Taiwan Dollar Falls Rapidly Again, Reinforcing Intervention Talk

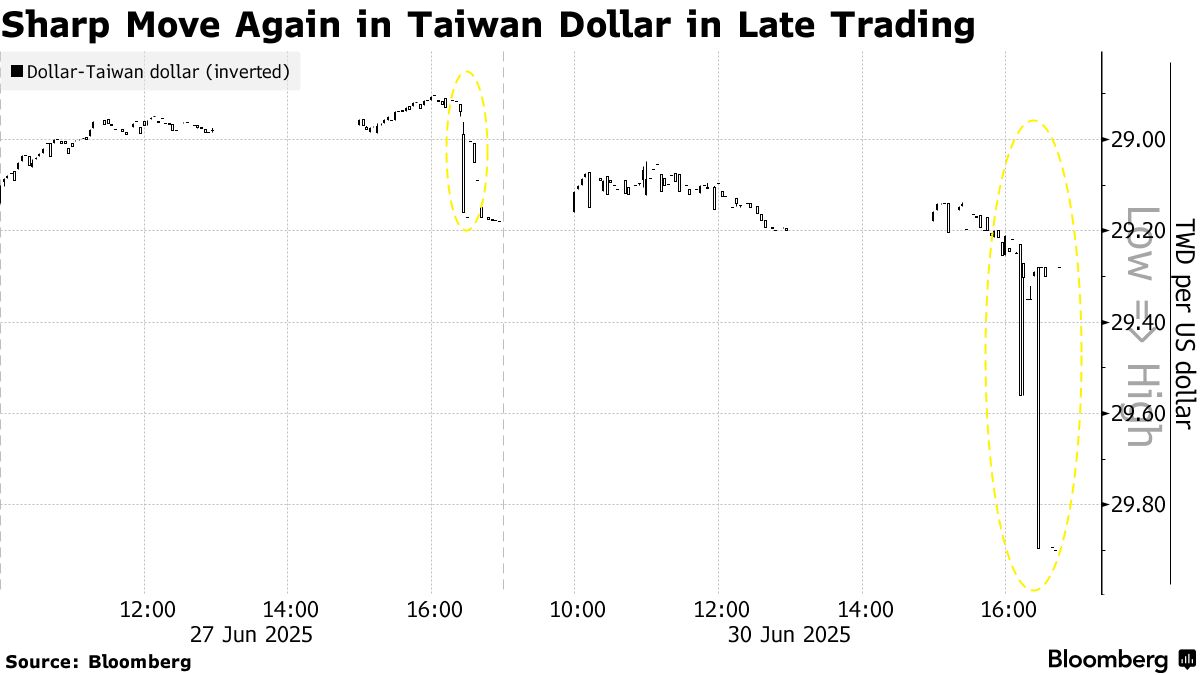

The Taiwan dollar slumped in a sudden move in late trading, following a pattern seen on Friday and fueling speculation the central bank intervened to curb strength in the currency.

The currency plunged more than 2% against the greenback to as weak as 29.895, according to data compiled by Bloomberg. The trading pattern — a sudden slump towards the end of the session — resembled a move seen last week that stoked bets the central bank may have sold the local dollar after it jumped to a three-year high.

State banks were seen buying the US dollar, according to three traders, who asked not to be identified as they weren’t authorized to speak publicly.

With its more than 10% advance, the Taiwan dollar is Asia’s best performer this year. The surge comes as foreign investors snapped up local shares and exporters ramped up their selling of the greenback amid concerns the US currency would keep falling. Repatriation of funds from the island’s asset managers also played a role.

The rally is posing a risk to the island’s export-reliant economy and putting pressure on its life insurers, which have massive exposure to dollar-denominated assets.

“An ‘invisible hand’ is sending a strong signal to markets that their threshold for Taiwan dollar strength may be nearing its limits,” said Christopher Wong , senior foreign-exchange strategist at Oversea-Chinese Banking Corp. “Near term, some consolidation is likely as markets digest the sharp moves.”