Treasuries Slip; Rally Pauses as Focus Shifts to Inflation Data

Treasuries slipped, snapping a four-day winning streak as investors braced for inflation readings this week which may show that ongoing price pressures could stand in the way of US interest rate cuts.

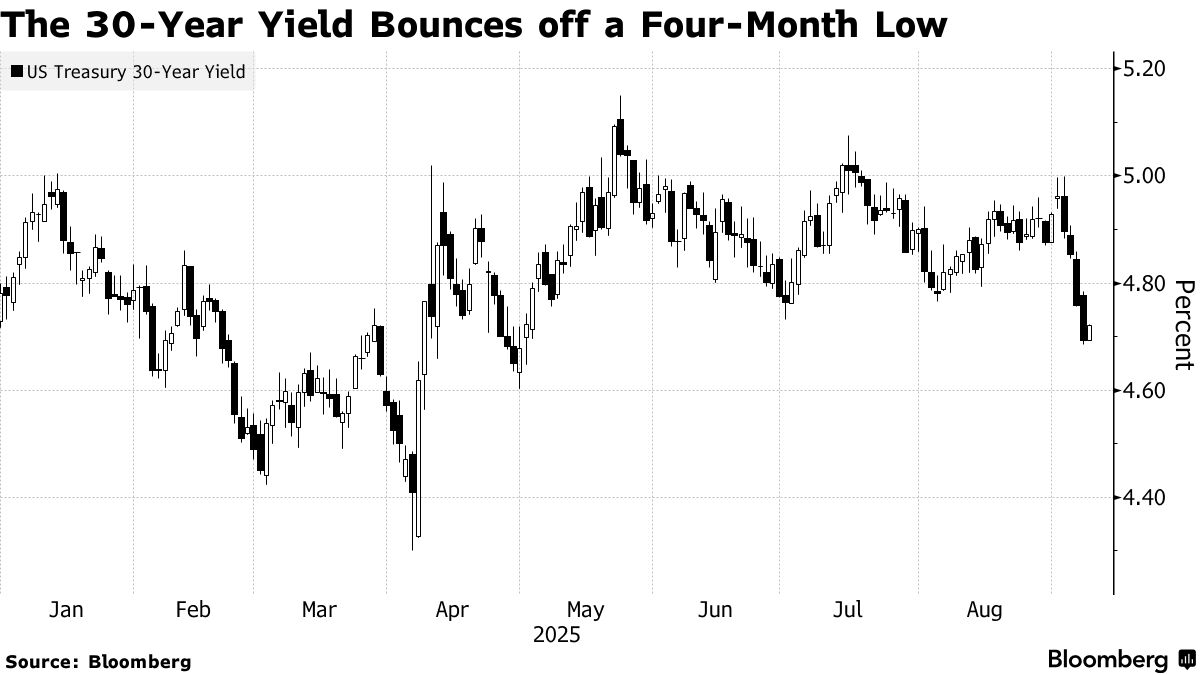

Yields rose across the board, pushing the 30-year yield as much as three basis points higher to 4.72%, off a four-month low hit the previous day. A smaller, 1 basis point rise in the two-year yield led to a slight steepening the yield curve.

While the market’s focus has shifted to inflation, investors were also anticipating a revised reading of US payrolls due later in the day. Ongoing signs of a softening labor market could raise expectations for more Federal Reserve monetary easing, after a weak jobs reading last week fueled a bond rally on bets the central bank will deliver as much as 75 basis points by year end.

Those gains have paused ahead of a crucial inflation reading on Thursday, when CPI is expected to show that prices continue to rise, even as the labor market slows. While traders are expecting the Fed to cut rates by 25 basis points next week, signs of persistent inflation would cool expectations that it will deliver consecutive cuts through the end of the year. PPI data is due on Wednesday.

“Yields are going higher as we shift the attention to inflation,” said Antonio Del Favero , head of US rates strategy at Macro Hive. “The market is pricing a soft landing and it is not sure the Fed will be forced to cut more than priced.”

Traders are betting on a more than 90% possibility that the Fed will cut rates by a total of 75 basis points by the end of December, having ramped up bets for cuts over the past week.

Expectations are that the latest revised jobs survey by the BLS will show that US job growth was in the year through March, and a weak reading could trigger a resumption in the Treasury rally, Del Favero said.