Pound Extends Recent Winning Streak as UK Growth Beats Estimates

The pound extended its recent outperformance versus major peers as UK growth data came in stronger than expected.

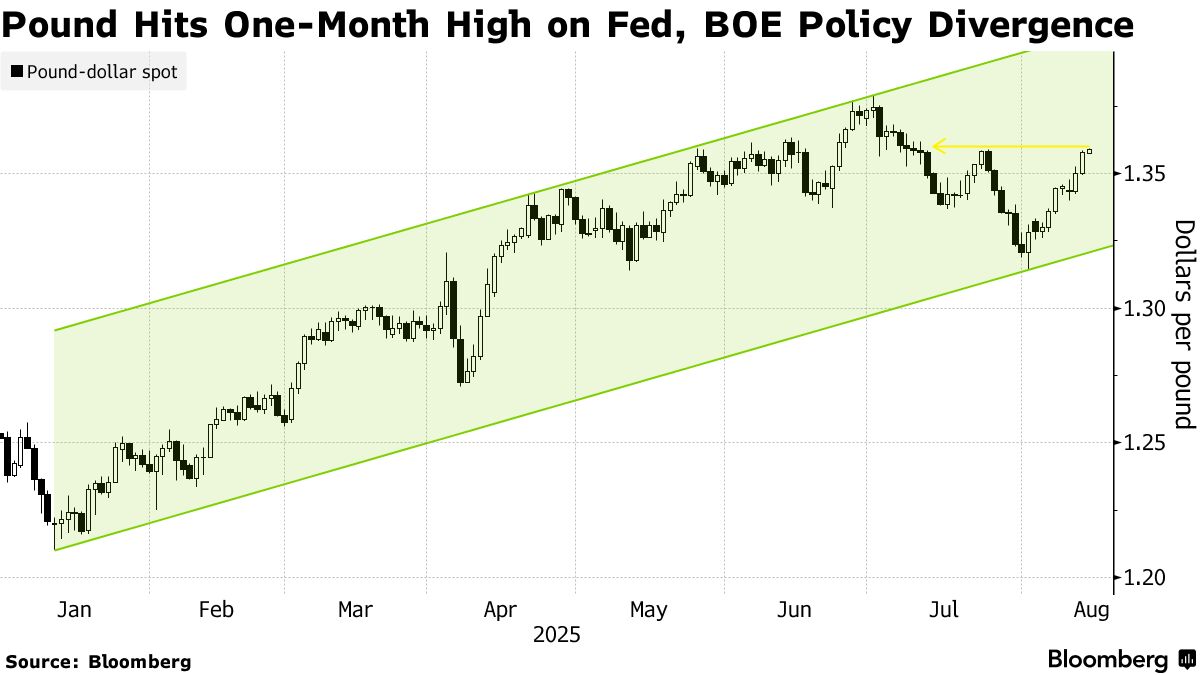

Sterling rose 0.1% to $1.3592 on Thursday, its strongest level since July 10. The UK currency has outperformed all Group-of-10 peers over the past week and is on track for a sixth straight gain versus the euro, its longest winning streak in three months.

Data showing the UK economy fared better than expected in the second quarter bolstered sentiment, with currency options markets shifting in sterling’s favor. Traders are now bullish on the pound over the next week against the dollar, while one-month sentiment has turned neutral for the first time since early July, according to the so-called volatility skew.

“The pound is among the outperformers of the month thanks to the hawkish turn from the Bank of England and positive labor data revisions,” said Jordan Rochester , head of FICC strategy at Mizuho. He estimates the pound remains about 2% undervalued versus the dollar, with his model trending higher in recent days.

The pound jumped last week after policymakers’ decision to cut interest rates was a far closer call than expected. Meanwhile, traders have cranked up bets on the pace of the Federal Reserve’s policy path lower.

The Fed’s softer tone contrasts sharply with the BOE’s stance, adding to sterling’s appeal. “Recent policy rate developments from both countries now offer stronger fundamental support to sterling,” said Antonio Ruggiero , strategist at Convera. “The pair appears more comfortable in the $1.35 zone, which is likely to establish itself as a new support level going forward.”

Money markets are pricing around 15 basis points of interest rate cuts by the BOE by year-end, compared to 62 basis points by the Fed over that period.