Millions in Polymarket Bets Decided by Anonymous Crypto Holders

With a global exchange that lets traders bet on the outcome of real world events — everything from elections to Elon Musk posts on X — Polymarket has become the talk of both Silicon Valley and Wall Street.

What’s less talked about: Sometimes those outcomes are decided not by objective facts, but by a group of anonymous crypto traders thrashing it out in an online chatroom.

As Polymarket paves the way to after three years, the largest platform in prediction markets is facing a growing backlash from users over the messy and sometimes illogical way it resolves its thorniest contracts.

Polymarket, which uses cryptocurrencies to process bets, outsources any markets where a dispute occurs to the holders of a digital token called UMA, who debate the matter before voting to decide the outcome. While anyone can monitor the deliberations and result, almost no information is available about who controls the UMA tokens — and hence who controls the outcomes.

The process has often produced results that have surprised and divided users. For instance, when more than $240 million was wagered on whether Ukraine’s President Volodymyr Zelenskiy had worn a suit before the end of June, the final say went to UMA holders. They determined he hadn’t, sparking anger among traders after media outlets showed photos and videos indicating the opposite.

Polymarket and its founder and Chief Executive Officer Shayne Coplan declined to comment for this story. Hart Lambur, CEO of Risk Labs, the issuer of the UMA token, said the system incentivizes voters to act in the long-term best interests of UMA, which means voting “their own true beliefs.”

Still, Polymarket and the decentralized group that oversees UMA are working together with another firm called EigenLayer to design a different methodology.

“The issue that you see there is the tyranny of majority,” said Sreeram Kannan, founder and CEO of EigenLayer, a decentralized finance project. “A majority can say something which is not true and then there is no consequence to that.”

Lambur said the goal is to “improve the system” but declined to provide details.

Prediction markets like Polymarket and its rival Kalshi are making rapid strides into the world of traditional finance after hitting the headlines for correctly calling the 2024 presidential election. A lifted restrictions on such betting last year in the US, and a growing list of luminaries is involved with the industry. Peter Thiel’s counts Polymarket in its portfolio, while Donald Trump Jr. is an adviser to .

In the major prediction markets, traders buy “yes” or “no” shares tracking the outcome of a real-world situation. The amount of buying and selling of those instruments determines the implied probability — and therefore the price — of each outcome at any point in time. Traders profit if they sell their shares for higher or if the market resolves in their favor.

But while the winner of an election or a sports game is generally clear, not every outcome is inherently easy to establish. In a betting on whether the Astronomer CEO will be “out” by a certain date after his affair was exposed at a Coldplay concert, does him being placed on leave count?

At Polymarket, if users believe a market should be “resolved” — meaning ended — they can put up some cryptocurrency to support their claim and make a proposal for UMA holders to review. Other users can then dispute that proposal if they disagree, setting in motion a public debate and subsequent secret vote to determine an outcome. The process is on the Polymarket website.

Previously anyone could make a proposal, with around 7,000 made on UMA’s platform every month, about 1% of which were disputed, according to a February on an UMA website. This week it was announced that the ability to a list of experienced users, although the power to dispute a proposal remains open to all.

Because disputed markets stay open during deliberations, many users attempt to trade the UMA process, monitoring which way voters are leaning and placing bets on that basis. But with UMA holders hidden behind pseudonymous screen names, there is no way to know the true identity of who is voting or what their motivations might be.

“If the payoff of manipulating a market is larger than the cost of doing so, what we see over time in every system is that they end up being manipulated,” said Omer Goldberg, founder of Chaos Labs, a blockchain-focused risk management platform.

Multiple Discord servers, some with hundreds of members, have been set up to discuss the issue and what users can do about it.

In July, a Panama-based law firm filed a formal complaint with the Panama Gaming Control Board on behalf of one user alleging a small number of “whales” have influenced UMA votes in ways that allowed them to profit. Polymarket’s terms say any legal dispute must be arbitrated in the country.

The user behind the complaint, who asked not to be identified, shared a copy with Bloomberg News. Written in Spanish, it accuses Polymarket of failing to stop the fraud, and allowing high-net-worth-users “to act with complete impunity.”

A spokesperson for the Panama Gaming Control Board confirmed receipt of the filing but declined to comment further on the specifics. He said that such complaints can take time to resolve. If any subsequent action is taken it could include a warning, suspension, or revocation of certification.

Even Coplan, the Polymarket CEO, may have expressed frustration with the current process last year. In a on X shared by a person who said he was a Polymarket user, a private message attributed to Coplan says that “candidly the UMA discord is a disaster.” Bloomberg isn’t able to independently verify the authenticity of the message. Coplan hasn’t publicly disputed it.

The existing dispute process is not entirely out of Polymarket’s hands. The company is able to intervene by issuing what’s known as a clarification — a statement that spells out the intent behind a contract. While it’s not explicitly written into the rules, Lambur has said UMA voters are expected to align with these edicts.

