Colombia’s ‘Cowboy’ Bond Chief Engineers Rally Loaded With Risks

Javier Cuellar is making very large bets. Upon launching a complex $9 billion debt deal in Swiss francs, dollars and pesos, Cuellar, Colombia’s public credit director, declared he was taking a risk so big that it had no precedent in the country’s history.

This was back in July and the 40-year-old was just three months into the job. He had arrived at the Finance Ministry as an unknown to traders on Wall Street and even to many in Bogota, but that transaction, and the torrid months-long rally it would spark, has quickly turned him into one of the most recognizable names in Latin American debt markets.

“He’s being different and risky,” said Jose Luis Hernandez , the head trader at Corficolombiana. “He wants to break the mold.”

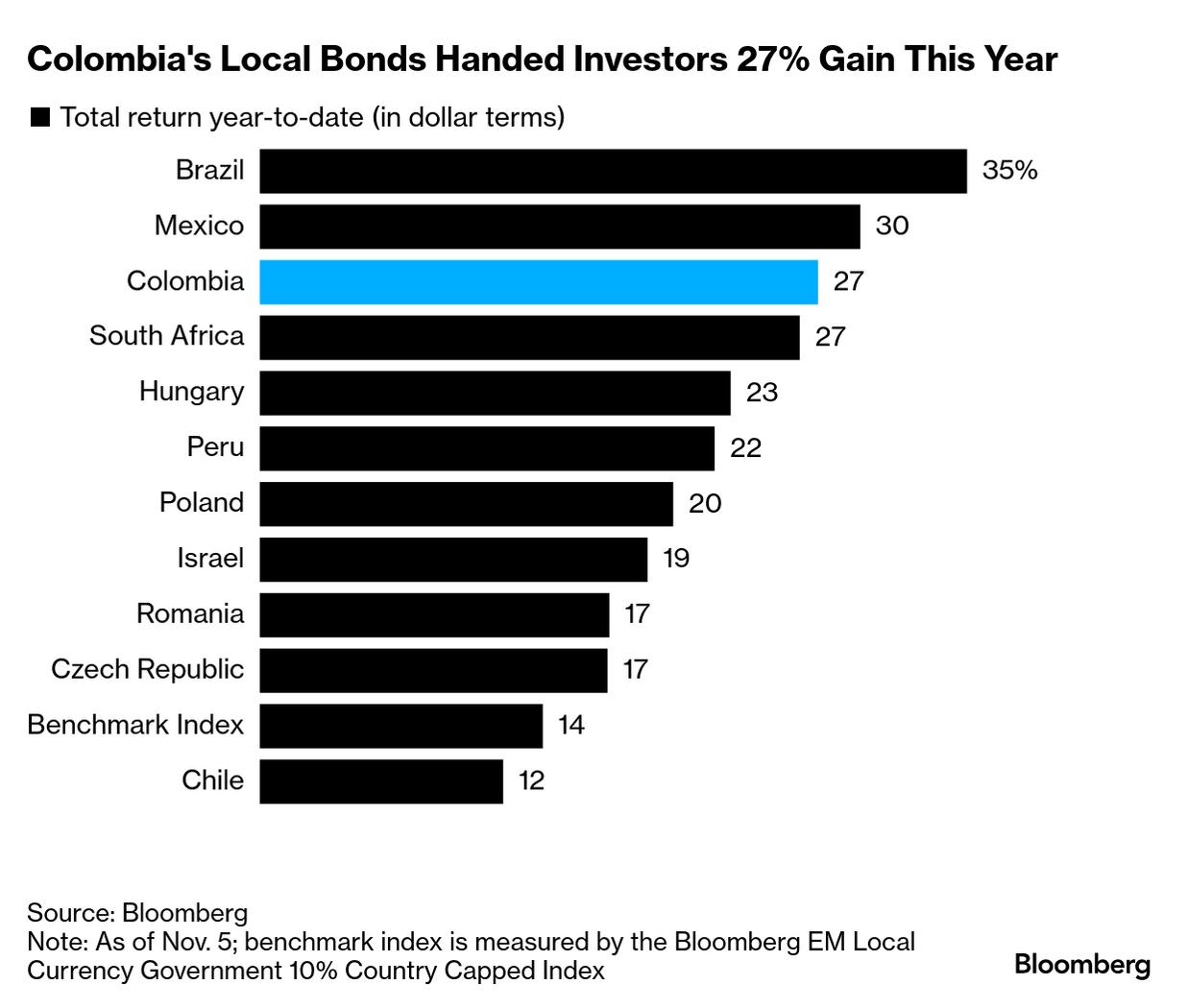

Some of those who’ve pocketed profits off the rally — the third-biggest among all developing-nation, local-bond markets — have started to affectionately call him “Mi Director.” To others, especially those who had been betting against Colombian assets and were burned by the sudden gains, Cuellar is a “cowboy” who’s taken unnecessary chances and lucked out by launching his plan just as emerging markets rallied.

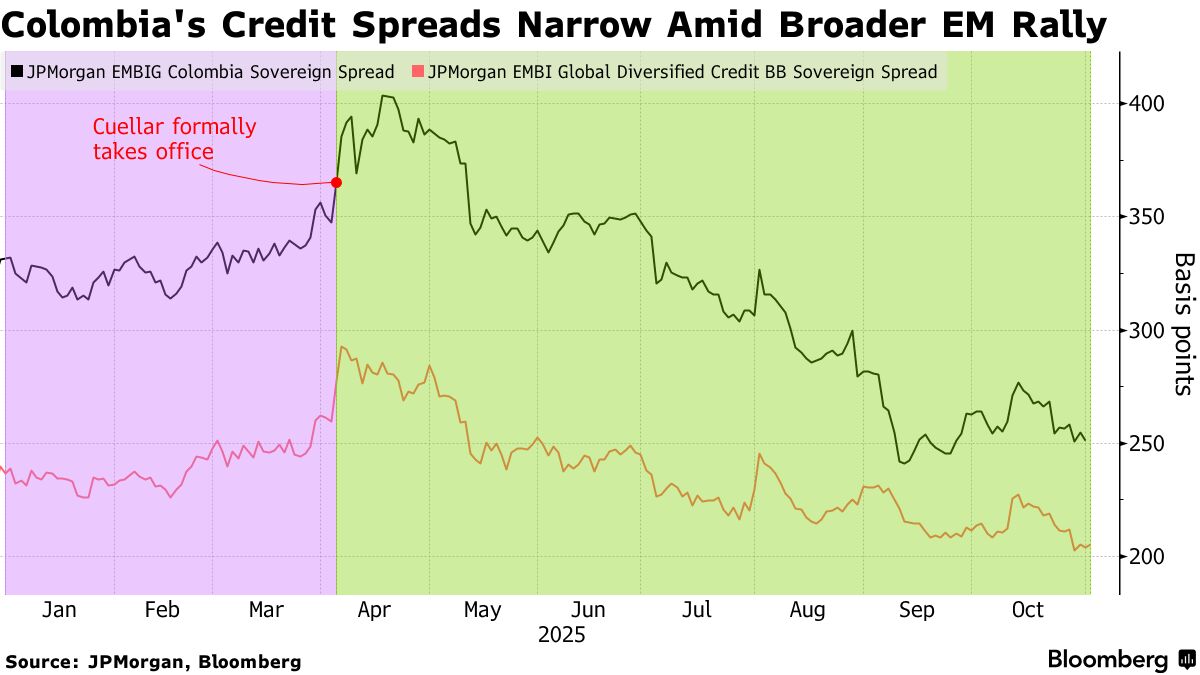

There were lots of investors in that bearish camp when Cuellar took over. His boss, the leftist president Gustavo Petro , had been running up huge budget deficits for years that spooked markets and drove up Colombia’s borrowing costs at home and abroad. Cuellar just wanted to break that cycle and turn market momentum around.

He’s pulled it off, for now, but the question is: at what cost? Officials have disclosed some details on the Swiss franc loan that’s central to the turnaround, but have kept others — including the total cost of the deal — under wraps.

Moreover, Barclays Plc estimates the deals Cuellar engineered could tack on $5 billion or more to the debt payments Colombia has to make next year, just as elections to replace Petro are held. Should a candidate as, or more, profligate than Petro win, raising the money to make those payments could prove tricky.

“He’s doing something that’s massive and taking a big risk,” said Benito Berber , chief Americas economist at Natixis. “It certainly raises the stakes for whoever is in power in 2026.”

Cuellar is unfazed. In a statement, he expressed confidence that he will keep down next year’s debt payments — in part by buying back more bonds that mature soon. “One of my main objectives as director of Public Credit is to ensure that the next government inherits a sounder debt maturity profile,” he said.

And if, to some in the market, that sort of deal-making means he’s a “cowboy,” well, so be it. “They say I behave like a cowboy — fair enough,” Cuellar said. “I’m working hard to prove that our fundamentals deserve tighter spreads.” He predicted that Colombia’s dollar bond yields could even start trading below those on Brazilian debt. They’re more than half a percentage point higher today.

Cuellar has spent most of his career in Colombia — and much of it in government. Outside of a stint at in Boston and London, he’s held jobs across the Bogota area, according to his LinkedIn profile.

He took over Colombia’s public credit office just as President Donald Trump ’s trade war was roiling global markets and triggering a rout in emerging-market assets. He quickly sprung into action.

He has borrowed billions in Swiss francs at low interest rates to repurchase Colombia’s dollar bonds, erasing costly debt from the country’s balance sheet and squeezing bearish investors. In just a few months, Cuellar struck deals with the likes of Goldman Sachs Group Inc., JPMorgan Chase & Co. and Banco Santander, refinanced a big chunk of the local debt, and even sold Colombia’s first euro-denominated bonds in a decade.

So far, at least, his strategy is working.

The extra yield investors demand to own Colombia’s government bonds over US Treasuries has tightened almost 1 percentage point this year, far outpacing the rally of similarly-rated peers. On average, Colombia’s peso-denominated bonds have delivered a 27% gain in dollar terms this year, trailing only Brazil and Mexico in the developing world.

A separate cross-currency swap Cuellar used to buy back the first batch of dollar bonds generated a profit of $85 million, the Finance Ministry said in October.

“If Cuellar had pursued a traditional debt issuance strategy, the scenario would be much worse than it is now,” said Felipe Campos, a strategist at Alianza Valores, a local brokerage. “The risk is paying off.”

Cuellar expects annual interest payments to fall to about 3.2% of gross domestic product — down from 4.7% currently — and that would pull the debt ratio back under 60%. He also that his debt strategy has reduced the outstanding amount of public debt by 39 trillion pesos ($10 billion).

‘New Playbook’

“We are creating a new playbook,” Cuellar said in an interview in September. “Judge me in 12 months by the results. Don’t judge me in advance based on an opinion.” In a follow-up conversation this week, he characterized the refinancing risk that so worries his critics as “low.”

“I’m not saying it doesn’t exist,” he said, “but it’s low.”

Pressed on the terms of the Swiss franc loan, Cuellar said the government had hedged out most of the currency risk and that it was paying a base interest rate of 1.5% plus a series of additional costs that he didn’t reveal. Goldman and JPMorgan declined to comment on the loan terms. A representative for Santander didn’t reply to a request for comment.

“It’s not publicly known what share of this borrowing is currency-hedged,” said Carlos de Sousa , a portfolio manager at Vontobel Asset Management. “Maybe in two, three years time, we’ll be able to reassess.”

By then, the new president will be in office, and the verdict on Cuellar’s strategy will be in.

“If a pro-market government wins the election, refinancing could come on even better terms than today,” said Alejandro Cuadrado , a strategist at BBVA in New York. “But if a candidate viewed unfavorably by investors prevails,” Cuellar’s plans could be harder to pull off.

Hernandez, the Corficolombiana trader, agrees. “This is a super electoral play.”