Yen Weakens as Ishiba Departure Fuels Uncertainty: Markets Wrap

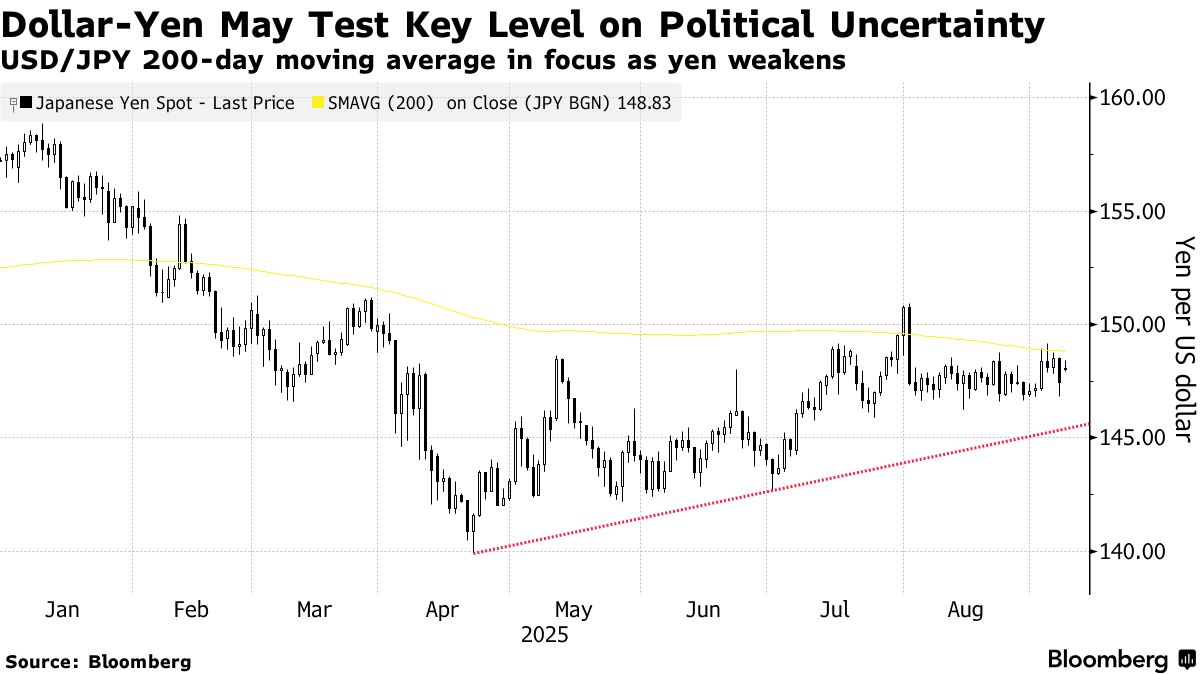

The yen dropped in early Asia trading as Japanese markets braced for fresh volatility after Prime Minister Shigeru Ishiba announced over the weekend that he will step down.

The currency fell as much as 0.7% against the dollar, wiping out Friday’s advance, while strategists said long-dated government bonds look amid growing concerns over fiscal spending. Ishiba’s resignation ends a tenure marred by bruising election results and leaves markets in limbo over Japan’s fiscal direction.

The departure is set to heighten investor uncertainty in the weeks ahead until a new leader emerges. US equity futures were little changed in early trading, while were firmer.

“This is yet another reason why few want to own the yen at present,” Chris Weston , head of research at Pepperstone Group wrote in a note to clients. “Look for yen weakness in Asia to become broad-based.”

Oil steadied after the Organization of the Petroleum Exporting Countries chose to start reviving a new layer of halted oil production more than a year early, rather than pausing — as traders had initially expected. It came straight after the group completed the surprise restoration of a previous tranche of halted output.

Elsewhere, Asian stock benchmarks are set to track Wall Street lower after a weaker-than-expected US jobs report on Friday ratcheted fears of a rapidly cooling labor market.

Australian bonds rose in early trading, tracking Treasury gains following the soft jobs data. Yields on two-year notes fell as expectations for a Federal Reserve rate cut this month were cemented and markets priced the chance of another two by year-end, according to swaps data compiled by Bloomberg.

“US dollar will track lower this week and could re-test” its year-to-date lows, Commonwealth Bank of Australia strategists including Joseph Capurso wrote in a note to clients. “Given the focus on the labor market in FOMC chair Powell’s recent speech, market participants may increase pricing of a 50 basis point cut to the Funds rate next week.”

Read More:

Traders will be looking to Chinese trade data later Monday to gauge the impact of US trade war on exports and the broader economy. China’s bond market may also be in focus after the Financial Times officials are considering allowing Russian energy firms to resume issuing yuan-denominated notes.

Stocks

Currencies

Cryptocurrencies

Commodities