US Futures Drop as Trump Steps Up Tariff Threats: Markets Wrap

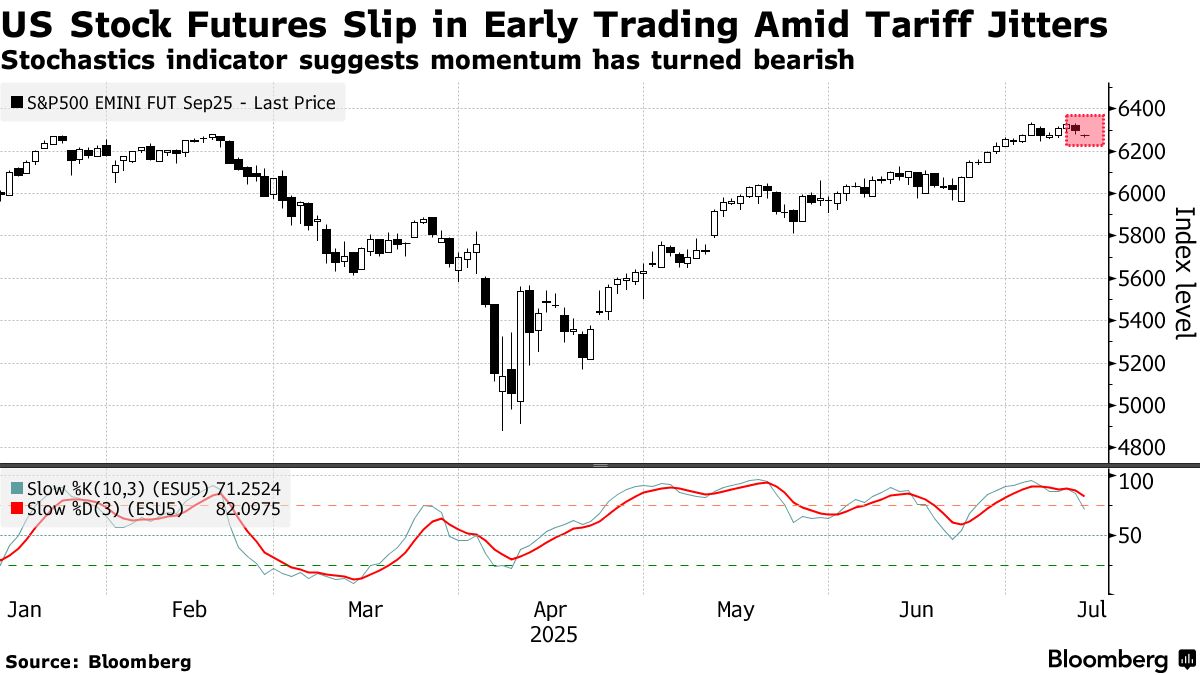

US equity futures dropped on Monday following President Donald Trump’s weekend of a 30% tariff on goods from the European Union and Mexico effective Aug. 1.

S&P 500 contracts fell 0.4% in early Asia trading. The dollar and Japanese yen edged higher against major peers while the Australian and New Zealand dollars slipped.

Trump’s latest tariff threats are testing the market’s resilience after the US leader ratcheted up trade measures on everyone from Canada to Brazil to Algeria last week. Despite warnings of complacency, investors have so far behaved as if they’re counting on the president to back down, having seen previous U-turns from his administration.

“Investors shouldn’t bank on Trump only bluffing with the 30% tariff threat on EU goods,” Brian Jacobsen , chief economist at Annex Wealth Management, wrote in an email. “That level of tariffs is punitive, but it likely hurts them more than the US, so the clock is ticking.”

Financial markets have been struggling with how to price in the on-again, off-again tariff campaign instigated by Trump so far in his second term. While markets responded to the April 2 “Liberation Day” announcements by selling risk assets and even US Treasuries, those moves have now almost all reversed as the president delayed many of his threatened levies.

The EU had been trying to conclude a tentative deal with the US to stave off higher tariffs, but Trump’s letter punctured the recent optimism in Brussels. The US president did, however, leave an opening for additional adjustments. The EU is now step up its engagement with other countries hit by Trump’s tariffs, according to people familiar with the matter.

“Why would any country enter into a trade deal with the US after seeing how Mexico and Canada have been treated a few years after signing the USMCA?,” Win Thin , global head of markets strategy at Brown Brothers Harriman, wrote in a note to clients. “At some point, markets will react to what we see as an ongoing erosion in US policy credibility.”

Elsewhere, Trump and his allies’ criticism of Jerome Powell’s handling of the expensive renovation of the Fed’s headquarters — with some administration officials building a case to remove Powell from the Fed’s Board of Governors — may also weigh on markets at the start of the week.

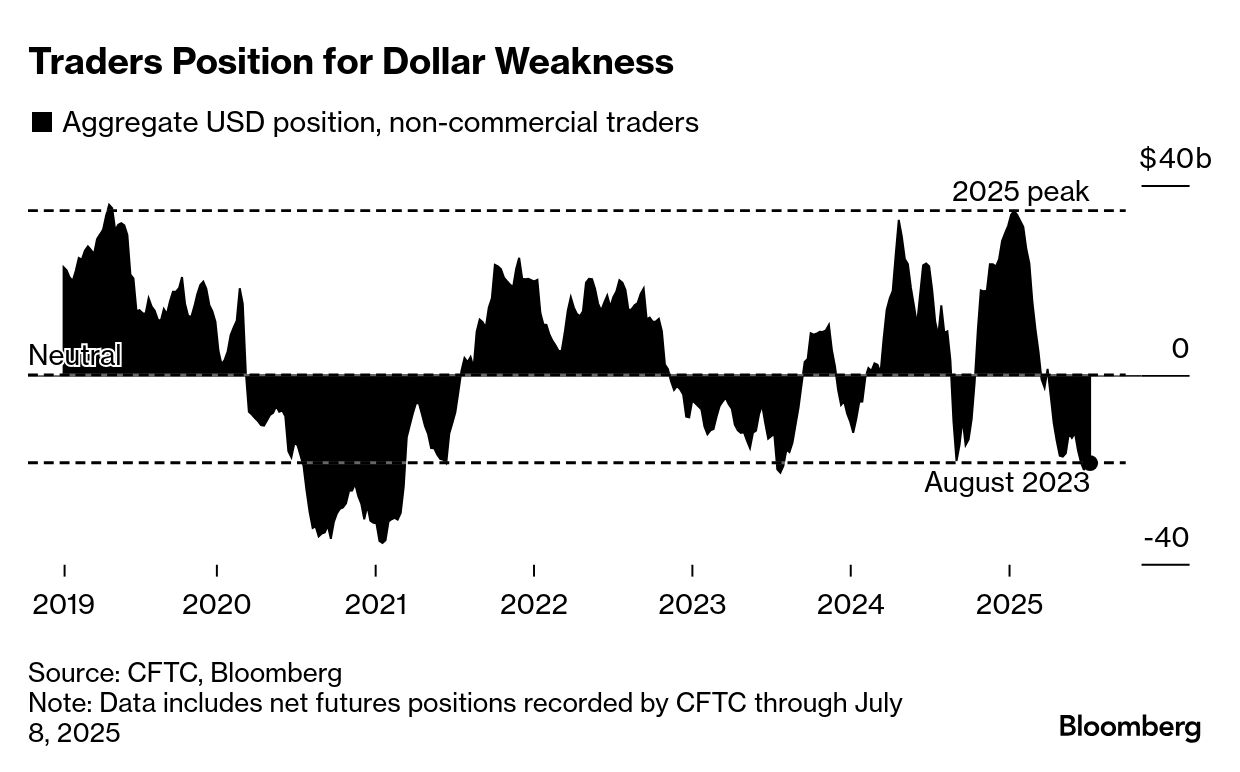

Deutsche Bank AG strategist George Saravelos said the potential dismissal of Powell is a major and underpriced risk that could trigger a selloff in the US dollar and Treasuries.

“If Trump were to force Powell out, the subsequent 24 hours would probably see a drop of at least 3% to 4% in the trade-weighted dollar, as well as a 30 to 40 basis point fixed-income selloff, Saravelos said.

Focus in Asia will soon shift to Chinese trade data to gauge the impact of US tariffs and the potential of front-loading of shipments. China’s gross domestic product report is also due this week, along with a slate of key data including inflation readings in Europe and the US.

Read More:

The second quarter earnings season is also due to begin this week, with Wall Street expecting the reporting season since mid-2023. It comes at a time that corporate credit ratings downgrades are .

“The upcoming Q2 earnings reporting season will test the market’s balance between momentum and value,” Bob Savage, head of markets macro strategy at BNY, in a note to clients. “Global equity holdings look vulnerable to outside shocks – and are unlikely to find much comfort in rate cuts or trade tariff extensions.”

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities