China Urged by Think Tanks to Strengthen Yuan Amid Trade Tension

A growing chorus of economists and former officials in the US and Europe is urging Beijing to strengthen the yuan, warning that prolonged undervaluation may escalate trade tensions and distort China’s growth model.

At least three researchers have issued studies or commentaries at think tanks in the past month, including the US-based Council on Foreign Relations, spotlighting the yuan’s suppressed real value and its role in supporting China’s export competitiveness.

The calls come as US and Chinese officials push ahead with tariff negotiations, with market expectations that foreign exchange might be a talking point. The commentaries also underscore how the yuan may shift as China explores policies to boost domestic demand and reduce reliance on exports. These discussions may help in influencing the US Treasury’s decision on whether to label China a currency manipulator in the coming months.

“The time has come for Chinese authorities to allow the renminbi to appreciate substantially,” Mark Sobel , a former 40-year veteran at the US Treasury, wrote in an Aug. 6 commentary for the Official Monetary and Financial Institutions Forum, a UK-based think tank where he’s US chairman.

The “massively undervalued” yuan has long been integral to China’s growth model, Sobel said. He cited undervaluation estimates ranging from 8.5% by the International Monetary Fund to more than 20% by the Brookings Institution.

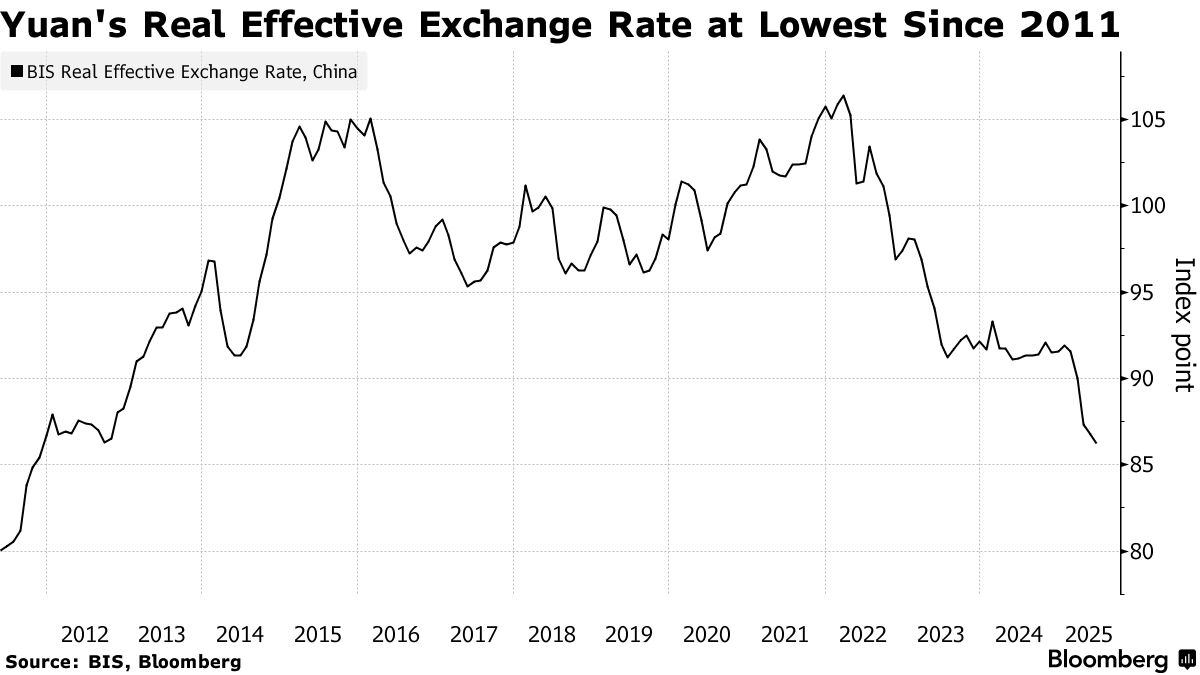

The yuan’s real effective exchange rate , a measure by the Bank for International Settlements that’s frequently cited as evidence of undervaluation, now stands at the lowest level since 2011, partly attributable to price deflationary pressures from soft domestic demand.

The low REER also results from a weaker exchange rate against the currency basket China uses to guide the yuan. In spot terms, the onshore yuan has gained just 1.7% versus the dollar this year, even as Bloomberg’s gauge of the greenback has fallen more than 8%. The yuan has depreciated against 19 out of 24 currencies of China’s major trading partners.

