Pimco Bond Chief Says Trump Will Make Orthodox Choice for Fed Chief

US President Donald Trump is likely to stick with convention when he picks the next Federal Reserve Chair, according to one of the world’s biggest bond managers.

Despite Trump’s vocal calls for lower interest rates and his public admonishments of current Fed chief Jerome Powell , the names rumored “all look like well qualified candidates,” said Andrew Balls , global fixed income chief investment officer at Pacific Investment Management Co LLC.

Although Powell — who Trump himself appointed — isn’t due to bow out until May, the President has already indicated that he has various candidates in mind. The front-runners include Kevin Warsh and Kevin Hasset , along with current Fed official Christopher Waller , who was formally nominated by Trump in 2020. US Treasury Secretary Scott Bessent is also in the mix.

The need for Senate approval further reduces the chance of an unorthodox choice, Balls added.

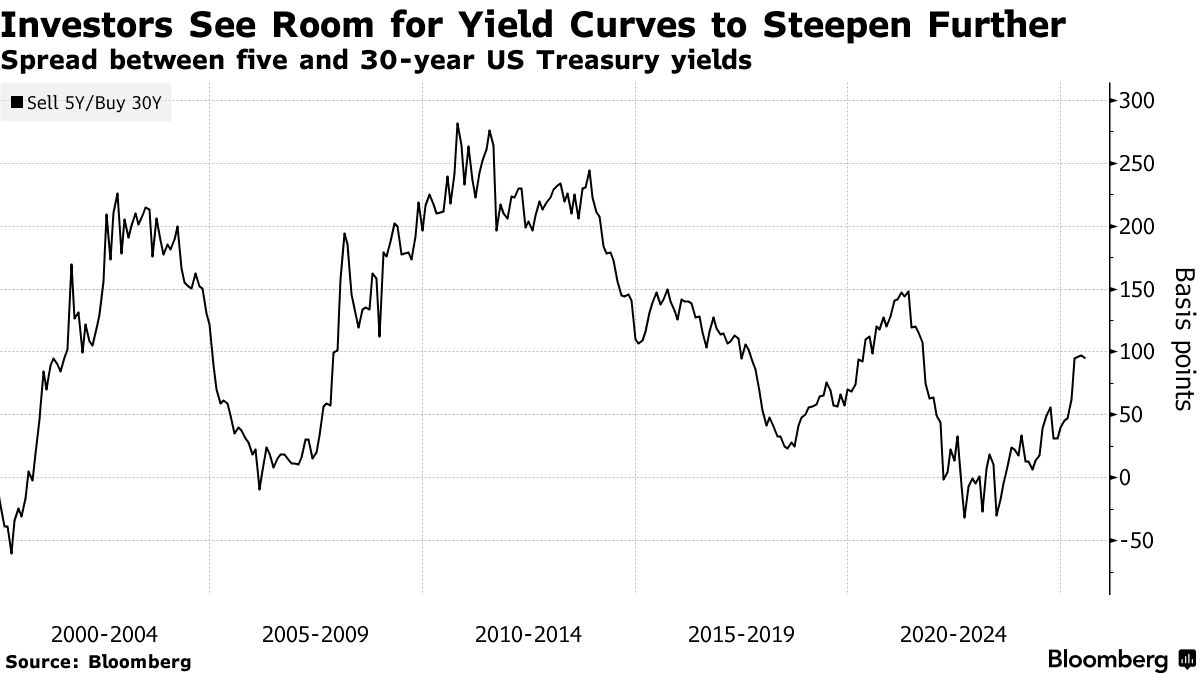

Balls said the $2 trillion asset manager was also sticking with its so-called steepener position, which has become one of Wall Street’s favored trades, because there remains a bias for central bank easing as growth slows and inflation cools.

Markets are pricing around 50 basis points of easing by December from the Fed, which has yet to lower borrowing costs this year. That should act as an anchor for shorter maturities, but the long-end looks more vulnerable, Balls said.

US Treasury sales of 10-, and 30-year debt this week met with reasonable demand, though yields have risen some 20 basis points since the start of July, with the long bond stuck just shy of 5%. While US yield curves have normalized considerably already, they’ve been much steeper in the past.

Investors are demanding higher premiums to compensate for the risk of rising government bond sales and challenging fiscal outlooks both in the US and globally. There’s also a higher bar for central banks to restart bond purchases in future crises, a process known as quantitative easing, Balls said.

While certain investors need to buy long-dated bonds to match their liabilities, that’s typically not the case for asset managers such as Pimco. And with high-quality fixed income offering attractive yields, that reduces the need to buy long-dated bonds to boost returns.

“You can have a bullish view on the five-year part of the curve and a bearish view on the 30-year part of the curve,” Balls said. “This trade can work in more than one way.”