Asian Stocks Look Subdued Ahead of Jackson Hole: Markets Wrap

Asian stocks are set for a muted open as investors await a key Federal Reserve gathering and as President Donald Trump pursues talks to end the war in Ukraine.

Equity futures pointed to flat opens in Tokyo and Hong Kong, with Sydney set to edge lower after the closed little changed. slid the most in more than three weeks on reports the Trump administration may take a 10% stake. Oil held steady after Monday’s gain, as the US president said he began arranging a meeting between Vladimir Putin and Volodymyr Zelenskiy.

The yield on 10-year Treasuries rose two basis points on Monday, while the added 0.2%.

A big week is coming up for the US central bank as the Kansas City Fed’s annual kicks off Thursday in . The prestigious event in the has been used by Fed chairs as a venue for making crucial policy announcements.

Jerome Powell is expected on Friday to unveil the Fed’s new policy framework — the strategy it’ll use to achieve its inflation and employment goals. He may also drop some hints about the Fed’s thinking ahead of its September policy meeting.

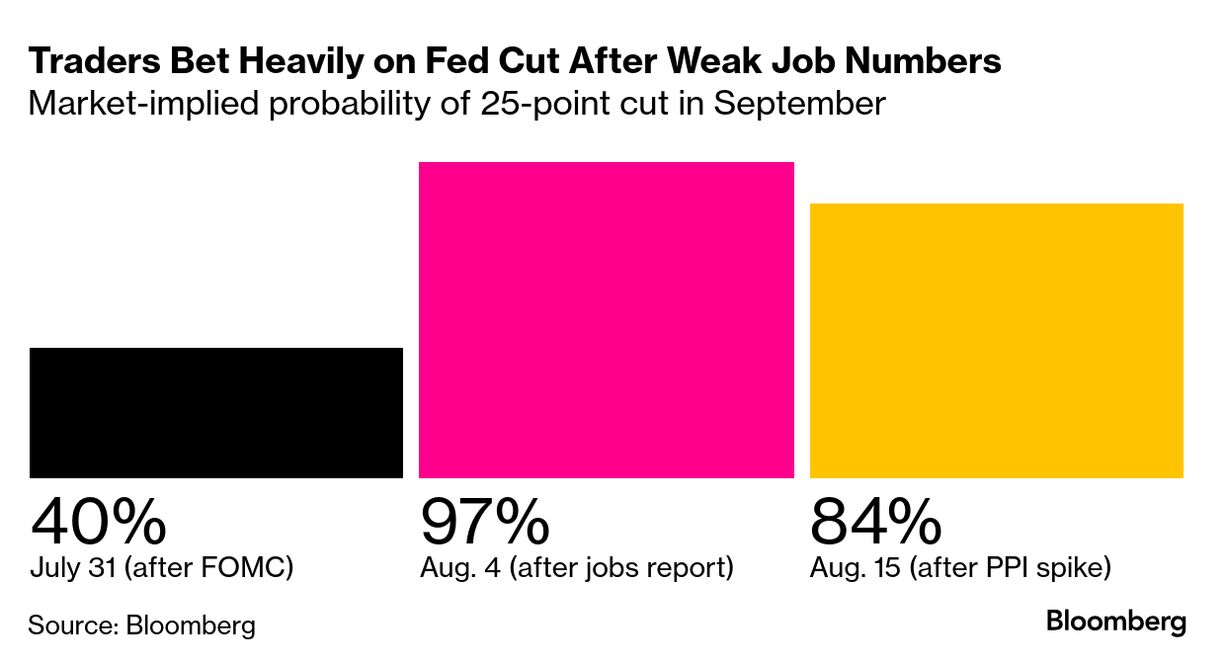

“For now, the market appears to be betting that signs of labor-market weakness will outweigh inflation risk in the Fed’s rate-cutting debate,” said Chris Larkin at E*Trade from Morgan Stanley.

Powell’s Jackson Hole speech will be the focal point this week, with the nature of the debate shifting from whether the Fed will cut rates to how much and how quickly, according to and at Glenmede.

“The stars are aligning for a September rate cut; inflation remains relatively restrained and the labor market is beginning to show early signs of weakness,” they said.

have been tempted to think it’s already a lock. Two-year Treasury yields have plunged this month as traders swung toward pricing in a quarter-point reduction in September.

Those bets took off after the unexpectedly bad July employment report, which also revised payrolls for the prior months downward. And they’ve only been dialed back slightly in the light of last week’s inflation surprise.

“If the Fed is going to cut next month, expect hints out of this week’s Jackson Hole Symposium,” said Scott Wren at Wells Fargo Investment Institute.

Interest-rate swaps show a roughly 80% chance that the Fed will lower rates next month by 25 basis points, with two cuts fully priced in by the end of the year.

“We believe that it would be irresponsible for the Fed to cut rates in aggressive manner going forward. That would only make the bubble a bigger one than it already is right now,” said Matt Maley at Miller Tabak. “That would create much more serious problems when that bubble inevitably bursts.”

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.