Asian Stocks Set for Muted Start After Fed Cut: Markets Wrap

Asian equities were primed for a muted open Thursday while US equity futures climbed in a sign of renewed sentiment following a lackluster response to the Federal Reserve’s Wednesday rate cut.

Contracts for the S&P 500 and Nasdaq 100 both rose around 0.3% in early Asian trading Thursday. The moves followed a minor rally in post-market trading for some of the largest US equity exchange traded funds. The SPDR S&P 500 ETF climbed 0.1% and Invesco’s QQQ ETF gained in after-market trading, after minor declines in the main session.

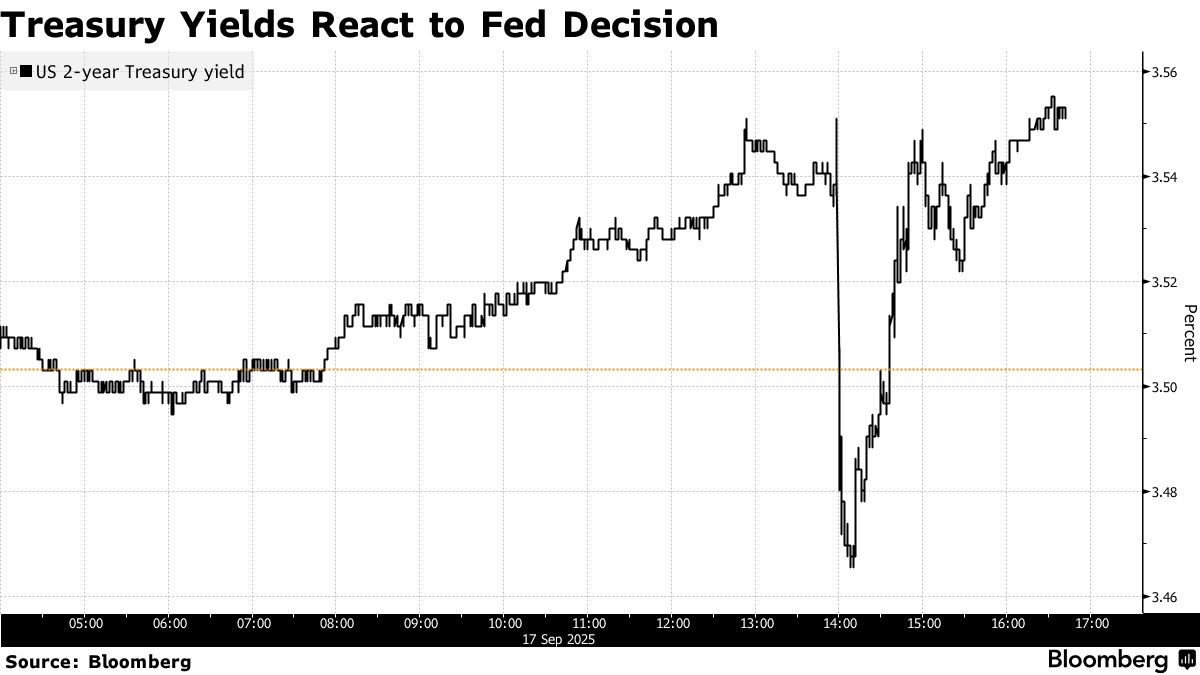

Equity index futures for Australia and Hong Kong slipped while those for Japan were little changed after US benchmarks edged lower on Wednesday. Treasuries fell across the curve, sending the policy-sensitive two-year yield five basis points higher, while an of the dollar strengthened.

The Fed had struck an initial cautious tone, acknowledging while stressing a data-dependent approach amid inflation risks. The Federal Open Market Committee voted 11-1 to cut rates to 4%–4.25%. Powell underscored the tension between jobs and inflation, saying policy is now “meeting-by-meeting situation,” and that “there’s no risk-free path” ahead.

“Powell’s tone and words in his press conference do indicate this was more a defensive move to avoid more weakness in the labor market,” said Steve Wyett at BOK Financial. The muted market response is a sign the cut “was widely expected,” he said.

Fed policymakers now see two additional quarter-point cuts this year, one more than was projected in June. They foresee one quarter-point cut in 2026 and one in 2027 and also slightly upgraded their outlook for both growth and inflation in 2026.

The decline in Treasuries signaled among bond traders who had bet on a more aggressive series of Fed cuts.

“The dot plot now implies two more cuts this year, but Powell downplayed its significance,” given the risk of further jobs weakness, said Dan Siluk at Janus Henderson Investors. “The messaging remains nuanced and far from a full pivot,” he said.

In Asia, data set for release Thursday includes jobs data for Australia, Swift payments for China and a rate decision in Taiwan. Later Thursday, the Bank of England is expected to keep rates steady.

China’s cyberspace regulator including to halt orders for a semiconductor that can be used for AI applications.

Chinese banks banks have on government debt at the fastest pace since 2019. In each of the past two months, commercial banks such as raised their overall holdings by more than 20% year-over-year, according to central bank data.

Oil prices after a three-session advance as traders assessed fresh US stockpile data and the Fed’s rate cut. Gold was steady after a Wednesday .

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Commodities

This story was produced with the assistance of Bloomberg Automation.