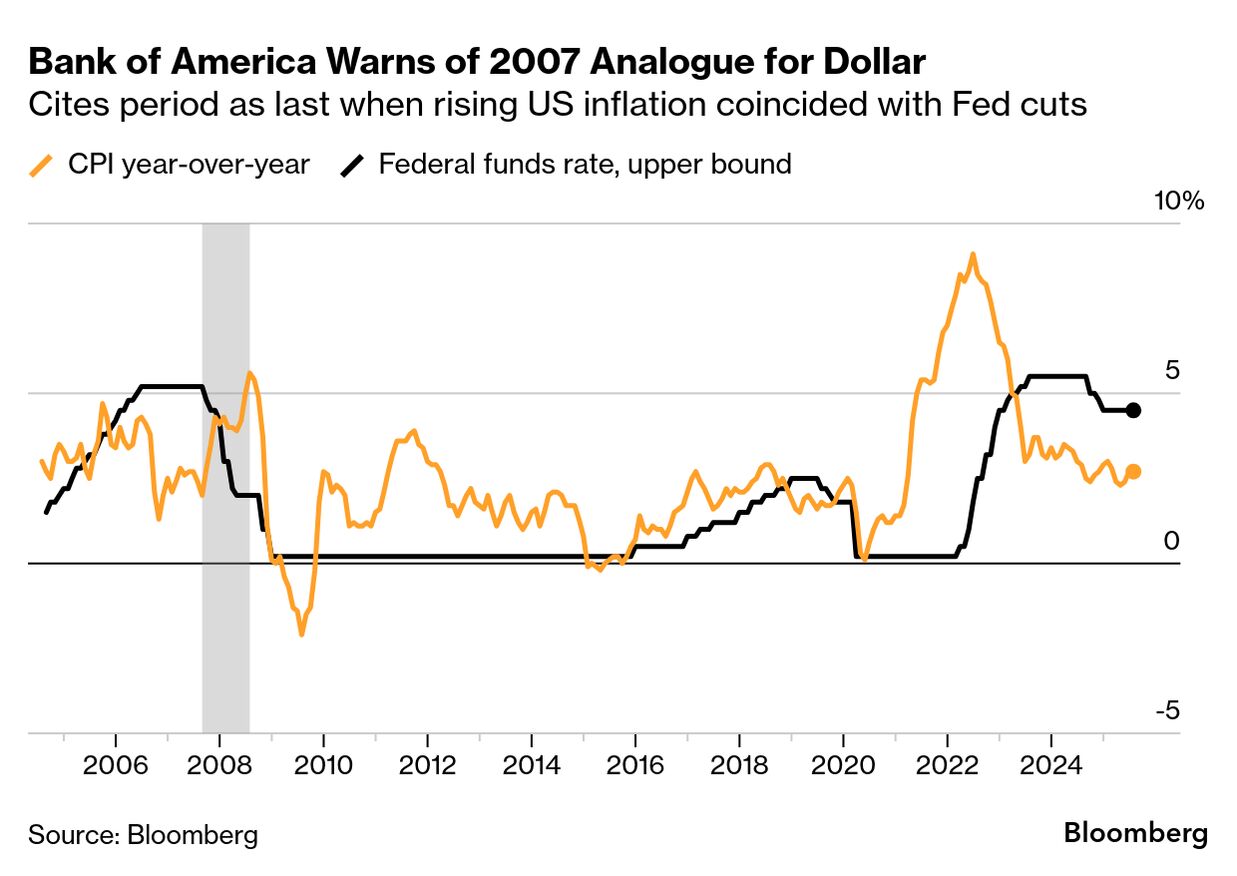

Echoes of 2007 Haunt Dollar as Fed Risks Easing Amid Inflation

The dollar is set for a toxic mix of a Federal Reserve cutting interest rates in the face of rising annual inflation, a damaging scenario last seen nearly two decades ago, according to Bank of America Corp.

“If the Fed cutting cycle were to resume, any rate cuts in the rest of 2025 would likely occur amid a backdrop of rising year-over-year inflation,” wrote Howard Du , a currency strategist at Bank of America, in a Thursday report to clients. “This is a possible but historically rare regime.”

This suppression of real policy rates in the US last occurred from the second half of 2007 into the first half of 2008, Du said — a period when a Bloomberg gauge of the dollar fell about 8%. His historical analysis found that the dollar depreciation begins before the Fed cut —as has occurred this year— and then lingers on after rates ease.

From the latter half of 2007 into 2008, supply shocks pushed up global food and energy prices. Still, the Fed lowered borrowing costs as weakness began to seep into both the US housing and job markets.

Today, the Fed must balance both the economic uncertainty surrounding President Donald Trump ’s steep tariff regime as well as a labor outlook. Traders are pricing close to 85% chance of a quarter point reduction in borrowing costs when Fed officials meet next month, even as inflation accelerated in July by the fastest pace since January and producer prices rose more than expected.

Bank of America estimates that even if headline CPI stays around the 0.1% mark on a monthly basis into the end of the year, the year-over-year figures will tally around 2.9% — above numbers seen by the middle of 2025.

Du and his colleagues recently encouraged traders to buy euros versus the dollar, targeting a roughly 3% rally in the single currency to around $1.20 by the end of the year.

The Bloomberg Dollar Spot Index is down about 1.3% so far in August, and some 8% in 2025. That’s the measure’s worst start to a year since 2017, according to data compiled by Bloomberg. The two-year yield on Treasuries, seen as the most sensitive to Fed policy, has fallen some 50 basis points so far this year.