers from Lazard Asset Management Ltd. to Pictet Asset Management Ltd. predicting additional gains amid a rotation away from US assets. The index briefly pared gains this week as traders weighed the likelihood of a US attack on Iran.

Read More:

BofA has closed some of its recommended trades across the asset class since the escalation of the Israel-Iran conflict. More recently, it scrapped an advice to buy dollar bonds from Argentina, Ecuador, Sri Lanka and South Africa.

“We don’t see very crowded trades” in external debt, Hauner said. “Cash is likely the best hedge, to be deployed on a correction.”