Dollar Weakens, Stocks Climb on Trump-Powell Saga: Markets Wrap

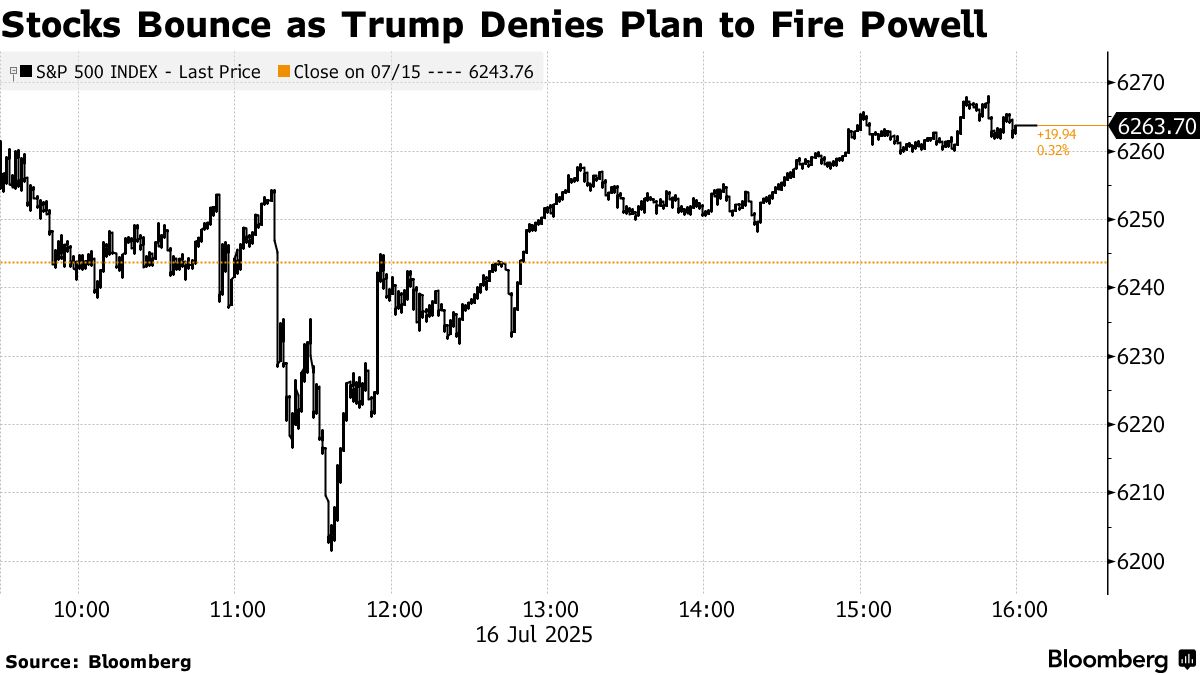

Asian equity futures struggled for direction Thursday after the dollar weakened and US stocks rose in volatile trading after President Donald Trump played down the prospect he may soon fire Jerome Powell .

Trump said he is “ on doing anything” to remove Powell, after a White House official said the president was likely to seek the Fed Chair’s ouster soon. The initial speculation sent the dollar, US stocks and Treasury yields downward before Trump’s clarification soothed market fears.

The ended the session 0.3% higher, while a 0.1% gain for the sent the tech-heavy benchmark to a new closing high. A of the greenback fell 0.3% Wednesday, ending a four-day run of gains. Treasury two-year yields fell five basis points and the 10-year yield fell three basis points.

The moves were by softer-than-estimated US producer prices , which reinforced bets on Fed rate cuts this year.

Japanese equity index futures fell early Thursday, while those for Australia and Hong Kong rose.

The trading action Wednesday hints at how Wall Street would react if Trump actually removed Powell — a prospect that strategists warn would rattle global markets.

“After the president’s subsequent backing off on remarks to remove Powell, the immediate crisis may have passed, though we doubt we are entirely done with this saga,” said Michael Feroli at JPMorgan Chase & Co.

Trump has repeatedly assailed Powell as the Fed has held off on cutting rates amid concern that tariffs may spur inflation. Treasury Secretary Scott Bessent on Tuesday suggested Powell should step down from the central bank’s board when his term as chair is up in May 2026.

The president’s remarks in the Oval Office left open the possibility of ousting Powell for cause. Trump and his allies have lambasted the Fed chair over the central bank’s decision to hold rates steady and the cost of a renovation of its Washington headquarters.

Read: What Firing Powell Would Cost the US Economy

Top bosses at some of Wall Street’s biggest banks emphasized the importance of an independent Fed.

Bank of America Corp.’s Chief Executive Officer Brian Moynihan and Goldman Sachs Group Inc.’s David Solomon joined JPMorgan’s CEO Jamie Dimon in stressing how critical the Fed’s autonomy is. Moynihan said in an interview with Bloomberg TV on Wednesday that the Fed was “set up to be independent.”

The Fed’s independence is “absolutely critical,” Dimon at JPMorgan said on a conference call Tuesday. Meddling with the Fed “can often have adverse consequences,” he noted.

A Trump dismissal of Powell would be an underpriced risk that could trigger a selloff in the dollar and Treasuries, Deutsche Bank AG’s George Saravelos recently said. If Trump were to force Powell out, the subsequent 24 hours would probably see a drop of at least 3% to 4% in the trade-weighted dollar, as well as a 30 to 40 basis point fixed-income selloff, he said.

US economic activity “increased slightly” between late May and early July, the Fed said in its survey of regional business contacts. The report also said that “uncertainty remained elevated, contributing to ongoing caution by businesses.”

Earlier Wednesday, data showed the producer price index was unchanged from a month earlier, after an upwardly revised 0.3% gain in May. US wholesale prices rose 2.3% from a year earlier, the least since September.

“Disinflation remains, but the Fed will be undeterred in keeping rates steady until September,” said Jamie Cox at Harris Financial Group. “As long as the labor market remains strong and resilient, rates aren’t likely to move meaningfully lower.”

In Asia, data set for release Thursday includes jobs data for Australia and Hong Kong, and exports for Singapore. June foreign direct investment data for China may be released any time through Friday.

Elsewhere, Japanese chipmaker sold of US junk bonds, the latest in a from the country’s corporations. In Hong Kong, a $25 billion pile of sour debt has a “bad bank” may be needed to soak up the non-performing loans.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.