Japan Stocks Face Further Losses on Trump Threats: Markets Wrap

Tokyo stocks were poised to extend losses after Donald Trump threats to hike tariffs on Japan and ruled out delaying the July 9 deadline for resuming higher levies on trading partners.

Futures for the Nikkei 225 pointed lower after the benchmark logged its steepest drop in almost a month on Tuesday. The S&P 500 fell after the US leader’s comments, closing little changed. The touched its lowest since 2022, as the yen led Group-of-10 gains versus the greenback, while bond yields rose as jobs data dimmed the outlook for Federal Reserve rate cuts.

Investors are closely watching how Trump decides to handle the current pause on his April tariffs, which he put on hold for 90 days to allow time for talks. The president on Tuesday deepened his criticism of Tokyo for not accepting US rice exports, and also said that auto trade between the two nations is imbalanced.

Meanwhile, Fed Chair Jerome Powell that the US central bank probably would have cut rates further this year absent Trump’s expanded use of tariffs, although he didn’t rule out easing at its meeting later this month.

Read More:

In US stocks, traders drove a rotation out of the tech megacaps that had powered the S&P 500 from the brink of a bear market. While the benchmark barely budged after notching all-time highs, a violent rotation took place at the start of July, with money chasing losers at the expense of recent winners.

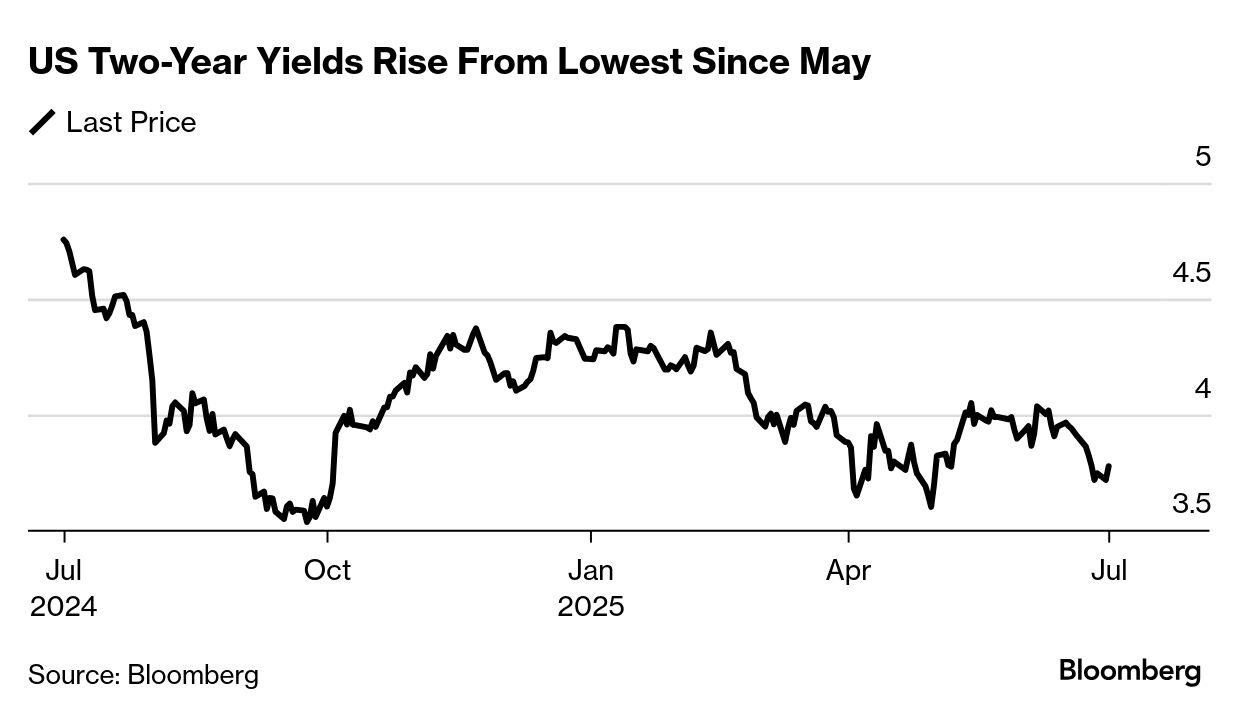

Short-dated Treasuries , which are more sensitive to imminent Fed moves, underperformed longer maturities.

US job openings hit the highest since November, largely fueled by leisure and hospitality, and layoffs declined. Fed policymakers have consistently characterized labor-market conditions as strong in recent weeks.

The government’s June employment report , due Thursday, is expected to show a slowdown in nonfarm payroll growth and an uptick in the unemployment rate.

“Federal Reserve interest-rate policy is likely on hold for now,” said Josh Hirt at Vanguard. “If the labor market remains on the trajectory we expect, the Fed can afford to be patient. We anticipate the Fed will be able to make two more rate cuts later this year in this environment.”

Separate data Tuesday showed contracted in June for a fourth consecutive month as orders and employment shrank at a faster pace, extending the malaise in manufacturing.

Meantime, Trump’s $3.3 trillion tax and spending cut bill passed the Senate after Vice President JD Vance’s tie-breaking vote. House lawmakers are returning to Washington from a holiday week to vote Wednesday on the Senate version of the bill but face Republican resistance from moderate and ultra-conservative GOP lawmakers.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.