The Big Dollar Short Is Turning Into a Pain Trade for Investors

Betting against the dollar has been the dominant trade this year in the $9.6 trillion-a-day foreign exchange market, but the wager is starting to stumble.

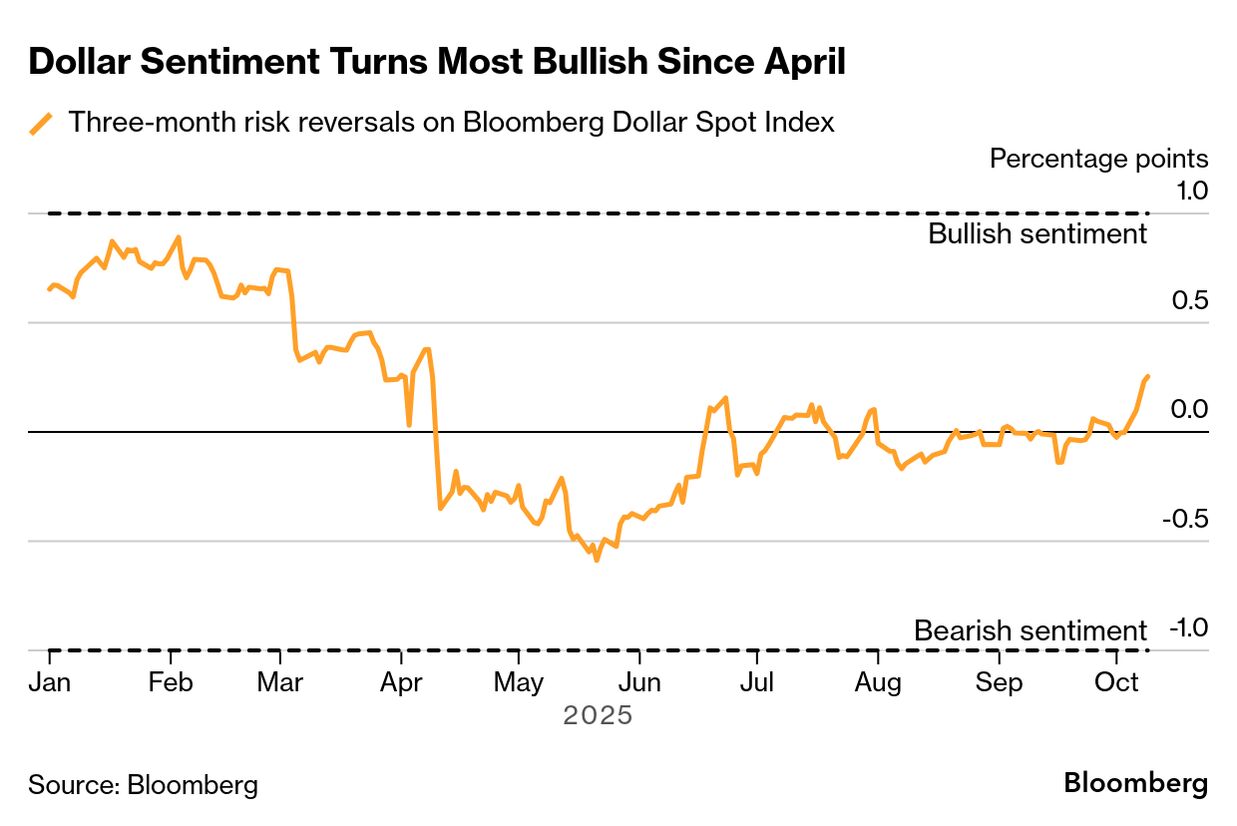

The world’s primary reserve currency is around a two-month high even as the US government shutdown drags on, and hedge funds are adding options bets that the rebound versus most major peers will extend into year-end.

Overseas developments have been a key driver, with the euro and the yen falling abruptly this month. At the same time, comments from Federal Reserve officials urging caution around further interest-rate cuts have boosted the dollar’s appeal.