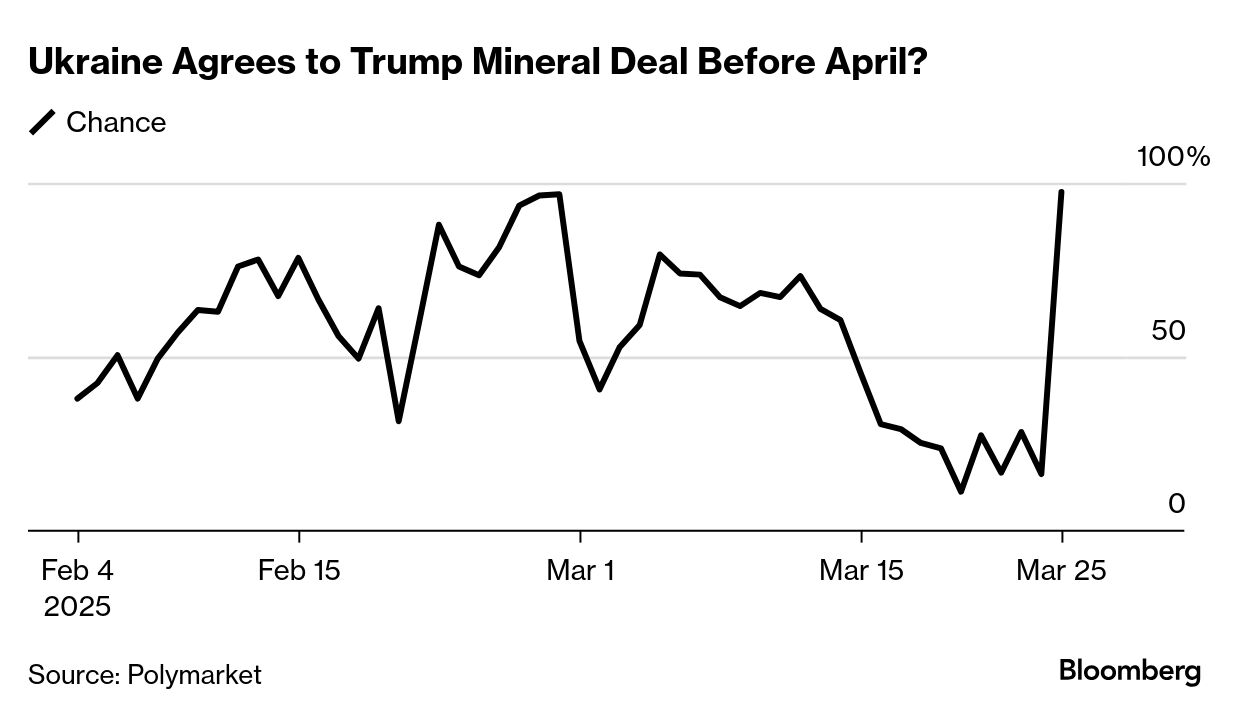

The system doesn’t always work as intended. In a market on whether Ukraine and the US would agree a mineral deal before April 2025, one user made an unexpected proposal to end the contract. It was quickly disputed, and Polymarket weighed in against the proposal. But the clarification came too late, and the market was resolved despite the firm’s wishes. A user on Polymarket’s Discord later claimed to have deliberately made the proposal at the weekend when they thought the company would be less likely to make a clarification.

Ultimately Polymarket has the power to overturn an UMA decision, but that is extremely rare. In a statement on the company’s Discord after the mineral deal vote, it called the situation unprecedented and said it was “not a part of the future we want to build.” It stopped short of reversing the outcome.

In part because they didn’t want to be put in the position of policing the results of real world events like elections, US financial regulators had previously prediction markets. Polymarket in 2022 agreed to ban US traders from its platform in a settlement with the Commodity Futures Trading Commission, which oversees event contracts, for not being registered with the agency.

But Kalshi overturned many restrictions in court last year, and the Trump administration has since support for making the industry more mainstream. The CFTC and Justice Department have both dropped investigations into Polymarket over violations of its 2022 settlement, and the company has just acquired a regulated derivatives exchange to help it the US market. It is also in the process of raising hundreds of millions of dollars in investment.

Polymarket isn’t alone in grappling with dispute resolution. Contracts in traditional areas of finance often become contentious, such as when creditors and borrowers face off over corporate restructurings. Meanwhile, Kalshi, which already has a US license, has on occasion angered its users over how it issues clarifications and resolves markets.

Last month, a Kalshi tied to whether “Linda Yaccarino leaves X this year” attracted a wave of “yes” bets after the media platform’s CEO said she was stepping down. But the wagers didn’t pay out because the — rules that dictate when and how a market can be resolved — said it would only be resolved to “yes” if X has a new CEO, not if she simply left the company.

Kalshi, which retains sole discretion over disputes in its markets, kept the market open, but changed the title. A spokesperson for the company said it’s legally required to resolve a market based on its rules, rather than a title.

“Capturing the spirit of a market in a few words is sometimes challenging, and we are always working hard to make sure our titles match the rules laid out in the contract,” the spokesperson said. “We have learned from the user feedback on this title and we encourage users to always read the market rules before placing a trade.”

In a few disputed cases, Polymarket has issued refunds to customers who say they were burned by unclear terms or an UMA vote not going to plan. But to date, that hasn’t happened with the Zelenskiy suit question.

Bloomberg News spoke to several US-based traders who still access Polymarket using a virtual private network, circumventing the platform’s efforts to block them. James Risner, a 29-year-old research analyst, said he lost $9,000 on the surprise outcome of the Zelenskiy vote.

“Had I known upfront that this was the process, I wouldn’t have touched this garbage with a 10-foot pole,” he said. “I was like, who’s making these choices? And then, what kind of idiot am I to be involved in it?”