Loonie Set for Rebound as Fed Cuts and Canada Slows Easing Cycle

Canada’s currency is poised to benefit from a smaller interest-rate gap with the US as the nation’s central bank nears the end of its monetary easing cycle while the Federal Reserve gears up for multiple cuts.

The so-called loonie has become an attractive option to buy versus the dollar, with firms such as JPMorgan Chase & Co. and BMO Global Asset Management targeting 1.35-1.36 level by year-end, compared with current price at about 1.38. A lower level means the loonie has strengthened.

“Canadian dollar is among the cheapest G-10 currencies versus the greenback from a valuation standpoint,” said Patrick Locke , a FX strategist at JPMorgan. “We are short USD/CAD through options, a trade that reflects our structural bearish dollar view and concerns over FX hedging.”

A flagging economy has driven central bankers in Ottawa to cut interest rates at more than twice the speed as their Washington counterparts since the start of 2024. But the Fed is now set to play catch-up and make a number of rate reductions as the US labor market weakens. That would compress the yawning rate gap between the neighbors and boost the Canadian currency. Loonie bulls also see a swathe of major infrastructure projects and potential clarity on US tariffs as other sources of support.

The BOC “is probably close to the end” of its rate-cutting cycle, said Bipan Rai , a managing director at BMO. More than half of economists by Bloomberg expect BOC Governor Tiff Macklem and his colleagues to enact a quarter-point cut on Wednesday, bringing the benchmark rate to 2.5%.

Swaps markets are pricing around 44 basis points of Canadian cuts between now and the end of the year, compared to about 70 basis points for the US. That outcome would tighten their rate differential and likely support a loonie rally.

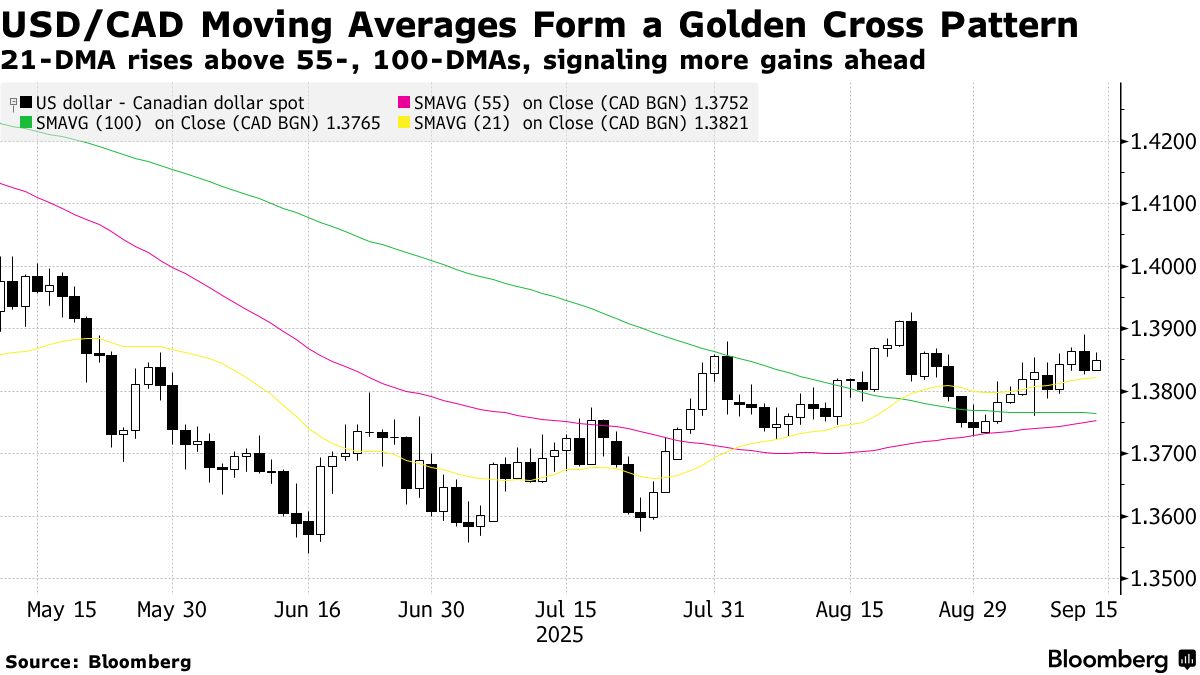

Every Group-of-10 currency has made gains against the dollar this year, but the loonie’s 4% rise has been the smallest. In August, the 21-day moving average for dollar-loonie climbed above both its 55- and 100-day moving averages, forming a so-called golden cross pattern that signals more weakness for the Canadian currency.

However, several fundamental factors suggest that the loonie is positioned to make gains.

Canada’s federal government last week released a list of major to be fast-tracked under a new law. A jolt of fiscal stimulus may mean that BOC doesn’t need to deliver additional cuts after Wednesday’s decision, sending the loonie down toward the 1.35-1.36 area by year-end, said BMO’s Rai.

Still, Canada’s bleak economic backdrop could spur multiple rate reductions in an effort to boost the economy. Citigroup sees the loonie weakening to 1.39 per dollar in the next several months and forecasts a quarter-point cut at each of the BOC’s next four meetings.

“The Bank of Canada has been very quick to react to any weakening data,” Alice Zheng , global strategist at Citi, said by phone. “We definitely think it’s possible.”

Three-month USD/CAD risk reversals have traded back and forth around parity in recent weeks, a sign that options traders are expecting a mostly stable loonie heading into year-end. Three-month implied volatility briefly dipped below 4.6% last week, the lowest since July 2024.

“The dollar-loonie cross has recently shifted more obviously into overshooting territory based on various fair value estimates, not only due to poor economic data but also as a result of lagged progress on a US trade deal,” according to JPMorgan’s Locke. Still, there’s scope for the pair to “course-correct lower” before year-end, he said. In late June, the bank recommended clients bet on loonie strength by buying a USD/CAD put option with a strike price of 1.3550 expiring on Dec. 24. Locke said he’s holding onto the position through Wednesday’s BOC meeting.

Even if policymakers in Ottawa take a dovish tone this week, the Fed’s decision — just a few hours later — should give loonie bulls an extra boost.

“We think the BOC meeting will be dovish given the lackluster economic outlook but expect USD/CAD downside to be driven by the Fed meeting the same day,” wrote Morgan Stanley strategists led by David Adams , head of G-10 FX strategy, in a Sept. 12 note.