Asian Stocks Set for Gains as Tariffs Downplayed: Markets Wrap

Asian equities are set for a positive open as traders brush off President Donald Trump’s latest tariff threats as bargaining tactics that are unlikely to derail global trade.

Tokyo, Hong Kong and Sydney futures pointed higher in early Asia trading. The eked out a gain as Trump indicated he’s open to trade talks, though still insisted his new tariff rates are “the deals.” fell as the US president’s plan to pressure Russia into a ceasefire with Ukraine didn’t include new measures aimed directly at hindering Moscow’s energy exports.

Trump to impose secondary levies of 100% on Russia if it doesn’t end hostilities with Ukraine. That’s after he unleashed more tariff threats at the weekend, declaring a 30% rate for Mexico and the European Union, and informing key trading partners of new rates that will kick in on Aug. 1 if they can’t negotiate better terms.

“We view the latest move from the White House as a negotiating tactic, and maintain our base case that the US effective tariff rate will settle around 15%, which we believe will allow the S&P 500 to rise further over the coming 12 months,” said Mark Haefele at UBS Global Wealth Management.

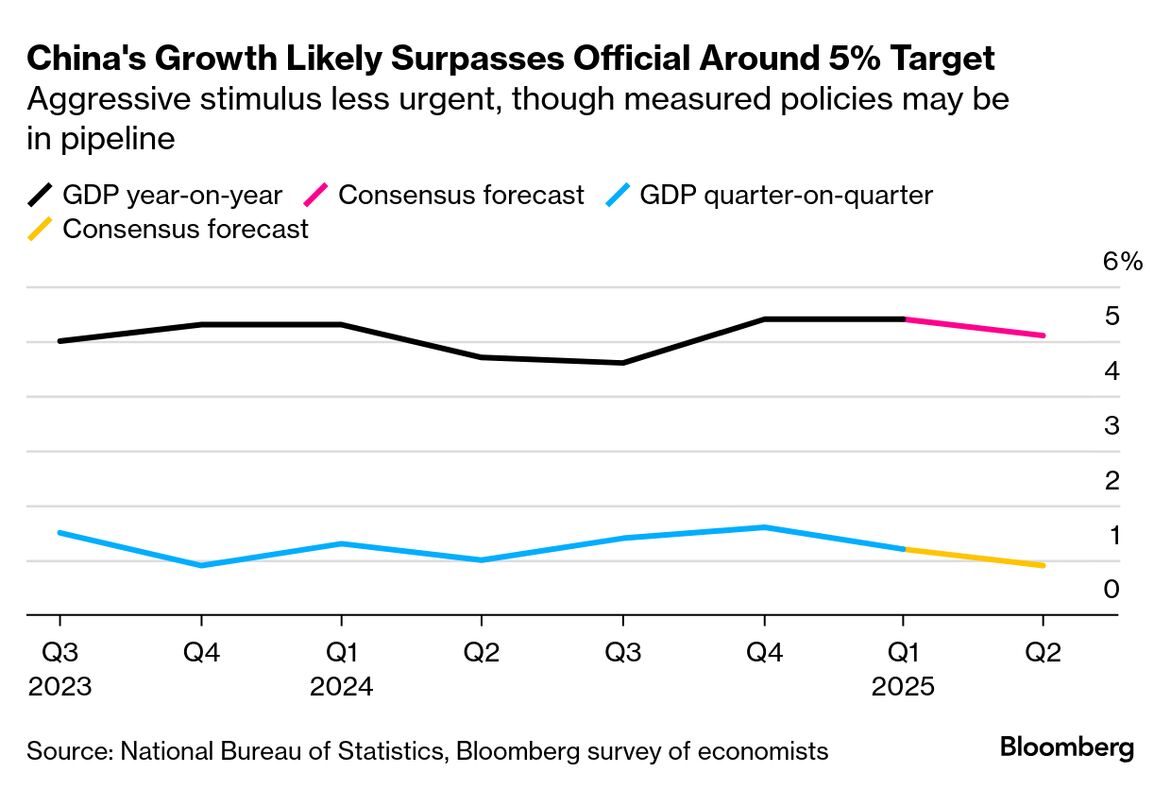

In Asia, eyes will be on Beijing’s release of second-quarter data that’s expected to show China’s economy likely expanded just above the government’s full-year growth target of 5%, easing pressure on the need for additional stimulus in the near term.

That print is due a day after data showed China ended the first half of the year with a record of about $586 billion as exports to the US began to stabilize, with factories riding out the tariff rollercoaster that upended global commerce.

Still, the in the nation’s property market were shown on Monday when China Vanke Co. said its first-half loss could reach as high as $1.67 billion.

CPI, Earnings

In the US, traders are gearing up for results from and inflation data. While Corporate America is bracing for its since mid-2023, lower estimates could be easier for companies to beat. As US financial giants kick off earnings season Tuesday, strategists say subdued profit expectations are setting the stage for their to continue.

Treasuries saw mild losses in the run-up to the consumer price index release. After months of seeing little , the CPI probably experienced slightly faster growth in June as companies started to pass along higher costs of imported merchandise associated with tariffs.

The is betting the S&P 500 will swing 0.6% in either direction after Tuesday’s CPI, based on the cost of at-the-money puts and calls, according to Citigroup Inc. That would be in-line with implied moves the past two months, though below an average realized swing of 0.9% over the last year.

“The stock market’s muted reaction to the latest volley of tariff headlines suggests investors may be growing numb to them, or are deciding that the tariff bark will likely be worse than the eventual bite,” said Chris Larkin at E*Trade from Morgan Stanley.

To Emily Bowersock Hill , investors have become inured to the tariff drama, arguably to the point of complacency, and the S&P 500 is now overpriced.

“Absent a negative surprise, we expect the complacency to continue, particularly given the equity market’s upward momentum,” said the founding partner of Bowersock Capital Partners.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities