Asian Stocks Seen Lower as Tariff Sentiment Cools: Markets Wrap

Asian stocks are poised for a weak start Tuesday following a stagnant session for equities on Wall Street, while the climbed the most since May.

Benchmarks in Tokyo, Hong Kong and Sydney were set to decline as the buoyant mood from the tariff deal between President Donald Trump and the European Union ran out of steam, even as hopes were bolstered for an extension of a China trade truce. Treasuries edged lower.

The start of a week expected to set the tone for the rest of the year in markets saw a gauge up nearly 1%. The euro slid the most in over two months as European leaders the US deal. The briefly topped 6,400 to close little changed. rose as Trump said he’d shorten his timeline for Russia to reach a truce with Ukraine.

In the run-up to the Aug. 1 US tariff deadline, traders will go through a raft of key data from jobs to inflation and economic activity. The big event comes Wednesday, when the Federal Reserve is expected to keep rates unchanged. Then there’s a string of big-tech earnings , with four megacaps worth a combined $11.3 trillion reporting results.

“This is about as busy as a week can get in the markets,” said Chris Larkin at E*Trade from Morgan Stanley. “This week could make or break that momentum in the near term.”

US and Chinese officials finished the first of two days of talks aimed at extending their tariff truce beyond a mid-August deadline and hashing out ways to maintain trade ties while safeguarding economic security.

Elsewhere in Asia, Trump said he had asked US officials to resume trade negotiations with Cambodia and Thailand after the countries agreed to along a disputed border.

In Japan, Prime Minister Shigeru Ishiba is fighting to stay in power, and insisted he would to stay on after some ruling party lawmakers stepped up their calls for following last week’s historic election setback.

Back in the US, the jacked up its estimate for federal borrowing for the current quarter to $1 trillion, mainly due to distortions from the debt limit. On Wednesday, the department will announce its plans for note and bond sales over coming months — which dealers widely see as staying unchanged.

“It is possible that as more trade deals are announced, the level of uncertainty that has hovered over business and the economy will ease,” said Brent Schutte at Northwestern Mutual Wealth Management Co. “Additionally, the impact of final trade deals could be less than originally forecast after the April 2 announcement of reciprocal tariffs.”

To Thierry Wizman at Macquarie Group, while the dollar’s strength today may reflect the perception that the new EU deal is lopsided in favor of the US, it may also reflect a feeling that America is reengaging with its major allies.

“Whether we agree or not with the use of tariffs and the deals announced, we are getting the big ones out of the way which will allow American businesses to adjust and plan, for better or worse,” said Peter Boockvar at the Boock Report. “And we can now focus on how this all plays out.”

Fed Chair Jerome Powell and his colleagues will step into the central bank’s board room for a two-day meeting starting Tuesday to deliberate on rates at a time of immense political pressure, evolving trade policy, and economic cross-currents.

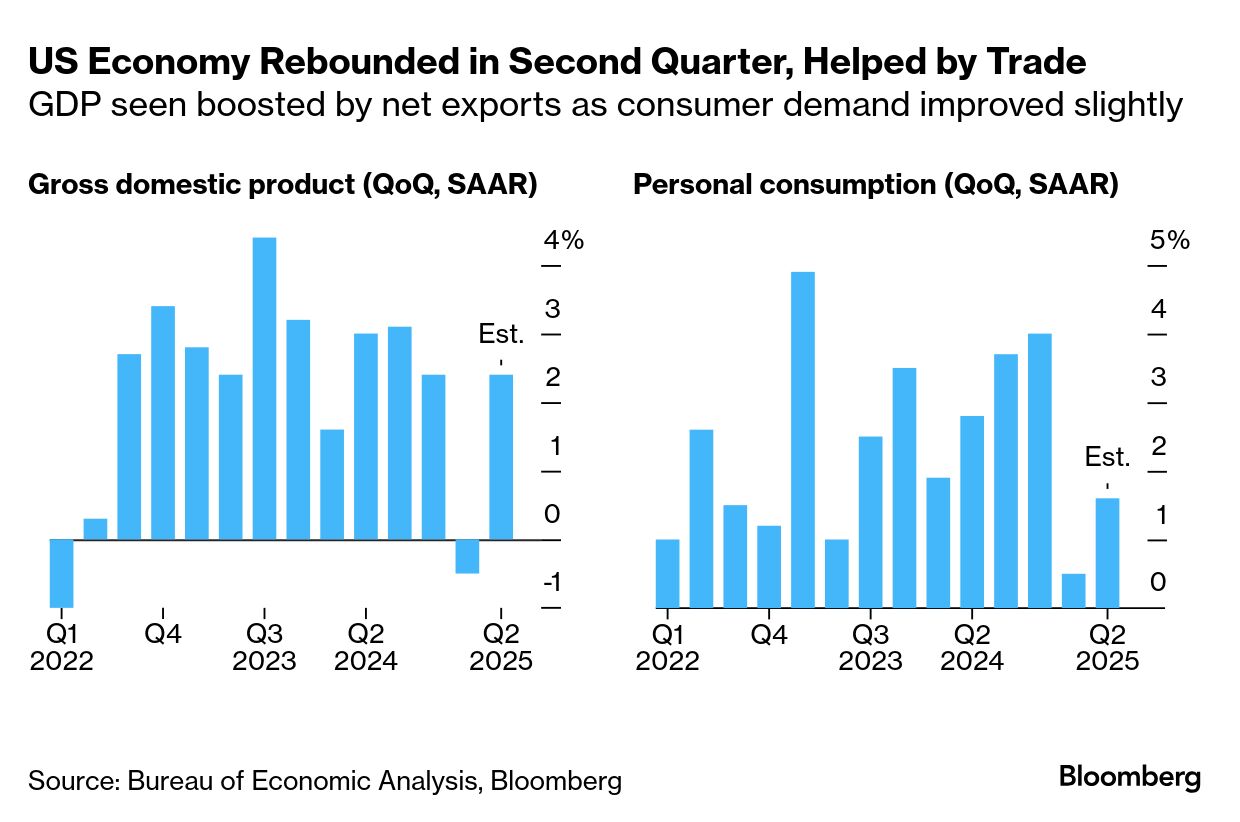

In a rare occurrence, policymakers will convene in the same week that the government issues reports on gross domestic product, employment and the Fed’s preferred price metrics. Forecasters anticipate the heavy dose of data will show economic activity rebounded in the second quarter.

While the stock market is moving sideways after a solid run, “if we get no surprises in earnings and some dovish comments by the Fed, it’s likely we’ll see yet more new highs by the end of the week,” said Louis Navellier , chief investment officer at Navellier & Associates.

“We do not expect the Federal Reserve to cut interest rates on Wednesday, but it’s possible that they make a stronger signal that cuts are on the horizon in the fall, especially as the inflation data continues to stay muted even in this tariff environment,” said at RGA Investments.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities