Yen Traders Revamp Option Bets Ahead of Japanese Elections

Option traders are beginning to flip the script on Japan’s currency with some of them bracing for political shocks, trade flare-ups, and shifting Federal Reserve expectations to push the yen lower against the dollar.

Trading volumes in dollar-yen call options, which gain in value if the yen depreciates against the dollar, more than doubled those of put options on July 11, according to data from the Chicago Mercantile Exchange Group’s central limit order book.

“There has been interest in some one-month cheapened topside structures that cover the Japan election, which could create a great deal of uncertainty in addition to the ongoing uncertainty around US-Japan tariff negotiations,” said Graham Smallshaw , senior FX spot trader at Nomura Singapore Ltd.

The options positioning contrasts with earlier data from Commodity Futures Trading Commission that showed bullish yen bets on the dollar-yen from asset managers were at a net long 89,331 contracts as of July 8.

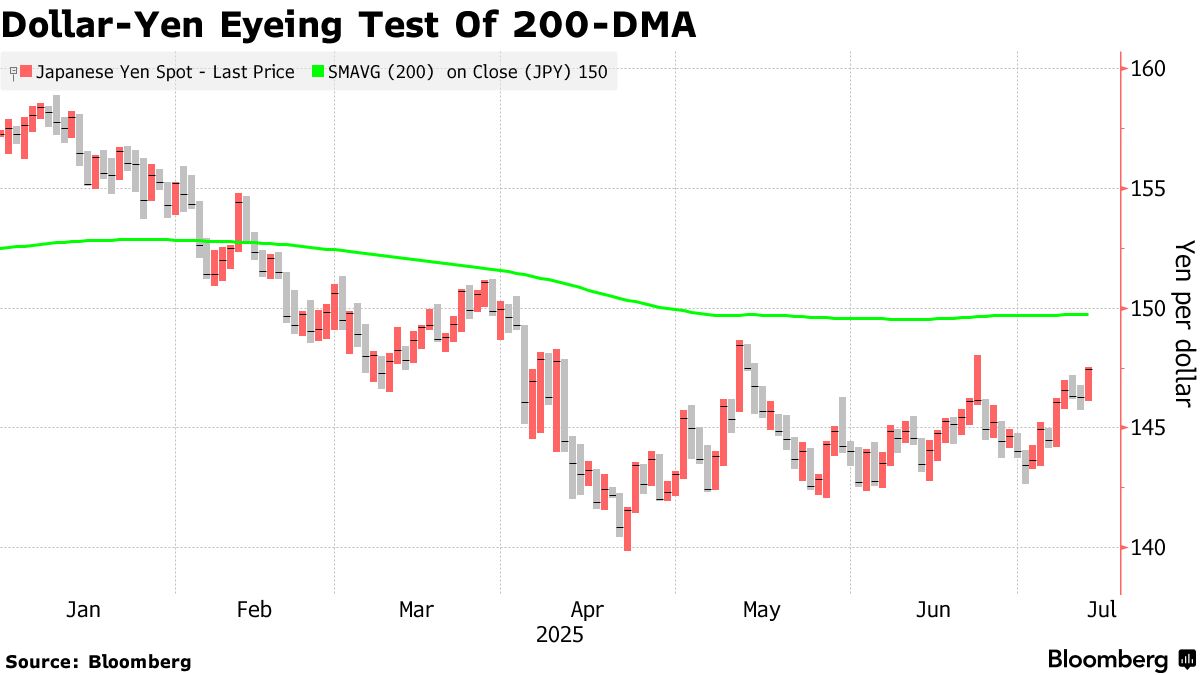

Some traders are targeting a dollar-yen rally toward its 200-day moving average, currently at 149.71, added Smallshaw. The pair closed last week at 147.43. A favored trade includes using topside options with knockout features, like reverse knock-out calls, that are more cost-effective than standard call options because they expire worthless if a specific price barrier is breached.

Expectations that the election outcome may pave the way for additional fiscal stimulus have already started to drive long-term Japanese yields higher. In a note to clients dated July 10, HSBC strategists Paul Mackel and Joey Chew noted that dollar-yen is now exhibiting a positive correlation with 30-year Japanese government bond yields and the steepening of the yield curve.

“Ahead of Japan’s upper house elections, we are seeing some funds increase their USD/JPY long positions,” said Akira Hoshino , head of markets for Japan at Citigroup. “Across yen pairs, the market anticipates a weaker yen due to the potential election outcome.”

Mackey and Chew also caution a lack of progress in trade talks between US and Japan along with fiscal concerns are “souring market sentiment on the yen.” Last week President Donald Trump that he will lift across-the-board tariffs on Japan to 25% starting on Aug. 1, citing the need to eliminate the trade deficit disparity between the two countries.

Further stoking interest in dollar-yen higher trades is the latest US non-farm payrolls report. It “seems to have caused a rethink around the timing of the US slowdown, and delayed potential rate cuts from the Fed which in turn has seen some interest in summer carry” trades, said Smallshaw. Carry trades involve borrowing in a low-interest-rate currency, like the yen, and investing in a higher-yielding one, such as the dollar.