Asian Stocks to Gain as US CPI Fuels Fed Cut Bets: Markets Wrap

Stocks in Asia were set to track Wall Street higher after an in-line US inflation reading bolstered speculation the Federal Reserve will have room to cut rates in September.

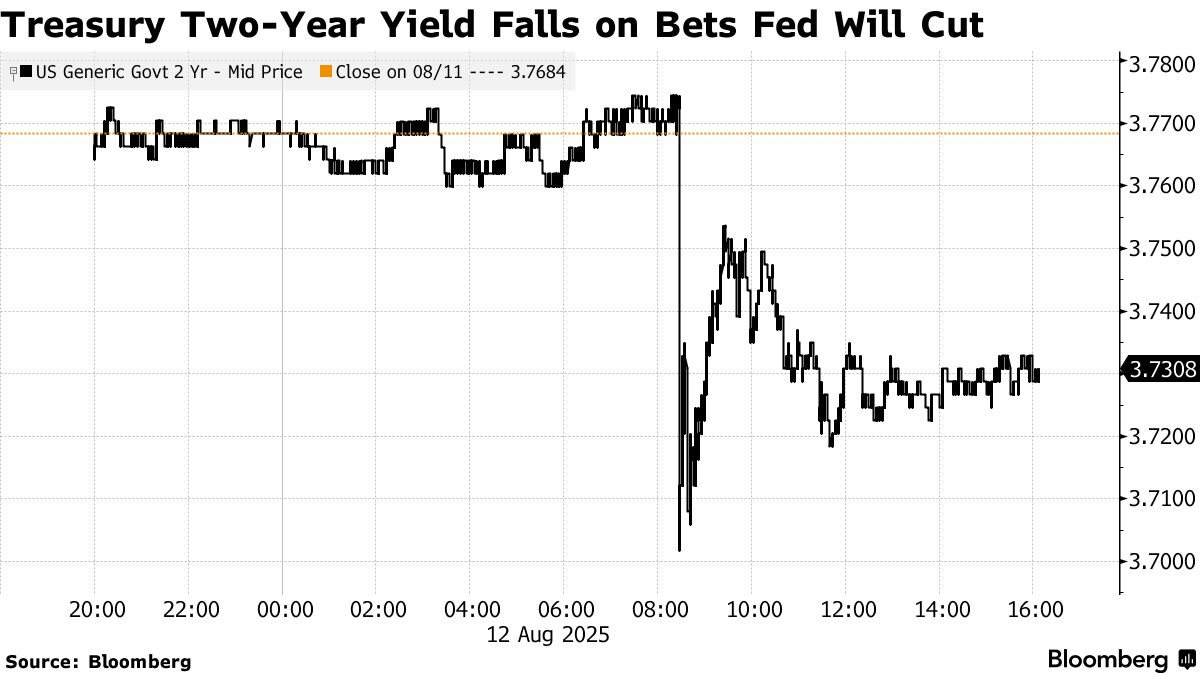

Equity-index futures showed benchmarks in Tokyo, Hong Kong and Sydney will all open higher. US indexes climbed more than 1%, with the and the hitting all-time highs. While an initial rally in Treasuries faded, money markets priced in an about 90% chance of a Fed reduction next month. Two-year yields , more sensitive to imminent policy moves, slid four basis points to 3.73%. The fell.

The data bolstered expectations that the Fed can move toward rate cuts without reigniting price pressures. While underlying inflation accelerated to the strongest since the start of the year, the modest gain in goods prices eased fears that trade-related costs may feed into broader price pressures.

“Inflation is on the rise, but it didn’t increase as much as some people feared,” said Ellen Zentner at Morgan Stanley Wealth Management. “In the short term, markets will likely embrace these numbers because they should allow the Fed to focus on labor-market weakness and keep a September rate cut on the table.”

Fed Bank of Richmond President Tom Barkin said uncertainty over the direction of the economy is decreasing, but it’s unclear whether the central bank should concentrate more on controlling inflation or bolstering the job market.

In a social media post, President Donald Trump resumed his criticism of Jerome Powell over the central bank’s decision to hold rates steady. Trump also said he is weighing a lawsuit against the Fed chief over the renovation of the central bank’s headquarters - a project whose cost overruns have drawn scrutiny.

“The Fed’s policy stance is highly data-dependent, and with inflation contained and labor market softness increasingly evident in revised payroll data, the emphasis will now be skewed toward employment,” said Alexandra Wilson-Elizondo at Goldman Sachs Asset Management. “This inflation print supports the narrative of an insurance rate cut in September, which will be a key driving force for the markets.”

In Asia, Beijing local companies to avoid using Nvidia Corp.’s H20 processors, particularly for government-related purposes, complicating the chipmaker’s return to China after the Trump administration reversed an effective US ban on such sales.

Meanwhile, China will more levies on Canadian rapeseed after an anti-dumping probe, escalating a trade spat that’s disrupted crop flows.

Separately, China Evergrande Group its Hong Kong stock will be delisted, marking the end of an era for the former high-flying developer whose demise came to symbolize the country’s property bust. The company’s collapse was by far the biggest in a crisis that dragged down China’s economic growth and led to a record spate of distress among builders.

Tariff Clarity

US officials have kept rates unchanged this year in hopes of gaining clarity on whether tariffs will lead to sustained inflation. At the same time, the labor market — the other half of their dual policy mandate — is showing signs of losing momentum.

With risks to the rising, the Fed would likely tolerate temporarily higher-than-expected inflation prints — provided that the risk of second-round effects remains contained and price expectations stay well-anchored, according to Marco Casiraghi at Evercore.

Read More:

“I think the real thing now to think about is should we get a 50 basis-point rate cut in September,” Treasury Secretary Scott Bessent told Fox Business. He said the Fed could have cut rates in June or July if they’d had the “original” jobs reports numbers.

With CPI out of the way, the focus will shift to Friday’s US retail sales figure, where investors will see if consumers appear as upbeat as corporate earnings commentary has made them seem and amid worries about the labor market, according to Bret Kenwell at eToro.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.