Asia Stocks Seen Higher as Fed Cut Momentum Builds: Markets Wrap

Asian stocks were poised for a mainly positive open Thursday as investors continued to ramp up bets that the Federal Reserve will cut interest rates next month.

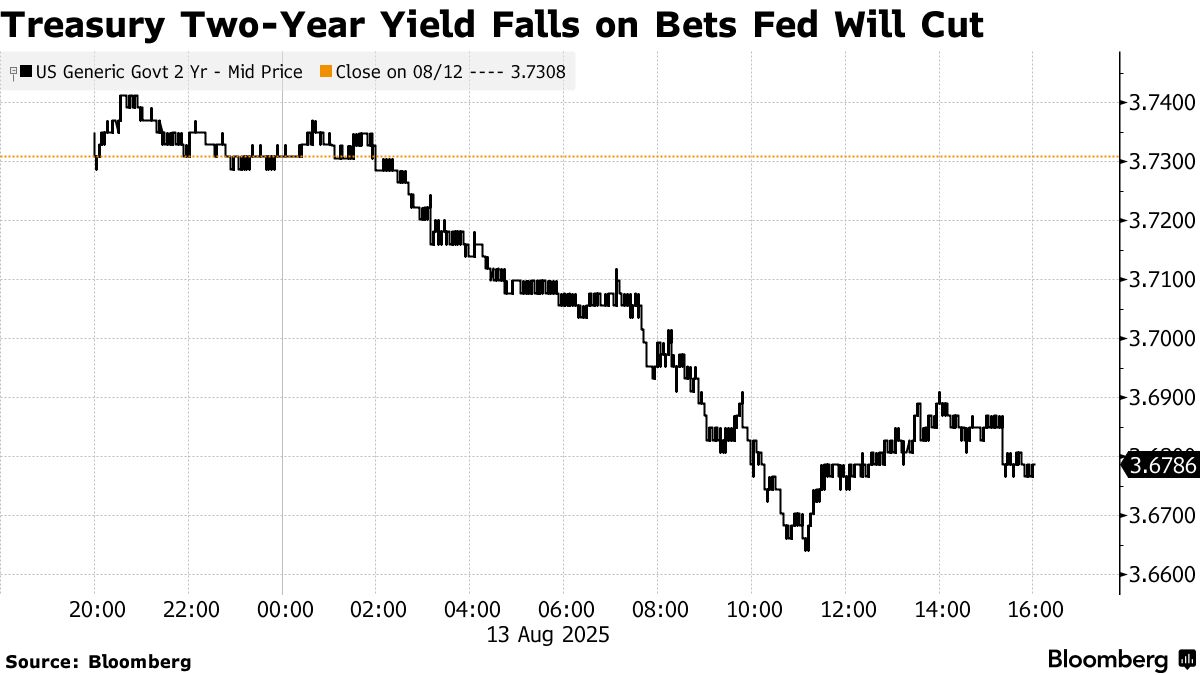

Equity-index futures pointed to gains in Australia and Hong Kong, while contracts for Japan declined. A gauge of US-listed Chinese shares rose for a second session, and the S&P 500 advanced as and climbed. Treasury yields fell alongside the .

The marked a sharp shift from two weeks ago, when markets saw less than a 50% chance of a September rate cut. Traders now fully expect a quarter-point move, with some betting on a larger reduction, as Treasury Secretary Scott Bessent said “we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September.”

“As the labor market continues to weaken, we think the US central bank will resume interest rate cuts next month, with 25-basis-point cuts at each meeting through January 2026 for a total of 100 basis points,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

Fed policymakers last month kept their benchmark at a target range of 4.25% to 4.5%. Bessent said officials might have cut rates if they’d been aware of the revised data on the labor market that came out a couple of days after the latest meeting.

President Donald Trump said he may name the next Fed chair “a little bit early” and added that he was down to three or four potential candidates as he looks for a successor to Jerome Powell .

“As the market continues to digest the shift in the trajectory of the real economy following the combination of July’s inflation and employment data, it follows intuitively that the question has become: how large of a cut should Powell deliver?” said Ian Lyngen at BMO Capital Markets.

A report on producer prices due Thursday will offer insights on additional categories that feed directly into the Fed’s preferred price gauge — which is scheduled for later this month.

“Tariff-related costs are still being absorbed by corporate profit margins rather than passed on to consumers, giving the Fed room to pivot without sparking inflationary risk,” said Fawad Razaqzada at City Index.

Some companies have been holding off on price increases for fear that consumers will pull back on spending, which will heighten interest for Friday reports on retail sales and consumer sentiment.

In other corporate news, Trump’s plan to take a cut of revenue from chip sales to China has US companies reconsidering their plans for business with the country, offering a model for circumventing years of trade tensions.

Meanwhile, geopolitical tensions remained on edge after the US president he would impose “very severe consequences” if Vladimir Putin didn’t agree to a ceasefire agreement later this week, following a call with European leaders ahead of his meeting with the Russian president.

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.