Stocks Ebb, Bonds Climb Ahead of Powell Speech: Markets Wrap

Asian equities were primed for a muted open Thursday as whipsawing trade on Wall Street favored bonds over stocks ahead of Jerome Powell’s Jackson Hole speech.

Share futures for Japan were slightly lower while those for Chinese and Australian equity benchmarks inched higher. A gauge of US-listed Chinese shares climbed in New York on Wednesday, running against the grain of tech-led declines for US benchmarks. The fell 0.2% and the dropped 0.6%.

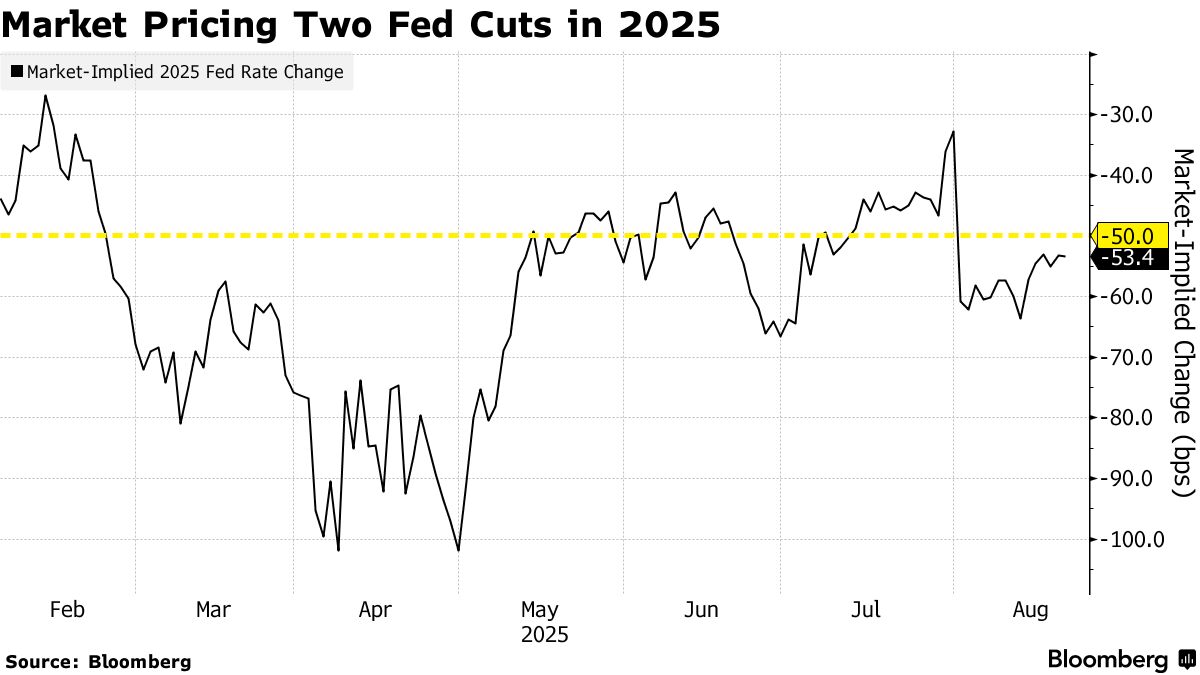

Treasuries climbed across the curve Wednesday, leaving the US 10-year yield two basis points lower. The advance was a sign traders were shrugging off identified in the latest Federal Reserve meeting minutes released Wednesday. Swaps showed traders continued to price in a high probability of lower US rates in September.

The moves reflected caution ahead of Powell’s comments due later Thursday at the Jackson Hole symposium where the Fed Chair is expected to unveil the central bank’s .

“The minutes are consistent with Powell’s hawkish comments last meeting,” said David Russell at TradeStation. “The bulls might get some cold water splashed in their faces at Jackson Hole.”

The ended Wednesday little changed and the yen was stable Thursday after strengthening against the greenback in the prior session. Oil climbed Wednesday as a report showed a in US reserves.

“The Fed will cut in September absent a re-tightening of the labor market combined with adverse inflation news,” Marco Casiraghi at Evercore said. He noted as a sign of stability, that the Fed minutes showed almost all participants believe the central bank “was well positioned to respond in a timely way to potential economic developments.”

In Asia, data set for release includes S&P Global PMIs for Japan, consumer inflation expectations for Australia and inflation for Hong Kong. Markets are closed in the Philippines.

Tech Selloff

US stocks are “in the early days” of a bubble, although the critical point for a correction has yet to come, Oaktree Capital Management LP co-founder Howard Marks cautioned.

Declines for US megacaps dragged down the S&P 500 for a fourth consecutive session Wednesday, despite a bounce off session lows. While most major groups in the US equity benchmark finished higher, some strategists warn that the extra-heavy weighting of tech giants could turn the “rotation” out of the sector into a broader rout.

“Rotation can only take place if the tech stocks hold up,” said Matt Maley at Miller Tabak. “If they decline, the only rotation we’ll see will be into cash.”

Mark Hackett at Nationwide says we’re seeing a notable drop in leadership, with large-cap growth significantly lagging small caps and value this month.

“Still, volatility and credit spreads remain calm, suggesting investors’ fears are modest,” he said.

At BMO Private Wealth, Carol Schleif says stock valuations are full right now leaving little wiggle room for disappointment.

“The stock market is currently discounting a bright future ahead, and that assessment is largely justified thanks to earnings, which have been much stronger than originally expected and increasing clarity on trade and tax policy,” she said.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.