Millions Wiped Off UK Debt as 239-Year-Old Agency Buys Gilts

Millions of pounds will be wiped off the UK’s debt stockpile after a two-centuries-old government body invested a gift from private donors into a gilt maturing this year.

The Commissioners for the Reduction of the National Debt — which can trace its back to 1786 — bought £586 million ($785 million) of a government bond maturing in Oct. 2025, according to accounts published Thursday. It will “cancel” these purchased notes, thus slightly reducing the UK’s roughly £3 trillion debt stock.

“The CRND purchases gilts from time to time when it is considered most beneficial for reducing the national debt,” said the foreword to the authored by Jo Whelan , Secretary and Comptroller General to the CNRD.

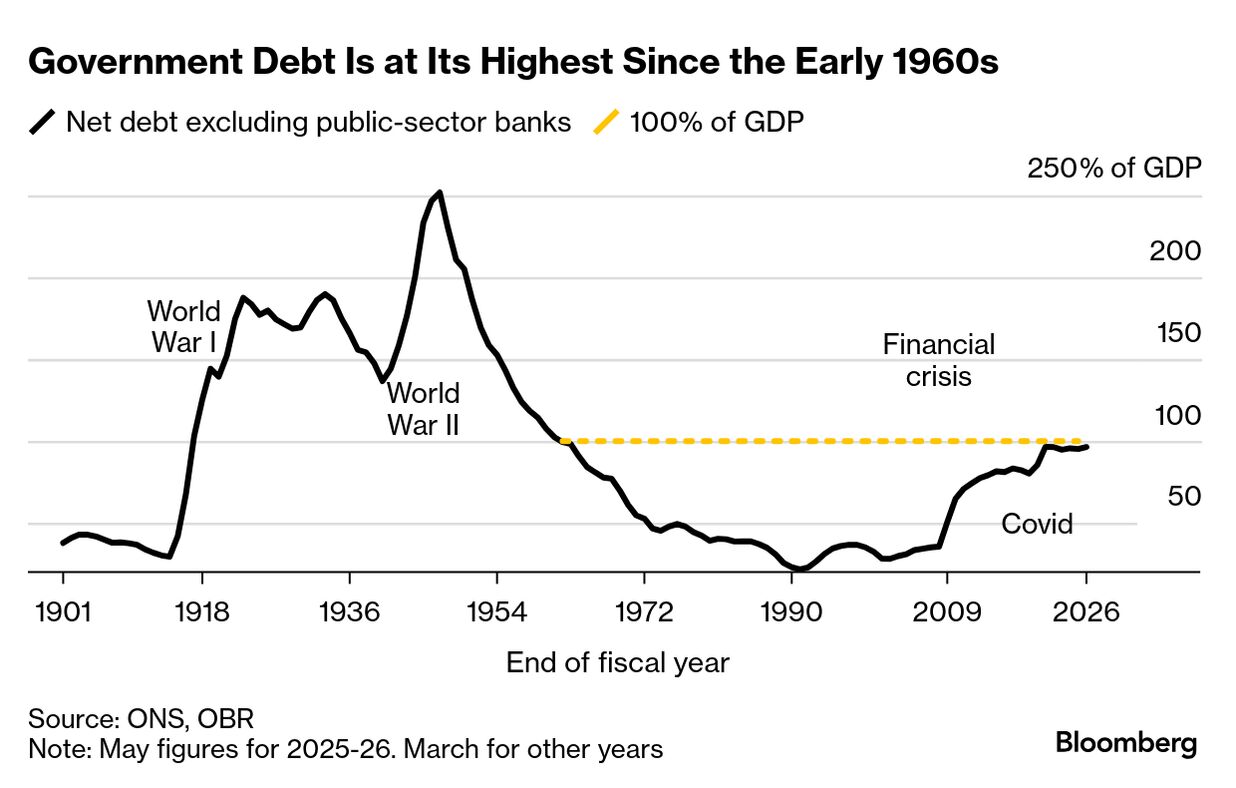

The donation came from the , which was set up in 1927 with the aim of raising enough capital to eradicate the national debt. While the reserve grew from an initial investment of around £500,000, it became clear it would likely never be enough to fully pay off outstanding debt, which has surged in recent decades.

That prompted a decision to transfer the funds early to pay off a small chunk of the national debt. In 2023, the Court of Appeal upheld a High Court judgment from 2022, which determined that the assets of the National Fund can be transferred to the National Debt Commissioners to reduce the national debt.