US Futures Climb After Trump Agrees EU Tariff Deal: Markets Wrap

US equity futures climbed after the US and European Union a deal that will see the bloc face 15% tariffs on most exports, averting a potentially damaging trade war.

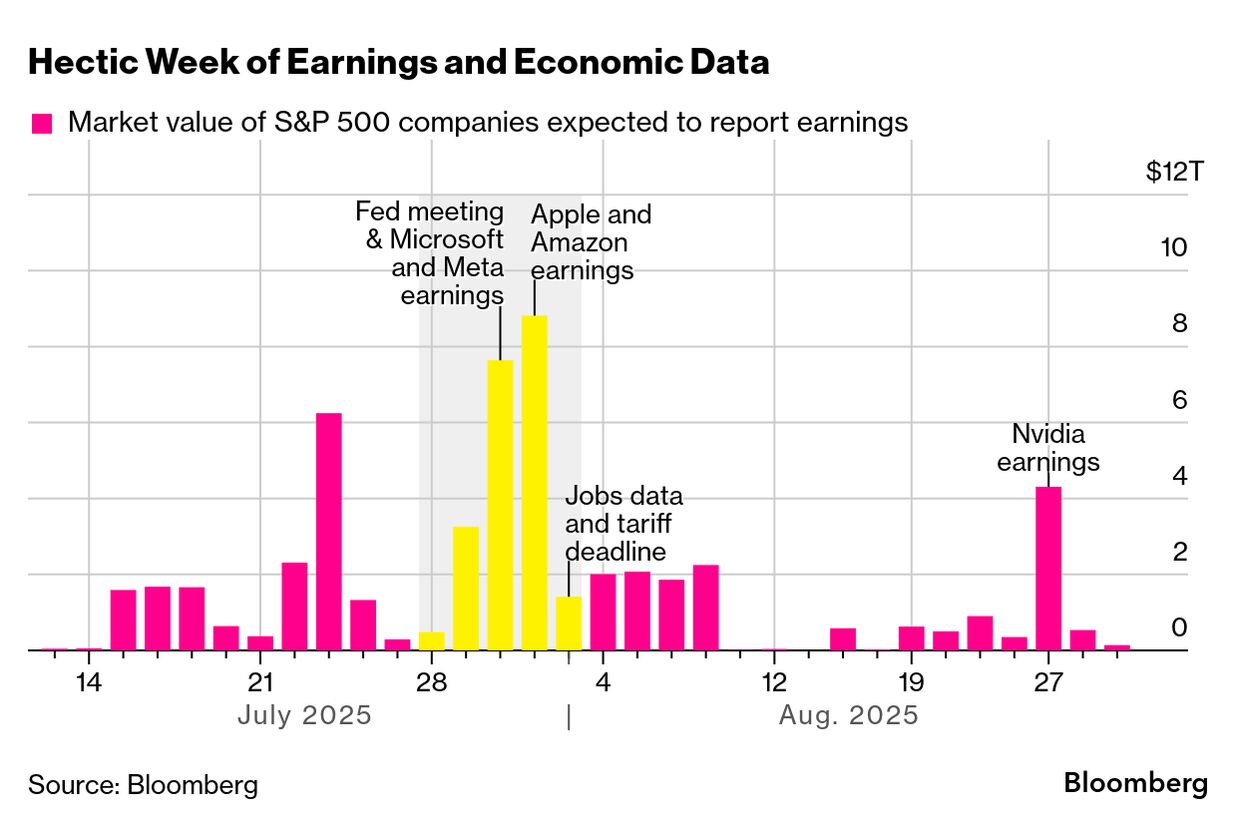

S&P 500 contracts rose 0.4% after the index notched its fifth-straight all-time high on Friday. Asian equity futures were muted as investors braced for a busy week of data including a Federal Reserve meeting and the Aug. 1 deadline for American trade pacts The euro was slightly higher against the dollar.

This week will also bring a US jobs report, while Magnificent Seven members , , and are all due to report numbers. Robust corporate earnings have bolstered investor confidence in US stocks, as companies head for their highest share of beats since the second quarter of 2021.

US President Donald Trump and European Commission President Ursula von der Leyen announced the EU deal on Sunday at his golf club in Turnberry, Scotland, although they didn’t disclose the full details of the pact or release any written materials.

Meanwhile, the US and China are expected to extend their tariff truce by another , the South China Morning Post reported, citing unnamed sources.

Elsewhere in Asia, Japanese Prime Minister Shigeru Ishiba signaled he in office despite a growing number of calls within the ruling party for him to step down. Later in the week, the Bank of Japan is set to keep interest rates with traders on alert for any signs of future guidance by the central bank.

Asian currency-watchers will be monitoring in Thailand and Cambodia after US President Donald Trump said he called the leaders of the countries to urge them to stop the fighting that erupted earlier this week, warning he wouldn’t make a trade deal with either nation while the conflict continued.

Separately, China’s industrial earnings fell for a , with authorities set to intensify their drive to rein in excessive competition that’s dragging down prices and compounding the pain from US tariffs.

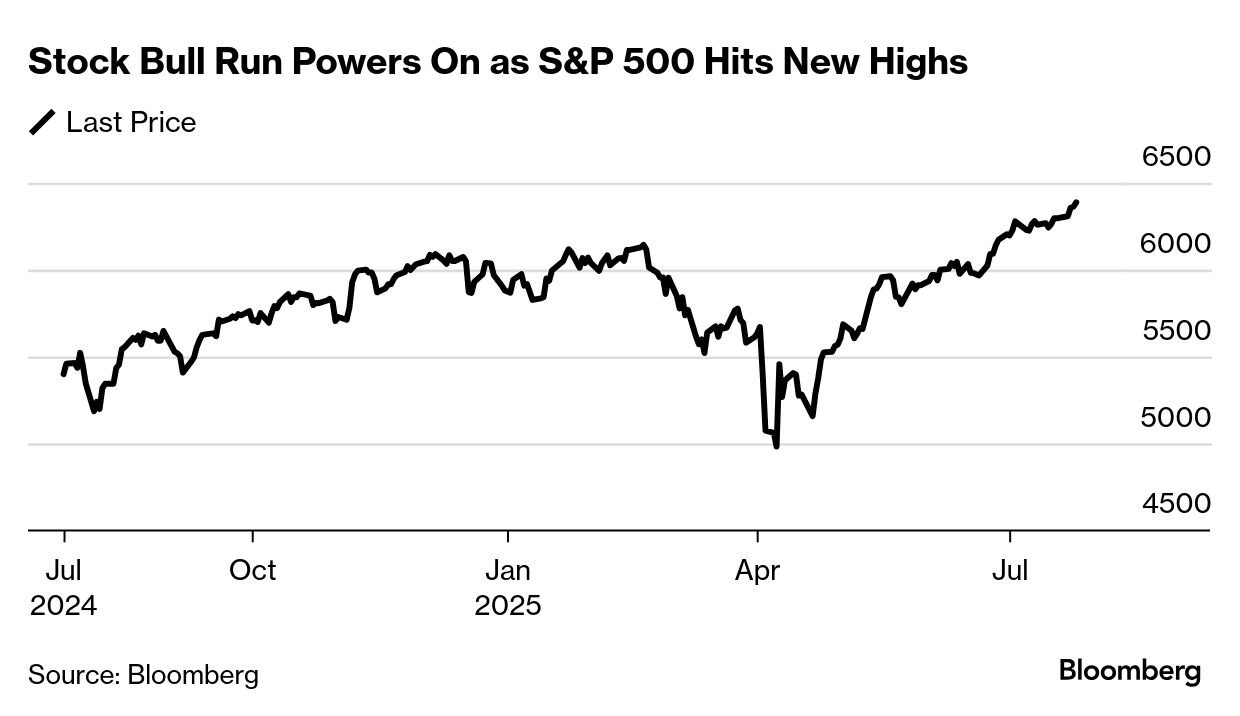

Stock Bull Run

Progress in trade deals, positive economic data and corporate resilience have offset worries that stocks are overheating. More than 80% of S&P 500 companies have exceeded profit estimates, according to data compiled by Bloomberg Intelligence.

The risk of a bubble in stock markets is rising as monetary policy loosens alongside an easing in financial regulation, says Bank of America Corp.’s Michael Hartnett . From a technical standpoint, Craig Johnson at Piper Sandler keeps his bullish view, citing factors such as improving market breadth and many of the popular averages reaching new highs.

In commodities, oil fell as the dollar strengthened, with West Texas Intermediate crude sliding more than 1% to settle near $65 a barrel in its last session. Gold extended its decline on Friday.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.