Stocks Touch Record as Trade Deal Boosts Sentiment: Markets Wrap

Stocks touched a record high in a sign of firming risk sentiment after President Donald Trump said he reached a with Vietnam. Asian equity futures were little changed.

An MSCI gauge of global shares set a new peak after the rose 0.5% to a new high Wednesday. The gained 0.7% as tech outperformed. News of a trade deal supported apparel stocks including amid hopes the latest accord will avert a potential supply-chain catastrophe. jumped 5% as a drop in sales was seen as better than feared.

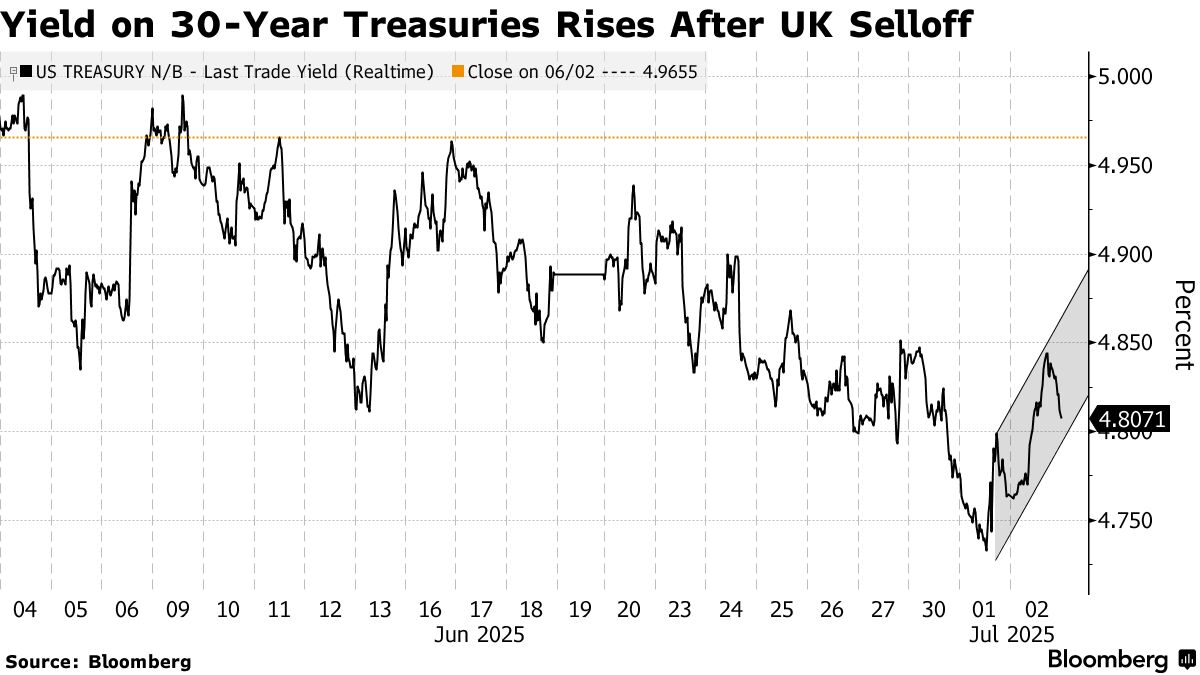

Treasuries fell Wednesday following heavy selling in the UK, where concerns about Chancellor of the Exchequer Rachel Reeves ’ future reignited questions over the nation’s fiscal position. Investors have raised similar concerns in the US, where the Senate passed Trump’s sweeping tax and spending bill.

The cross-asset moves underscored cautious optimism as traders contend with pockets of uncertainty ahead of US jobs data that will help identify the path ahead for interest rates. The US 10-year yield climbed four basis points while the UK 10-year yield soared 16 basis points Wednesday. Gold rose, oil climbed around 3% and the was little changed.

“Investors are already pricing in the One Big Beautiful Bill, at least in some form,” Zachary Griffiths , head of investment-grade and macroeconomic strategy at CreditSights, told Bloomberg Television Wednesday. “We’re going to see more supply from the US and there’s concerns fiscally across the globe” including in the UK.

The monthly nonfarm payroll data due later Thursday — a day earlier than usual due to a holiday — is forecast to show 106,000 jobs added to the economy in June, which would mark the fewest in four months.

Separate private payrolls data from ADP Research on Wednesday employment at US companies fell for the first time in over two years. Despite signs of a downshift, Federal Reserve Chair Jerome Powell has repeated the labor market remains solid. Policymakers have refrained from lowering interest rates this year as they wait to see the impact of tariffs on inflation.

“One of the reasons the Fed has been able to be patient before cutting rates was because the job market was holding up so well, so if that were to change, then the Fed may be forced to move earlier than they would like,” said Chris Zaccarelli at Northlight Asset Management.

In Asia, data set for release includes S&P Global services PMIs for Japan, trade for Australia and June Caixin composite and services PMIs for China. US markets will close early Thursday ahead of the Independence Day holiday Friday.

US Jobs

Following ADP Research’s private payrolls data, traders added to wagers on at least two rate reductions this year, with the first coming in September. If the upcoming jobs report shows further weakness, traders reckon the Fed could move up cuts.

“The ADP report increased the odds of a downside surprise in Thursday’s nonfarm payroll release,” said Jeff Roach at LPL Financial. “Investor jitters could be a catalyst for a drop in yields tomorrow if the jobs report is weaker than expected. I expect a weaker-than-consensus report, increasing the odds the Fed cuts three times this year.”

Meantime, while stock buyers have stormed back into the market over the past couple of months, Zaccarelli at Northlight Asset Management says he’d be cautious right now because valuations are high, the economy is slowing its pace of expansion and it’s possible that we’ve reached full employment.

Sentiment has been supportive of the rebound in US stocks, but the outlook for valuations and earnings suggests the rally is getting overbought from a fundamental perspective, according to RBC Capital Markets strategists led by Lori Calvasina .

“Overall conditions in US equities didn’t seem frothy quite yet but were headed down that path,” they wrote. “If we do end up getting some inflation pressure or broader economic potholes from tariffs or the Fed doesn’t cut after all, we think it will come as a negative surprise to many investors.”

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.