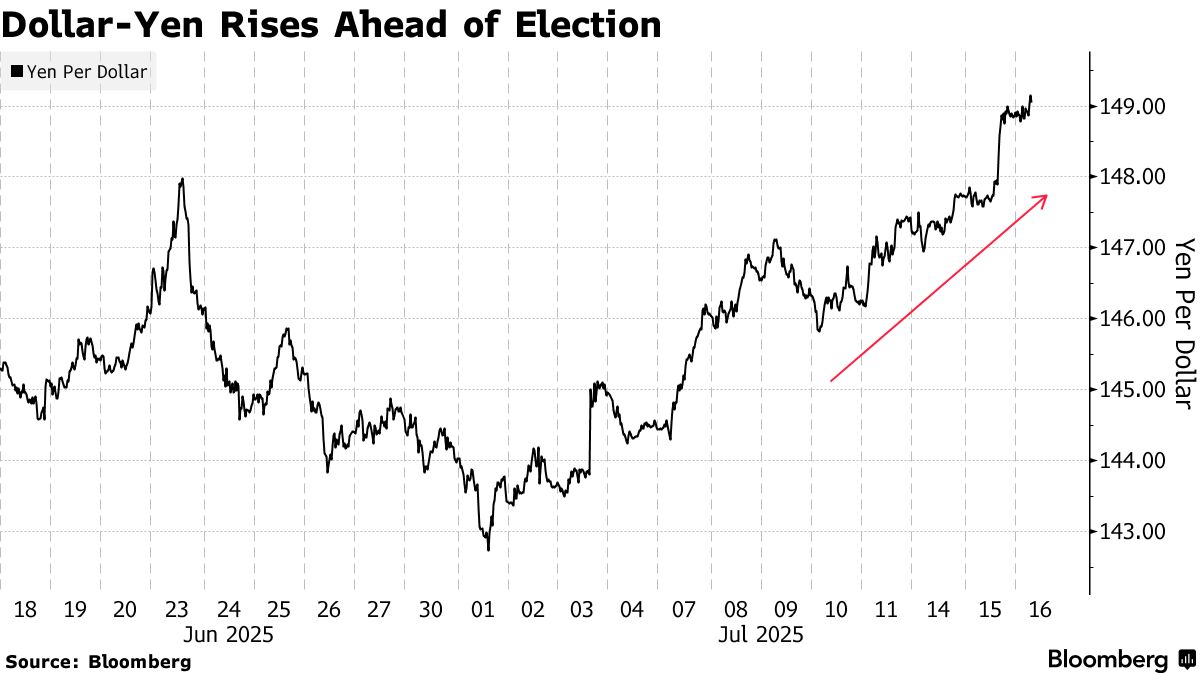

Yen Watchers Eye Possible Slide Past 150 as Japan Election Looms

Currency strategists are preparing for more weakness in the yen if Japanese Prime Minister Shigeru Ishiba ’s ruling bloc loses its majority in the upcoming upper house election.

Several local Japanese media suggest the Liberal Democratic Party-led coalition may fail to win enough seats to retain a majority. But whatever the election outcome, more government spending seems likely. To entice voters, the LDP is dangling cash handouts, while opposition parties are pushing an expensive plan to cut the sales tax.

Fiscal concerns have already driven up Japan’s bond yields to multi-year highs. But election anxiety is also weighing on the yen, which has fallen to its weakest level since April this week. In another sign of potential pressure on the currency, short-dated options bets turned net bearish on the yen versus the dollar this week for the first time in almost a year.

“Usually when yields rise, the yen should be bought, but this seems like the bad type of rising yields where there’s a big chance that Japan’s stocks, bonds and the yen will be sold off together,” said Marito Ueda , general manager of the market research department at SBI Liquidity Market. “Japan’s fiscal expansion is something that can’t be avoided, no matter how things turn out.”

The yen weakened 0.4% Thursday to 148.42 per dollar.

While the currency has also been hit by US economic data and this month’s gains in the dollar, some strategists say the election may be a catalyst to push the yen to levels not seen since early this year.

If the ruling coalition were to lose its majority, the currency could fall to the 152-per-dollar level, Ueda said. “If more polls come out saying it’s going to be an even worse result for the LDP, there’s even a chance that dollar-yen will break 150 before the election results.”

Read more:

US President Donald Trump’s tariffs have whipsawed the yen and cast a shadow of uncertainty over the Bank of Japan’s policy path. Japan’s currency has weakened against all its major peers in the past three months, and leveraged funds pared their long yen positions to the least since early April, according to the latest Commodity Futures Trading Commission data as of July 8.

Shoki Omori , chief desk strategist at Mizuho Securities Co. in Tokyo, said a massive loss of the majority by the ruling coalition may weaken the yen as far as 155 against the dollar, a level not seen since February.

“Markets will likely lose confidence in the yen and yen rates as fiscal spending expands,” Omori said.

On top of the election risk, global foreign-exchange reserve managers made an unprecedented switch from the yen to the Swiss franc in the first quarter, reinforcing the view that Japan’s currency may be losing its haven luster due to the nation’s persistent trade deficit and sluggish economic growth.

Read more: Reserve Managers Ditch Yen for Swiss Franc in Haven Bet Pivot

Then again, a better-than-expected result for the LDP would be good news for the yen, some analysts say. Mizuho Securities’ Omori said the yen may strengthen to around 144 per dollar if the ruling coalition retains its majority.

Ultimately, the yen’s outlook may hinge more closely on trade negotiations with the US as the Aug. 1 tariff deadline approaches after months of little progress.

“Once the elections are out of the way, there is also the expectation that discussions on trade negotiations between Japan and the US will progress,” said Kumiko Ishikawa , a senior analyst at Sony Financial Group.

“If the ruling coalition wins the majority, there may be some yen strength from relief, but it’ll be a temporary movement as attention shifts to how Ishiba manages to negotiate with Trump on tariffs,” Ishikawa said.