Asia Stocks Eye Tepid Open as Prices Halt US Rally: Markets Wrap

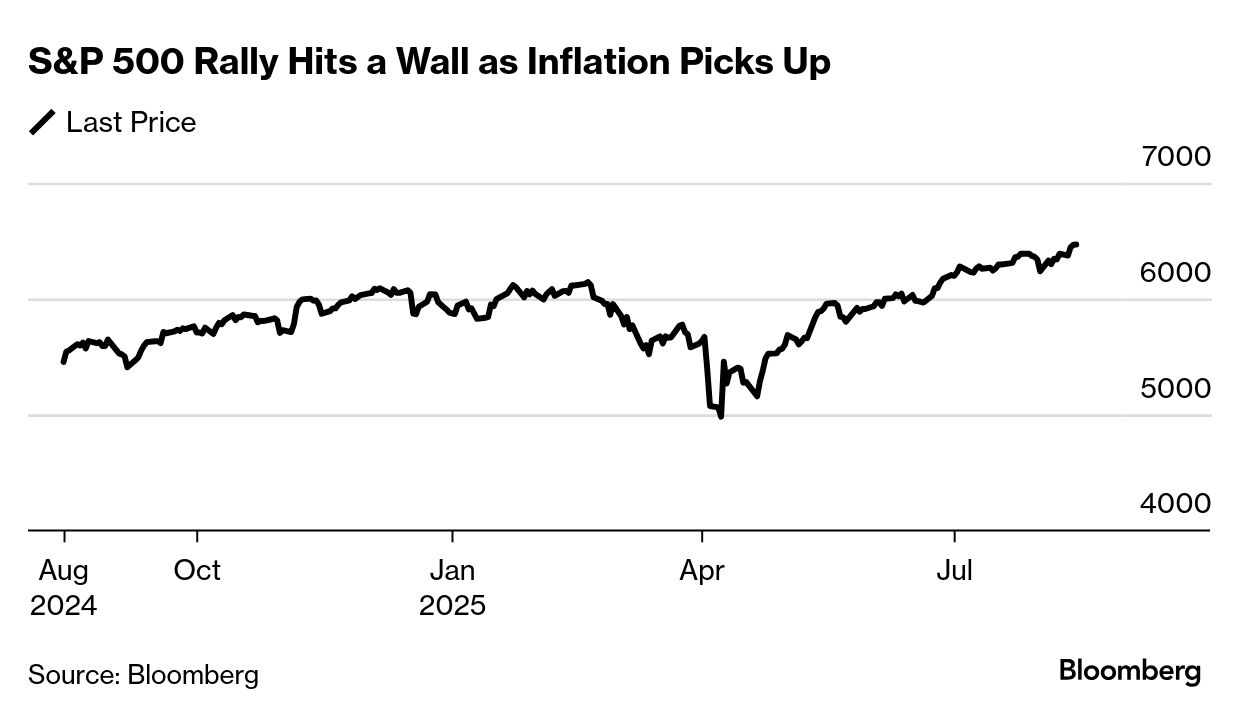

Equities in Asia were set for a tepid start after a pick-up in inflation halted a rally in US stocks and lifted bond yields as traders pared bets of Federal Reserve interest-rates cuts.

Equity futures in Australia and Japan pointed to gains in early trading while contracts in Hong Kong fell. After a 30% surge from its April lows, the barely budged. jumped as the US was said to taking a stake in the chipmaker. In late hours, gave a downbeat forecast. The rose.

US wholesale inflation accelerated in July by the , suggesting companies were passing along higher import costs related to tariffs.

With earlier this week pointing to a milder pass-through in July, and the labor market now shifting to a lower gear, the Fed is widely expected to cut rates next month. However, firm wholesale inflation data may give some officials pause that prices are rearing back up.

“Markets shouldn’t take for granted that rates will be cut deeply because there is an inflation problem in the US,” said Kyle Rodda , a senior market analyst at Capital.com in Melbourne.

Two-year Treasury yields climbed six basis points to 3.73%, with the odds of a September rate cut falling to about 90% from more a certainty, according to swaps data. Bitcoin from a record high.

Read More:

Traders in Asia will now shift focus to China’s monthly data dump which will help gauge the health of the economy as it battles the deflation streak since at least the 1990s and the US trade war.

of a deepening downturn are mounting, with expectations retail sales growth and industrial production slowed in July from the month prior, according to Bloomberg surveys.

“China’s July activity will probably show signs growth softened heading into the second half,” Chang Shu and David Qu , economists at Bloomberg Economics wrote in a note. While weather was a drag, industrial output was likely “under pressure from the trade war and consumers pulling back further,” they wrote.

Read More:

Elsewhere, Indian assets will be in focus after an spurred by a ratings upgrade from S&P Global Ratings . Yields on 10-year bonds fell as much as 10 basis points after S&P’s upgrade, which said the economy’s growth prospects won’t be derailed by US President Donald Trump administration’s 50% tariff shock to the country.

“We believe the rating upgrade reflects an outcome of policy prudence and sound growth so far, but there are challenges on the horizon,” ANZ Group Holdings economists including Bansi Madhavani wrote in a note to clients. “The evolving fiscal space will be worth watching – nominal GDP growth may disappoint and if high US tariffs linger for longer on Indian goods, and some fiscal support may be needed for the affected sectors.”

In commodities, oil losses in thin trading ahead of Friday’s summit between Trump and Vladimir Putin. Trump warned he would impose “very severe consequences” if Putin didn’t agree to a ceasefire, following a call with European leaders. Meanwhile, gold on the trimmed-back expectations of a Fed rate cut.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.