“There is a clear case for more exchange rate flexibility and for a fundamental change in the People’s Bank of China’s currency management system,” said Juergen Matthes, an economist at the German Economic Institute. “It is no longer acceptable to the world that China manages its currency the way it does.”

The yuan’s “unfair” undervaluation against the euro was a key cause of Europe’s merchandise trade deficit with China, Matthes wrote in a July 23 for the institute, suggesting “trade policy action is urgently warranted” as China looks to divert exports to non-US markets.

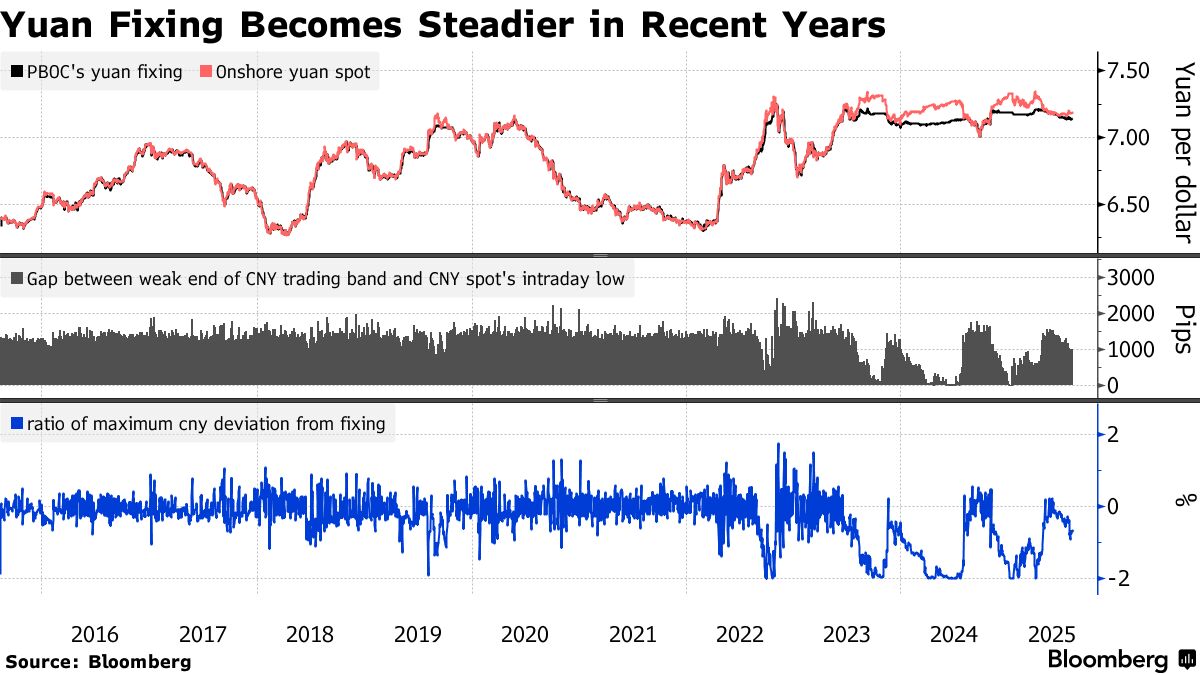

The Chinese central bank has repeatedly said it will keep yuan basically stable. A PBOC official said earlier this year that China doesn’t seek a competitive advantage through yuan depreciation.

The PBOC didn’t immediately reply to a Bloomberg fax seeking comments.

Treasury’s Callout

With the yuan’s depreciation despite robust exports, the issue may surface in the next US report on foreign exchange, Brad Setser , senior fellow at the Council on Foreign Relations and a former Treasury official, wrote in a July 16 on the think tank’s website.

The US Treasury Department from labeling China as a currency manipulator in its foreign-exchange report in June, but criticized Beijing for the lack of transparency around its exchange-rate policies and practices. The semiannual report has been released in June and November in the past three years.

Markets are watching to see whether China’s against industrial overcapacity — alongside the recent, modest uptick in the PBOC’s yuan fixings — will lead to a recovery of yuan’s real effective exchange rates.

A stronger yuan would support domestic demand, boost real incomes and signal official intent to shift the economy toward non-tradable goods and services for the domestic market, Sobel said. It would also help the government’s “anti-involution” push to curb excessive competition and counter deflationary pressure.

China’s has remained strong in recent months, reducing the urgency to keep the yuan soft.

The yuan fixing adjustment is welcome, but a far more “significant move” is needed to meaningfully address the depreciation, said CFR’s Setser.

“China’s leaders seem content to grow on the back of net exports,” he wrote. “They are underestimating how significantly their refusal to take basic steps to support China’s domestic economy impacts global perceptions around China.”