Euro Traders Revive $1.20 Bets With ECB-Fed Divergence in Focus

The euro is climbing back toward $1.20 as investors bet the common currency will benefit as the Federal Reserve and European Central Bank set interest rates on increasingly divergent paths.

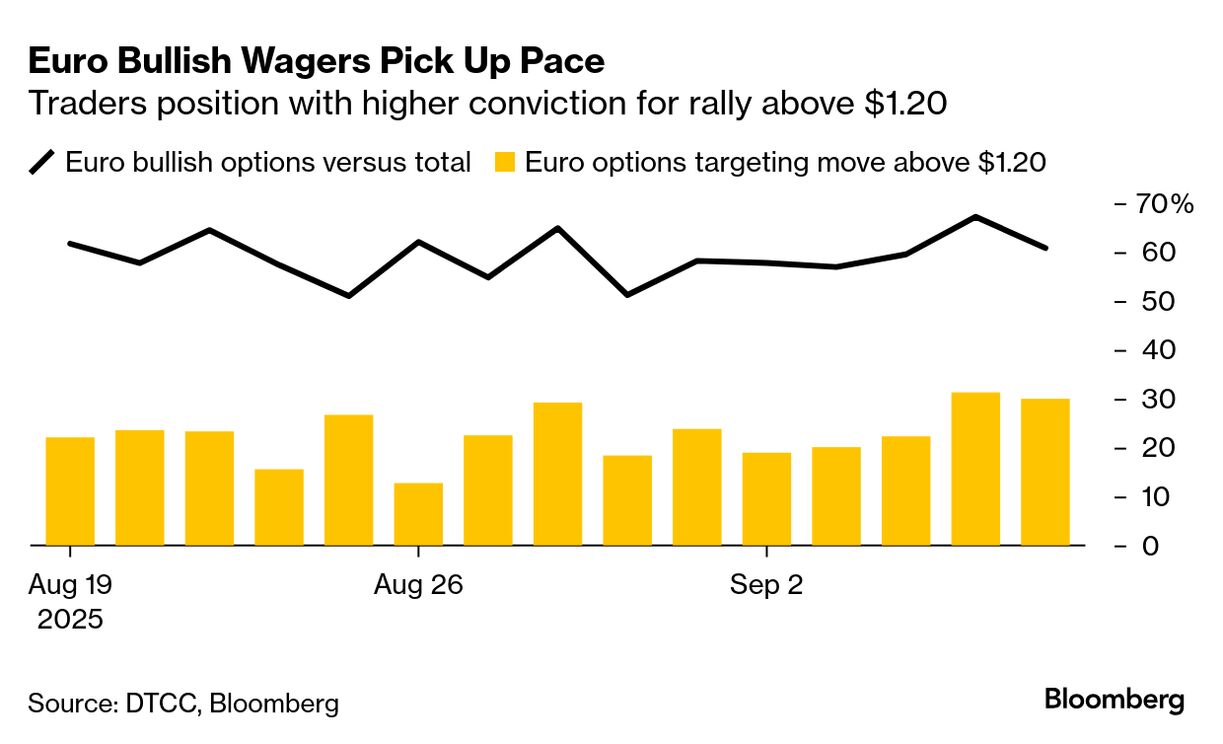

The euro rose 0.1% to $1.1780, its strongest since July 24, before erasing gains ahead of the ECB decision on Thursday. Options markets reinforce the move with so-called risk reversals showing bullish sentiment across maturities. Data from the Depository Trust & Clearing Corporation indicates that one in three bullish wagers since Friday target a break above $1.20.

The next key resistance level is $1.18 , where stop-loss triggers could accelerate gains, according to Thomas Bureau , co-head of FX options at Societe Generale.

Weak US non-farm payrolls data last week added to the euro’s advance, fueling expectations for deeper Fed rate cuts and hurting the dollar. The ECB, meanwhile, has hit pause on its easing cycle and money markets assign only a one-in-three chance it will cut by December. Another negative benchmark revision to US jobs data later today could further underpin the euro.

With the US unemployment rate at the highest level since 2021, some analysts think there’s potential for a significant move by the Fed. Strategists at Standard Chartered Plc. in interest rates next week.

“The underlying cyclical support for the dollar has deteriorated, reflected in a material narrowing in the EUR–US rate differential which is now consistent with a financial fair value in EUR/USD in the 1.18-1.20 range,” according to George Saravelos , global head of FX research at Deutsche Bank AG.

“It is stating the obvious that additional Fed cuts from here would increase incentives to hedge dollar assets by foreign investors,” he added.

The euro also shrugged off French political risks, climbing 0.4% on Monday even as Prime Minister François Bayrou lost a confidence vote in parliament. Hedging costs for euro strength rose in tandem.

Read more:

Danske Bank analysts wrote in a note that wider French spreads could cap the euro’s topside, but they continue to see the cross as undervalued.

France may face credit ratings downgrades after Bayrou’s fall, though a full-blown crisis still looks unlikely given its near-balanced current account, said Holger Schmieding , chief economist at Berenberg.

“ECB president Lagarde will have to mince her words carefully this Thursday, neither suggesting that the ECB may eventually bail out an unrepentant fiscal sinner nor taking such a harsh line as to unsettle markets that still give France the benefit of the doubt,” he said.

Technical indicators are turning constructive on the euro: A so-called Bullish Belt Hold Line has formed on the monthly chart, signaling the euro could retest its July peak of $1.1829. In the short-term, the so-called fear-greed indicator shows euro bulls in their strongest position in more than two months.