Hong Kong Steps Up Defense of FX Peg as Fixed Range Tested Again

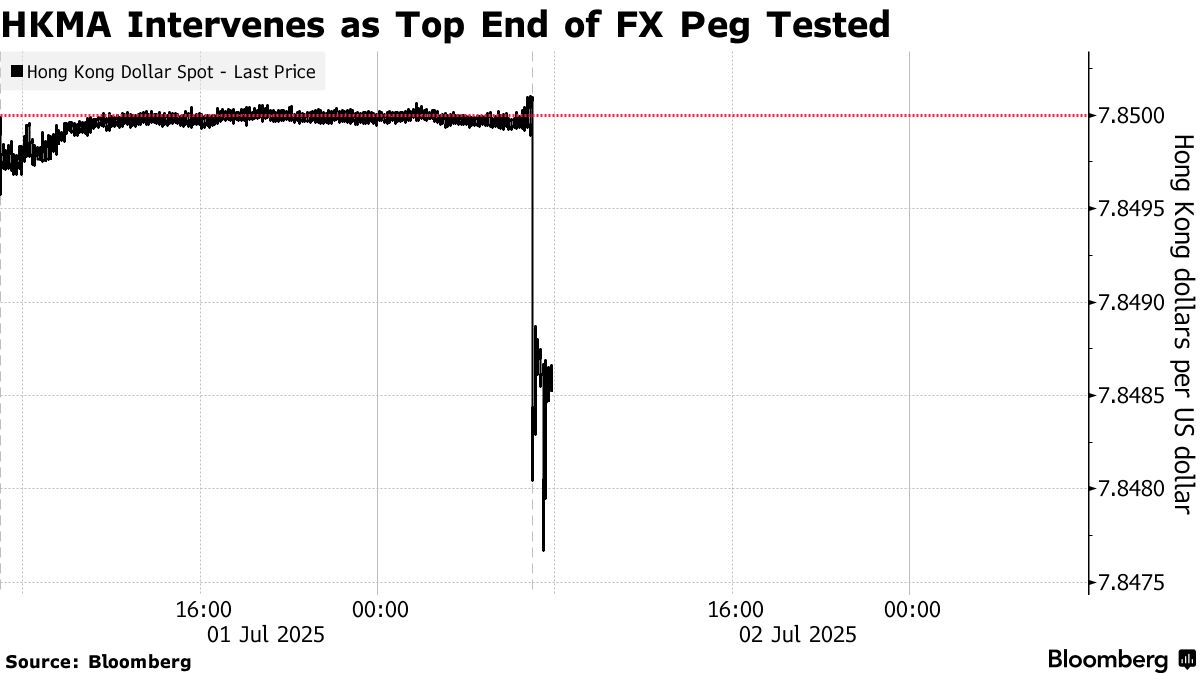

Hong Kong’s de-facto central bank ramped up purchases of the city’s currency as it sought to defend a peg that has been strained by volatility in the greenback.

The Hong Kong Monetary Authority bought HK$20.02 billion ($2.6 billion) after indicative pricing suggested the local dollar breached the upper end of its permitted trading range in late New York trading. That’s more than double the HK$9.42 billion it last week.

The intervention follows a rollercoaster ride for the Hong Kong dollar in recent months that has seen it swing between both ends of its trading range as authorities sought to protect the currency peg. The volatility has intensified debate about the sustainability of the currency’s regime, even though there are no signs that a change is imminent.

The monetary authority’s predicament stands in contrast to the dilemma faced by most other Asian central banks, which are trying to cool their currencies’ gains as the dollar declines.

The problem started in May, when the HKMA flooded the financial system with cash to rein in what had become a rapid appreciation of the Hong Kong dollar amid broad weakness in the greenback. But that served to push borrowing costs lower and drove the spread between local interest rates and those in the US to a record.

When local funding costs are significantly lower than those in the US, traders tend to borrow the city’s currency and buy the higher-yielding greenback to earn the interest-rate difference — a so called carry trade.

The latest intervention will turn trader focus to Hong Kong’s interbank rates, known as Hibor. One-month Hibor rate rose to 0.97% after HKMA intervention Thursday, but fell back to trade at 0.73% Monday.