Yuan Heads Near Levels That May Prompt Exporters’ Dollar Selling

China’s yuan is nearing key levels that may spur more local companies to convert their dollar holdings, analysts said.

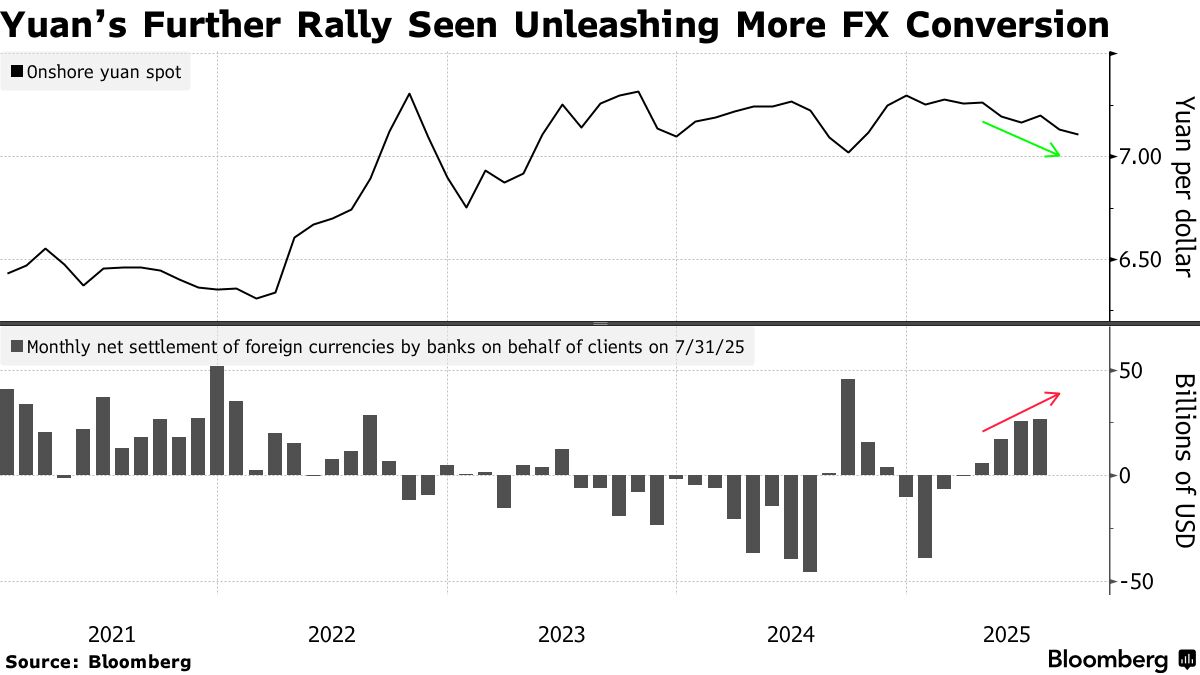

Traders have reported more dollar sales in recent weeks, while data in July showed there was more demand to swap foreign currencies into yuan than buy them. If the onshore yuan breaks into the 7.0 to 7.10 range from its current 7.11 against a dollar, firms are likely to step up conversion, and up to $300 billion of foreign currency holdings may be unwound, according to a range of estimates by Barclays Bank Plc. and Dongwu Securities.

Across Asia, investors are rethinking the dollar’s appeal amid trade tensions and uncertainty over the Federal Reserve’s interest rate path. In China, this reassessment stands out due to its large surplus and exporters’ past preference for higher-yielding dollar assets. A stronger yuan may boost foreign interest in Chinese assets and raise domestic purchasing power.

“The market is building a consensus for yuan appreciation and weakness in the dollar,” said Lu Zhe, chief economist at Dongwu Securities. “This will curb foreign currency buying demand among corporates and residents, and increase currency settlement.”

Foreign currency hoarding has long been visible across China’s financial system. Since 2022, banks have mostly been net buyers of dollars on behalf of clients. Many exporters chose to keep their revenue in dollars rather than instantly convert them. Foreign currency deposits held by residents and companies have also risen since late 2023.

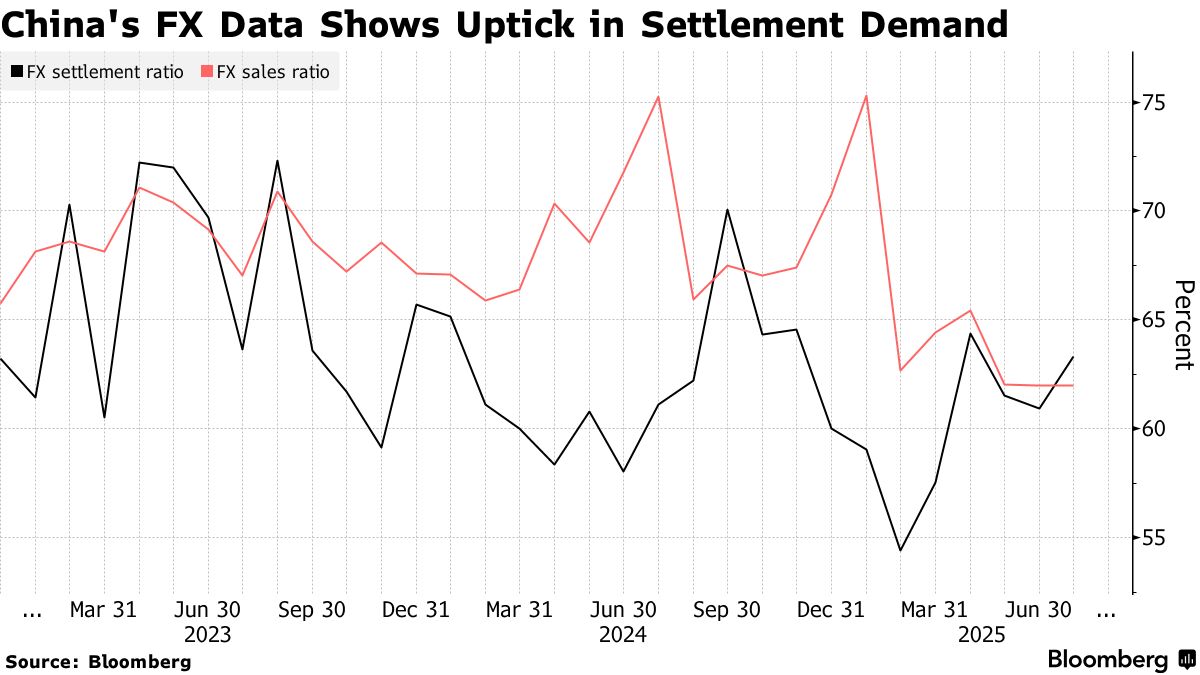

In July though the ratio of foreign currency converted into yuan relative to cross-border receipts rose. This is the first time since September 2024 that this metric surpassed a similar gauge for foreign currency purchases.

Meanwhile, exporters ramped up dollar selling in late August and early September, which then cooled before picking up again this week, according to traders familiar with the transactions who declined to be identified as they’re not authorized to speak publicly.

The onshore yuan strengthened to 7.11 per dollar this week, its strongest since November, extending a 2.7% rally against the greenback this year.

According to Dongwu’s Lu, up to $300 billion currency conversion may take place as the yuan strengthens toward 7.04-7.05, the average cost for exporters’ unsettled dollar positions.

Barclays offers a similar view. Chinese companies are hoarding about $700 billion in dollars, and says an appreciation to key levels like 7.08 and 7.10 may trigger up to $240 billion in dollar selling, according to the firm’s strategist Lemon Zhang .

Traders are also watching subtle shifts in the People’s Bank of China’s recent approach. The central bank has steadily strengthened the daily fixing toward 7.1 per dollar, signaling comfort with a stronger yuan. Market watchers interpret this as a possible gesture from Beijing to facilitate smoother trade negotiations with the US.

Corporates may further raise hedging ratios on dollar exposures this year, “likely driven by market volatility and tariff uncertainty,” Zhang said.

In the onshore derivatives market, hedging is already rising. About $35 billion of short dollar forwards were signed at Chinese banks in July, the largest amount since September last year, according to Bloomberg-compiled data.

“Chinese exporters have enjoyed good cash flows and profited from interest rate differentials earned from holding dollars in recent years,” said Liu Yang , general manager of the financial market business department at Zheshang Development Group. “Now, they might start to fear yuan appreciation breaking such a trade, especially if the yuan gains further to break the 7 per dollar level.”