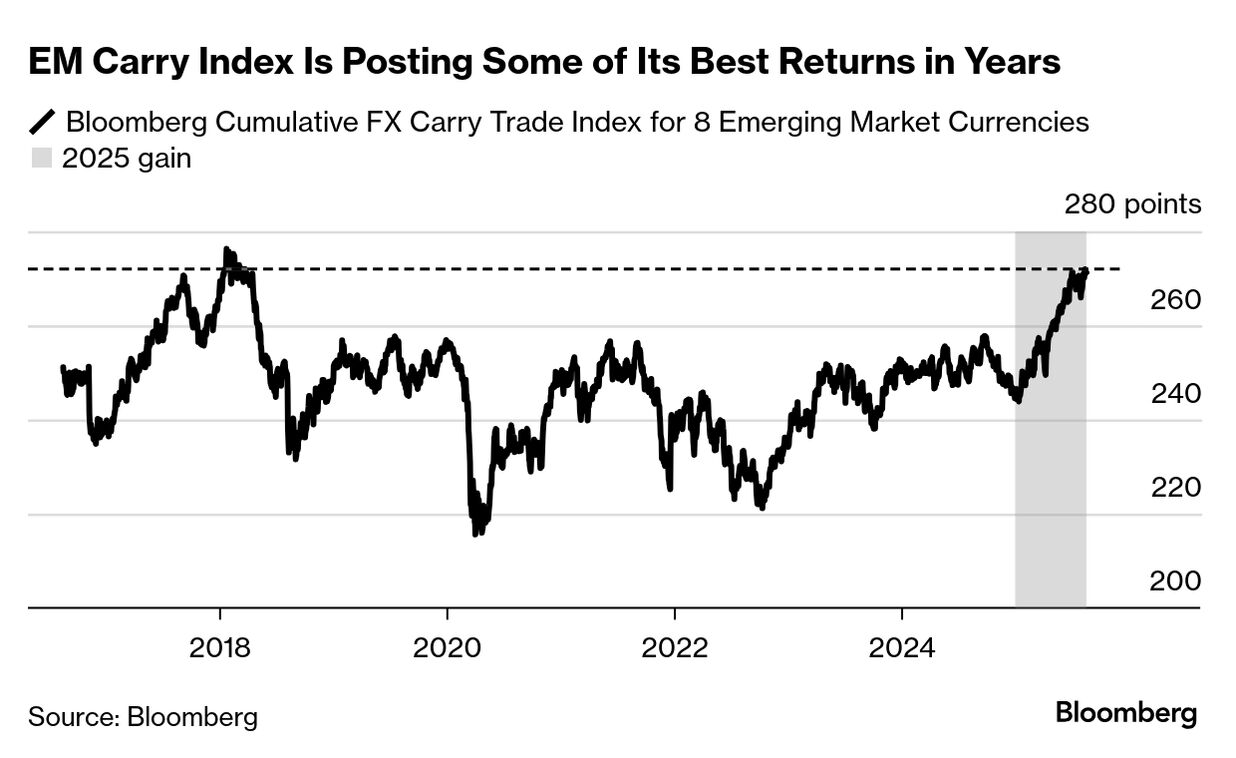

Citi Says Biggest Carry Trade Rally in Years Has Longer to Run

Buying emerging-market currencies against the dollar this year has delivered some of the most attractive returns of the decade, and according to Citi’s head of strategy, the trade still has further to run — at least in the short term.

A more pro-actively dovish stance from the Federal Reserve, combined with caution from emerging-market central banks, will continue to bolster developing-world currencies against the dollar, Luis Costa , Citi’s head of emerging-market strategy, said in an interview.

A Bloomberg index that measures carry-trade returns from eight emerging markets, funded by short positions in the dollar, has climbed more than 10% this year and is now on track for the biggest yearly gain since 2017. The carry trade is a strategy that involves borrowing in countries with low interest rates to invest in higher-yielding assets and currencies.

“The average EM central bank stance is also very cautious — pretty much neutral in many jurisdictions — which continues to suggest the sustainability of real policy rates,” Costa said. “It’s also important to take into account implied market expectations of a potentially even more dovish Fed in 2026. Putting all this together, the mix still supports a well-behaved dollar, despite renewed appetite among international investors for US equities.”

The Bloomberg Dollar Spot Index has fallen 7.8% this year, as aggressive US tariffs and their messy rollout have stoked doubts about the stability of the world’s reserve currency. Yet some investors and economists — including strategists at HSBC Holdings Plc — have said that the relentless dollar selling poised to burst, suggesting the greenback’s bottom may be near.

The carry return on Brazil’s real has outperformed its peers, posting a gain of more than 20% against the dollar this year. Costa said Citi remains bullish on the currency, with markets still pricing in the central bank’s cautious stance.

Still, he warned that the outlook will grow more difficult in the second half of next year. Loose financial conditions and fiscal policy could push the US economy from a soft landing into a rebound and reflation territory, he said.

“In that potential scenario — marked by a steeper US yield curve and a firmer dollar — international assets, including emerging markets, could find it far more challenging to perform,” Costa said.

Last month, Citi strategists also recommended buying Turkish lira against the dollar via 3-month forwards.