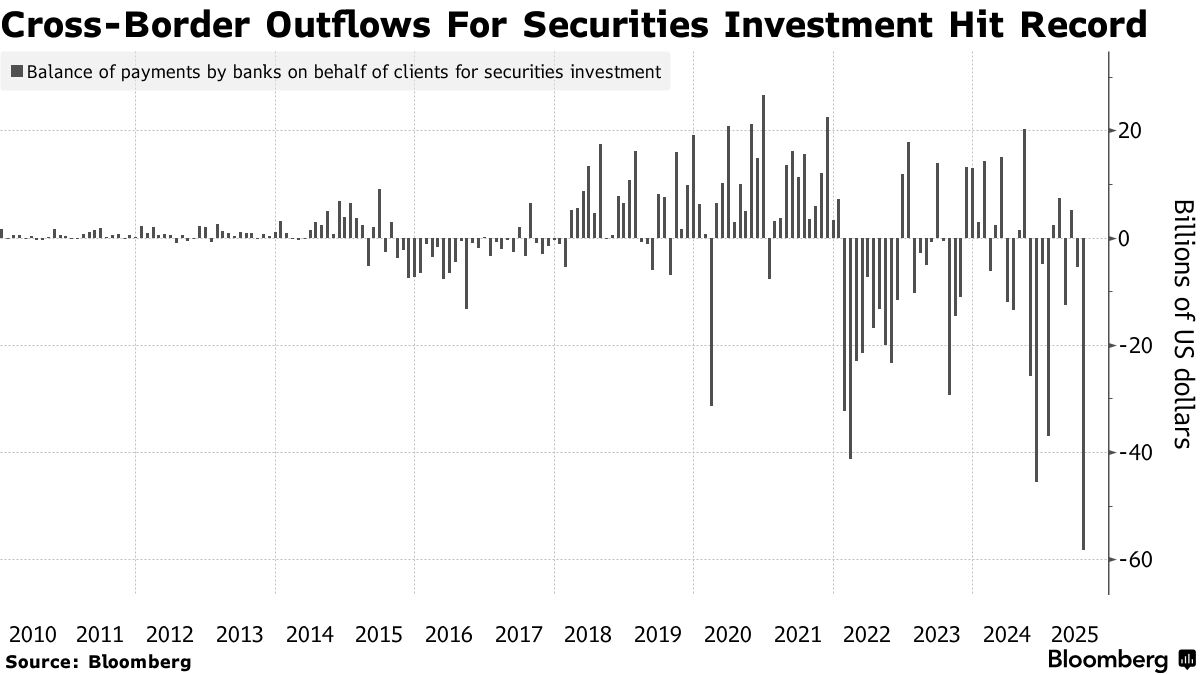

China’s Capital Outflow Accelerates After Liberalization Efforts

China’s capital outflows hit a record in July, driven by mainland investors’ aggressive buying of Hong Kong assets following new market liberalization measures.

Domestic banks wired a record $58.3 billion of funds overseas on a net basis on behalf of their clients for securities investment last month, according to data released late Friday by the State Administration of Foreign Exchange. That’s the highest monthly outflow since records began in 2010.

The steeper capital outflow was partially attributable to mainland investors’ hefty buying of this year and the July expansion of the Southbound Bond Connect program that allows more offshore debt investments. Meanwhile, foreign funds continued trimming their holdings of Chinese bonds, likely due to diminishing relative appeal compared to and .

China is expected to tolerate some capital outflows this year, leveraging a weak-dollar environment to gradually liberalize its capital account — a step aimed at helping the yuan’s long-term globalization. In June, regulators the amount of money that approved investors can allocate into overseas assets for the first time in over a year.

Read More: How a Weak Dollar Helps China Open Up Capital Flows: QuickTake