Asian Stocks Under Pressure After US Tech Slide: Markets Wrap

Asian stocks are poised for a sluggish start after a selloff in dragged Wall Street lower.

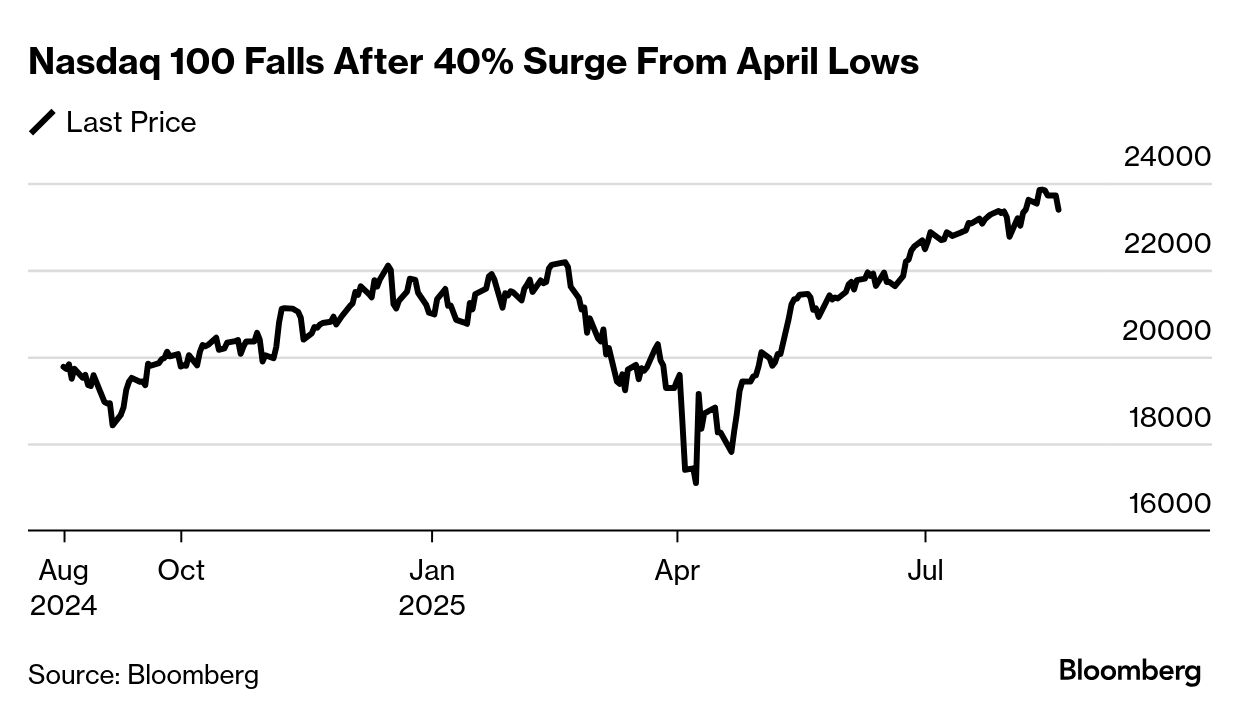

Equity futures show declines in Tokyo and Hong Kong after the logged its second-worst drop since April’s tariff shock. The slump was driven by a 3.5% slide in , highlighting the US market’s heavy dependence on a handful of tech giants. Sydney contracts signal a modest gain at the open.

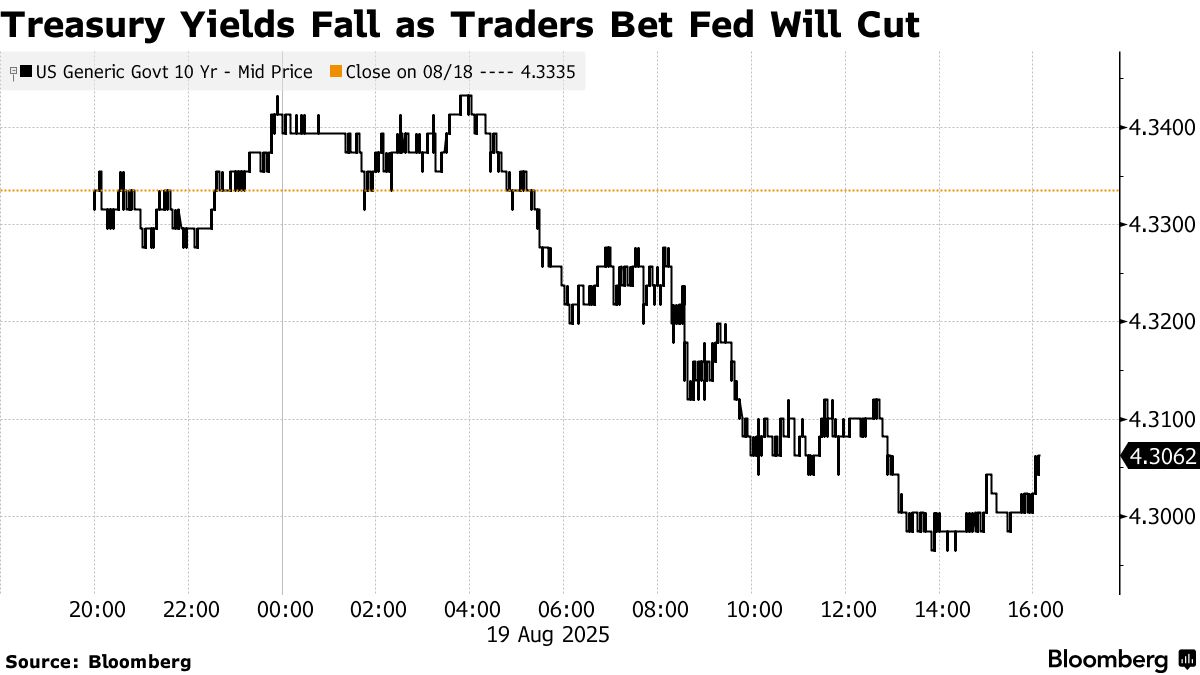

Treasuries rose ahead of Federal Reserve Chair Jerome Powell ’s Jackson Hole speech Friday, with traders firming up bets on a September cut. Ten-year yields slid three basis points to 4.3%.

S&P Global Ratings said revenues from tariffs will help soften the blow to the US’s fiscal health from tax cuts, enabling it to maintain its credit grade. The crypto world joined a slide in risky assets.

Positioning across US equity markets remains at elevated levels following a strong reporting season, according to Citigroup Inc.’s Chris Montagu . At Citadel Securities, Scott Rubner said individual investors are likely to their torrid pace of stock buying in September before resuming later this year.

“It is always easier when the markets are going up,” said Nicholas Bohnsack at Strategas. “It is difficult to poke holes in the bull case; the path of least resistance is likely higher, but we find ourselves increasingly worried that traditional risk assets (stocks and bonds) appear priced to perfection.”

Bank of America Corp. strategists led by Michael Hartnett have recently said the rally that’s propelled the so-called Magnificent Seven stocks higher from April lows looks . Hartnett has repeatedly warned of a in US shares this year.

US Homeland Security Secretary Kristi Noem indicated the government will step up of steel, copper, lithium and other materials from China to enforce a ban on goods allegedly made with forced labor in the country’s Xinjiang region.

US Treasury Secretary Scott Bessent also claimed some of the “richest families in India” benefited from the purchase of , while reiterating plans to boost tariffs on the South Asian nation.

Meantime, traders are gearing up for Powell’s speech on Friday in Jackson Hole, Wyoming, with the Treasury market seeing a quarter-point rate cut next month as virtually a lock and at least one more by year-end.

“As the market readies for Powell’s speech at Jackson Hole, we’ll argue that the biggest risk for Treasuries is if the Fed chief chooses to throw cold water on the widely anticipated September rate cut,” said Ian Lyngen at BMO Capital Markets.

While this is not Lyngen’s base-case scenario, he says the front-end of the curve is vulnerable to a correction if Powell doesn’t deliver on the degree of dovishness currently anticipated.

Investors are waiting to see if Powell affirms the market pricing — or pushes back with a reminder that new data arriving before the next policy gathering could change the picture. They’re also looking for clues about the longer-run trajectory of Fed cuts into next year.

A couple of weeks ago, when the latest jobs report revealed a slump in hiring, the case for lower rates appeared all but closed. Then came the sharpest spike in US wholesale prices in three years – fuel for the concern about tariff-led inflation that’s kept Fed officials on hold so far this year.

In an interview with Bloomberg Television, Fed Governor Michelle Bowman deflected when asked if she would be interested in leading the central bank as chair.

On the geopolitical front, President Donald Trump urged Russia’s Vladimir Putin and Ukraine’s Volodymyr Zelenskiy to show some “flexibility” as the US president accelerates his efforts to end the war in Ukraine and encourages the two leaders to hold a bilateral summit.

“While there’s a sense that the path to peace is at least slightly clearer, traders remain wary,” said Fawad Razaqzada at City Index and Forex.com. “And rightly so – the toughest conversations, namely over territory, still lie ahead.”

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities