Asian Stocks Set to Track US Optimism on Fed Cuts: Markets Wrap

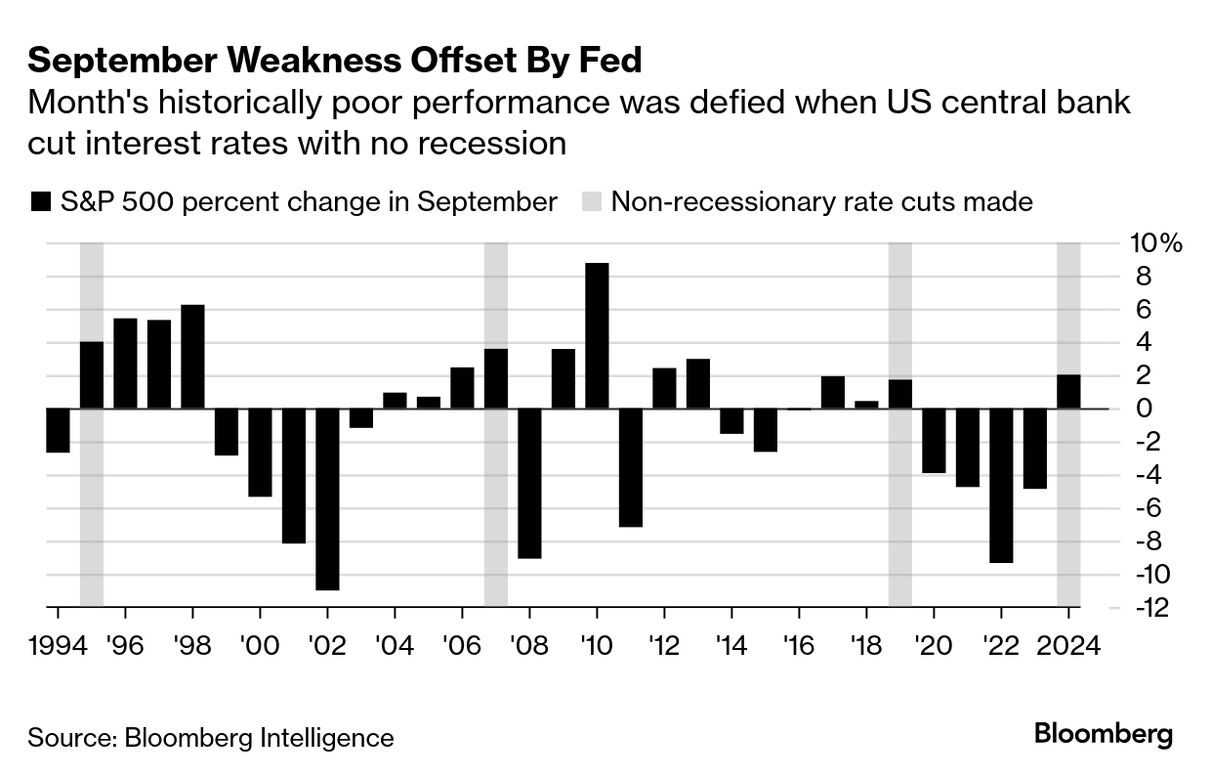

Wall Street’s upbeat mood ahead of expected Federal Reserve rate cuts look set to carry into Asian trading.

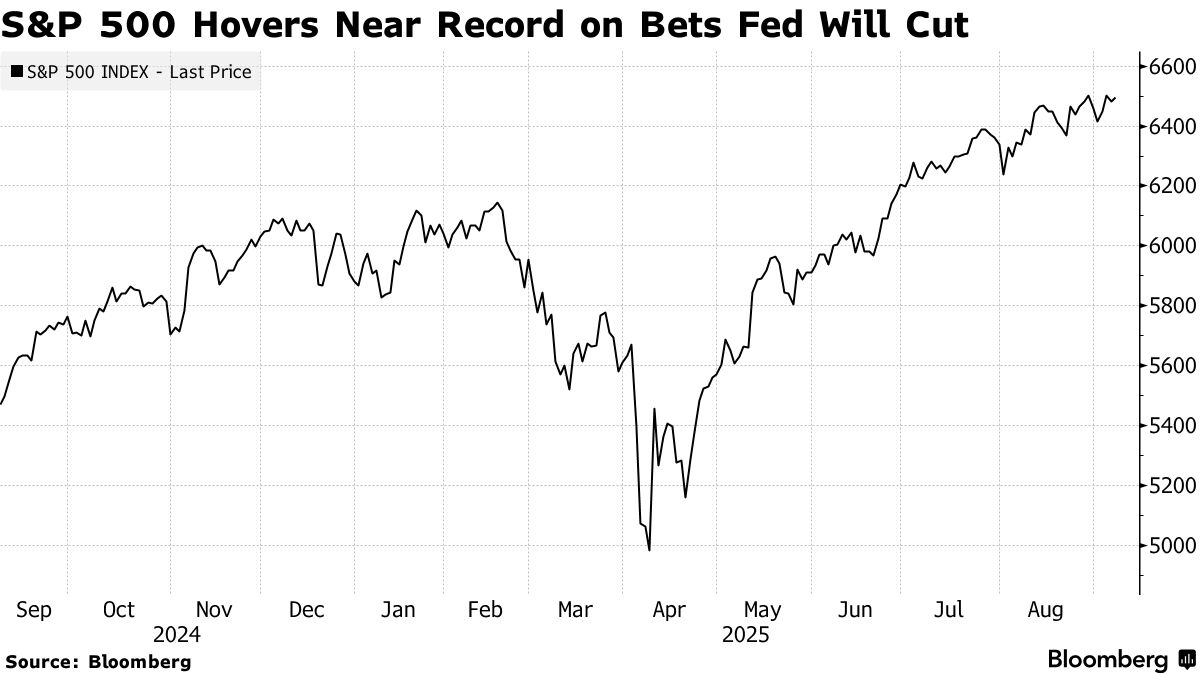

Futures point to gains for equity benchmarks in Tokyo and Hong Kong on Tuesday, though Sydney is set to slip. The moves follow a surge in bets on US central bank rate cuts that pushed stocks near record highs on hopes that easier policy will fuel corporate America.

After sliding on weak , the S&P 500 rebounded. Even as upcoming data is projected to show stalled progress on reducing inflation , traders are bracing for almost three Fed cuts this year, starting this month. Treasuries extended gains, with the two-year yield remaining at its lowest since 2022. The fell and gold hit a new .

“After last week’s tepid jobs numbers, it will likely take a major upside surprise from this week’s inflation data to derail a Fed rate cut next week,” said Chris Larkin at E*Trade from Morgan Stanley.

Fed officials have signaled concerns are shifting from the inflation risks posed by tariffs to weakness in the job market. are an indication that tariffs could prove a one-time price shock. That’s even if they take several months to work their way through the economy.

Ahead of next week’s Fed meeting, Thursday’s core consumer price index is projected to show a 0.3% increase in August for a second month. Before that, figures from the Bureau of Labor Statistics on Tuesday will likely unveil another US jobs markdown that will set the stage for a rate cut.

“While the Sept. 5 report showed job growth had slowed, it doesn’t appear to be signaling a recession,” according to . “Slower growth, anchored inflation expectations, falling yields, and anticipated rate cuts point to an optimistic outlook for stocks.”

US INSIGHT: What 550k Fewer Jobs Means – Worst Is Probably Ov

Elsewhere, Indonesian President Prabowo Subianto Sri Mulyani Indrawati as finance minister, risking renewed financial turmoil for Southeast Asia’s biggest economy following violent protests in recent weeks against his administration.

In Japan, the implications of the nation’s spilled has spilled into markets. Long-maturity Japanese government bonds slumped Monday as Prime Minister Shigeru Ishiba’s decision to step down underscored expectations for looser fiscal policy.

China’s to the weakest in six months as a slump in shipments to the US deepened again, although a surge in sales to other markets kept Beijing on track for a record trade surplus.

Read: S&P 500’s Rare Summer Climbs Send Bullish Signal: Equity Insight

To Megan Horneman at Verdence Capital Advisors, upcoming inflation data probably won’t be enough to change the likelihood of a Fed reduction in September. The biggest question for investors now is how many more rate cuts we will receive.

“After this week’s inflation data, we will get a better picture on what the Fed can do with rates,” Horneman said. “However, we are not out of the woods with inflation, and the Fed may deliver a ‘hawkish cut’ while reminding investors of their , especially if inflation continues to move further away from their target.”

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities