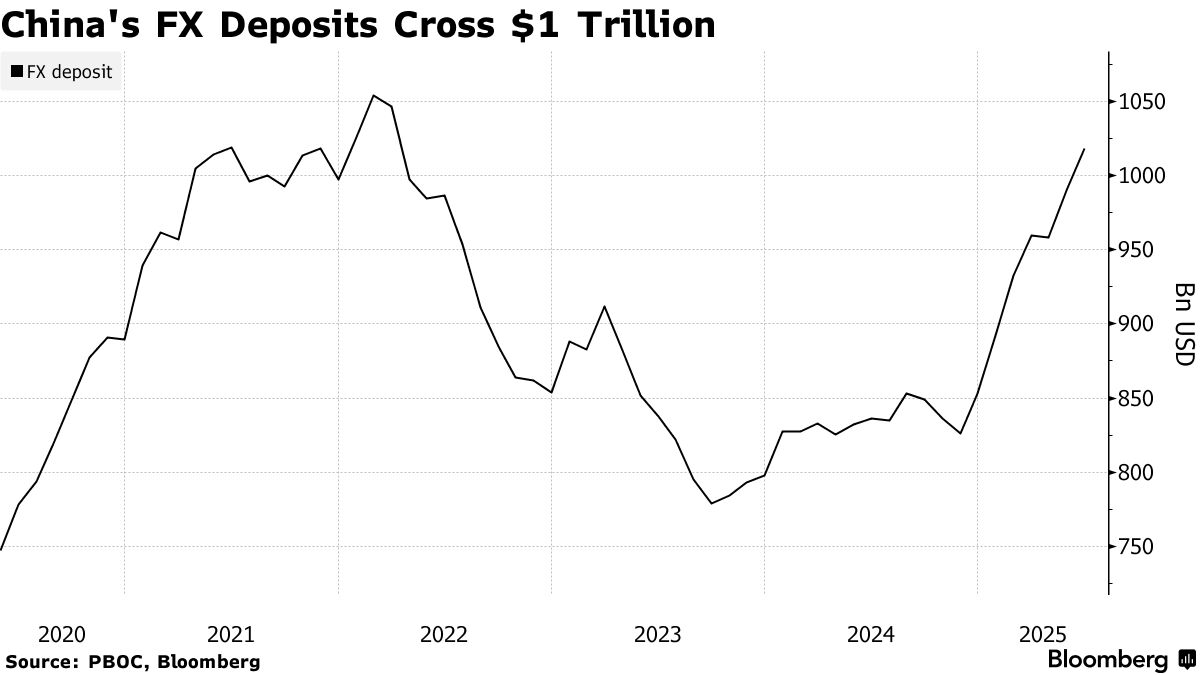

Chinese Investors’ FX Pile Hits $1 Trillion Amid Low Local Rates

Chinese corporates and households boosted their foreign-currency deposits last month to the highest in three years, as they shunned the yuan on bets domestic interest rates will remain low.

Total foreign-currency deposits onshore rose to $1.02 trillion in June, the highest since March 2022, according to data from the People’s Bank of China released Monday. The net increase in the first half of the year was $165.5 billion, the biggest jump in data going back to 2005.

The accumulation of foreign deposits reflects lower confidence in the economy and expectations for a further depreciation in the currency even as the dollar weakens amid President Trump’s tariffs and fiscal policy. Fixed-asset investments in the first half of the year missed estimates, reflecting caution among companies to deploy funds for expansion.

“This is a reflection of a low FX conversion ratio still due to a much lower interest rate for yuan than dollars,” said Becky Liu , head of China macro strategy at Standard Chartered Bank.

There is also a “strong desire to diversify the business into global markets given deflationary entitlement at home, and a lack of conviction that the yuan will continue to appreciate despite a weak dollar,” she said.

The yuan has risen in 2025 after posting losses for three consecutive years as the dollar fell more than 8% this year. Still, the yuan’s gains have lagged those in most Asian currencies as the Chinese economy continues to face and the prospect of further interest-rate cuts to support growth.

Both residents and non-financial companies increased FX savings last month. Trade surplus reached in June, the highest in five months. Exporters repatriating their proceeds onshore may have also boosted foreign deposits.

While PBOC data reflect activities in June, there are some signs that Chinese traders may have , with swap points reflecting decreasing demand for the US currency. However, any withdrawal is unlikely to be rapid with US interest rates still much higher than China’s, and with emerging over a widely expected Federal Reserve rate cut in September.

“The onshore yuan is more likely to depreciate than appreciate in the second half, on weaker economic growth, weaker exports, and stronger outbound securities investments after the ,” Liu said.

“The FX deposit will continue to increase in the second half.”