Surge in Euro Options Trading Adds to Chances of Hitting $1.20

Blockbuster euro trading volumes in the $300 billion-plus foreign exchange options market are another sign investors are betting the currency’s gains may have room to run.

Trading volume was more than $56 billion on Thursday, according to Depository Trust & Clearing Corporation data compiled by Bloomberg. That’s more than quadruple the volume for the yen, the second-most traded currency at $13 billion, and some five times more than volumes for the Canadian dollar which came next.

FX traders are focusing on euro call options — which gain in value if the currency rises versus the greenback — and the volume of contracts betting on a break of $1.20 climbed over the past week, the data showed. It’s a signal that fresh funds are piling into bullish euro strategies as the US trade war and deepening fiscal jitters for the dollar.

“It’s full steam ahead for euro bulls and we’re seeing that reflected in options markets this week,” said Shoki Omori , chief strategist at Mizuho Securities Co. in Tokyo. “If Trump really shuts down trade, the eurozone will be the largest economic ‘state’ outside the US and investors would want to trade the currency.”

The common currency advanced past 1.17 on Thursday to trade at its strongest against the dollar since September 2021, as the Iran-Israel truce and expectations for Federal Reserve interest-rate cuts weighed on the greenback. Germany’s historic fiscal spending plans are also bolstering investor confidence that Europe is finally shaking off years of stagnation, adding to the case of owning the common currency.

The euro has strengthened against almost every Group-of-10 currency in the past month, and is trading near the highest in a decade against the likes of the yuan . European Central Bank President Christine Lagarde’s speech at Sintra next week may provide traders with their next catalyst.

“The fleeting support for the greenback, born of geopolitical tensions and its traditional safe-haven appeal, has all but evaporated,” said Antonio Ruggiero , strategist at foreign exchange and global payments firm, Convera. “The euro will continue to benefit from persistent dollar pessimism.”

The euro traded little changed at $1.1688 in Asia Friday, having advanced more than 15% from its February low. The common currency last traded at $1.20 in June 2021.

To be sure, some warn that the euro’s gains are at risk of losing steam. Short-term euro-dollar fair value has spiked, Francesco Pesole , strategist at ING Groep NV in London, wrote in a note.

“Something needs to happen on tariffs, Treasuries or the Fed, for a run to $1.20,” he said.

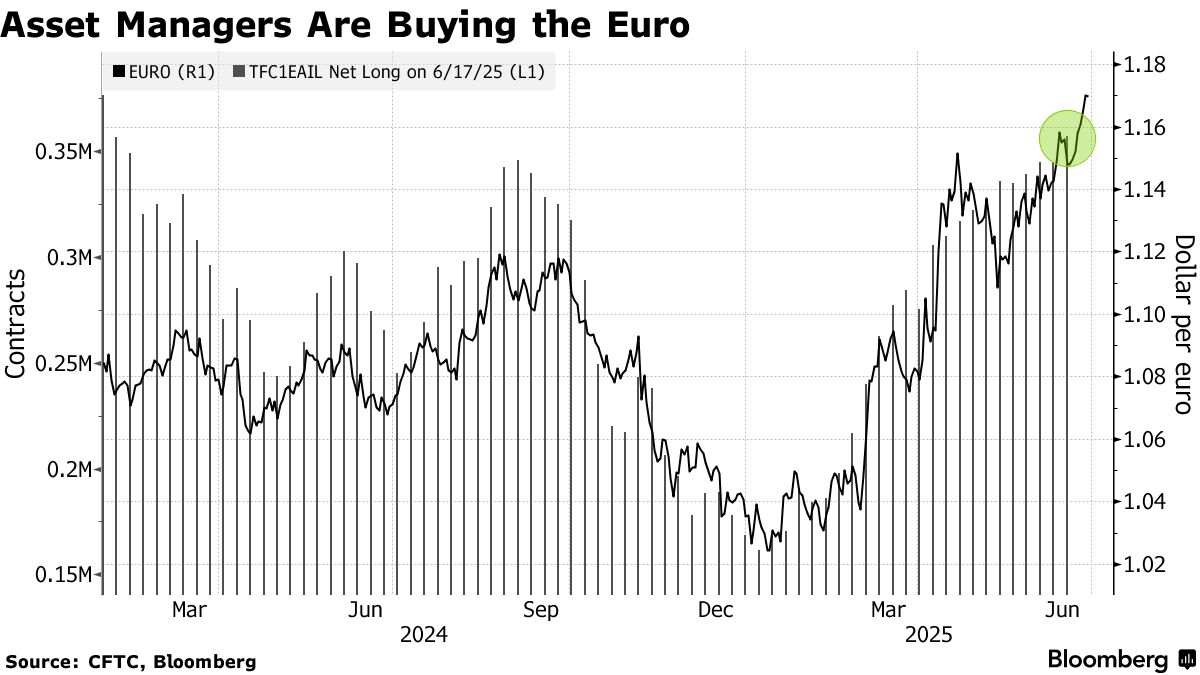

Still, options and investment positioning data suggest there’s reason for market convictions for fresh euro gains. Asset managers are most bullish on the common currency since early 2024, Commodity Futures Trading Commission data show . Hedge funds are also least bearish on the euro since April.

“The ECB nearing the end of its easing cycle while portfolio flows and reserve diversification out of the dollar may favor alternative reserve currencies such as the euro,” Oversea-Chinese Banking Corp. strategists including Frances Cheung and Christopher Wong wrote in a note.