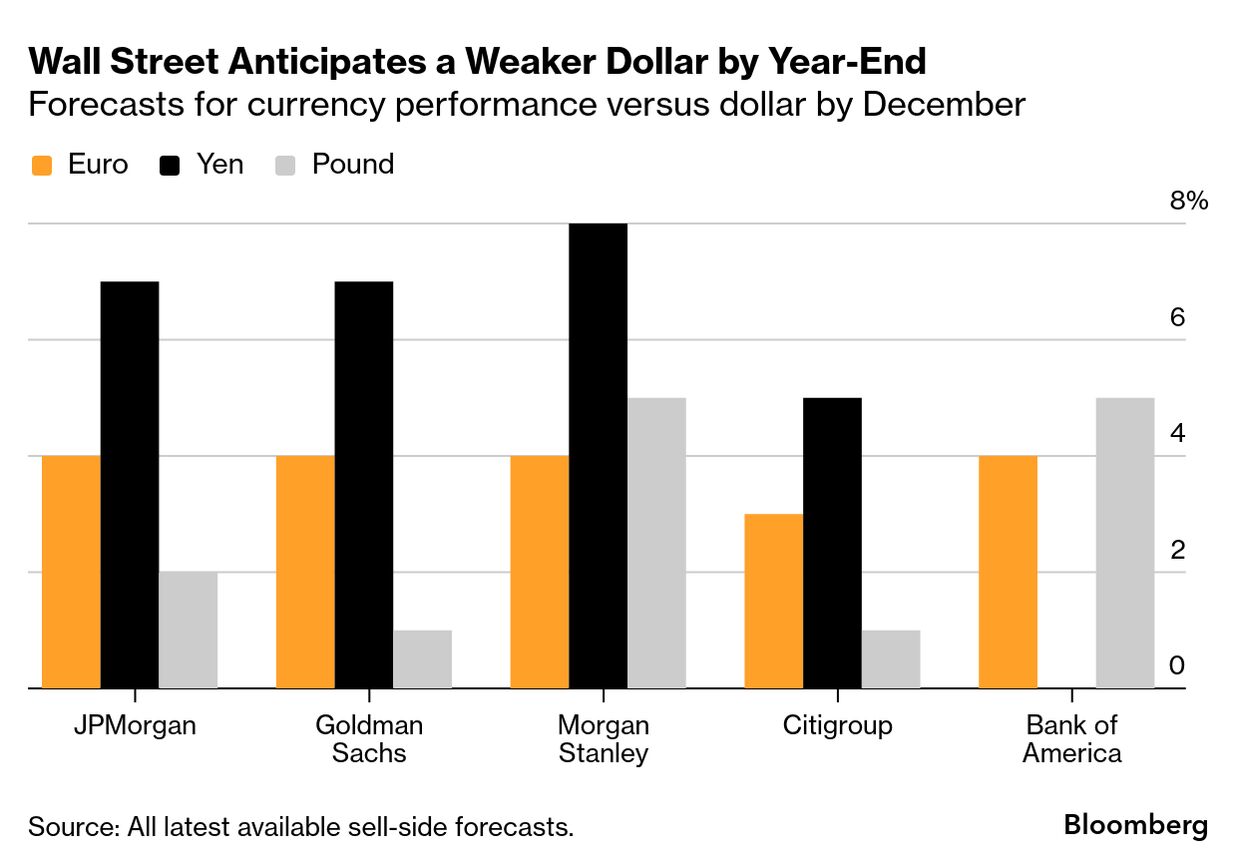

The longer the strength persists, the more painful it is for those sticking with calls for the greenback to take another leg lower. Among the bears: Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley.

The trend, if it continues, could reverberate across the global economy, for example making it harder for other central banks to ease monetary policy, pushing up the cost of commodities and increasing the burden of foreign borrowings in the currency.

A rapid rebound could derail bullish for emerging-market equities and bonds in the final quarter of the year and also risks weighing on the shares of American exporters.

Count Ed Al-Hussainy at Columbia Threadneedle among dollar pessimists who have flipped their view. The portfolio manager went short at the end of 2024 when the greenback was still rallying as part of the so-called Trump trade after the US election.

Over the past month and a half he’s trimmed that stance by reducing exposure to emerging markets. For him it boils down to markets leaning too heavily toward Fed rate cuts given the resilience of the American economy.

“We have become a lot more positive on the dollar,” he said. “The markets have priced in a very aggressive series of cuts, and it’s going to be difficult to execute them without a lot more labor-market pain.”

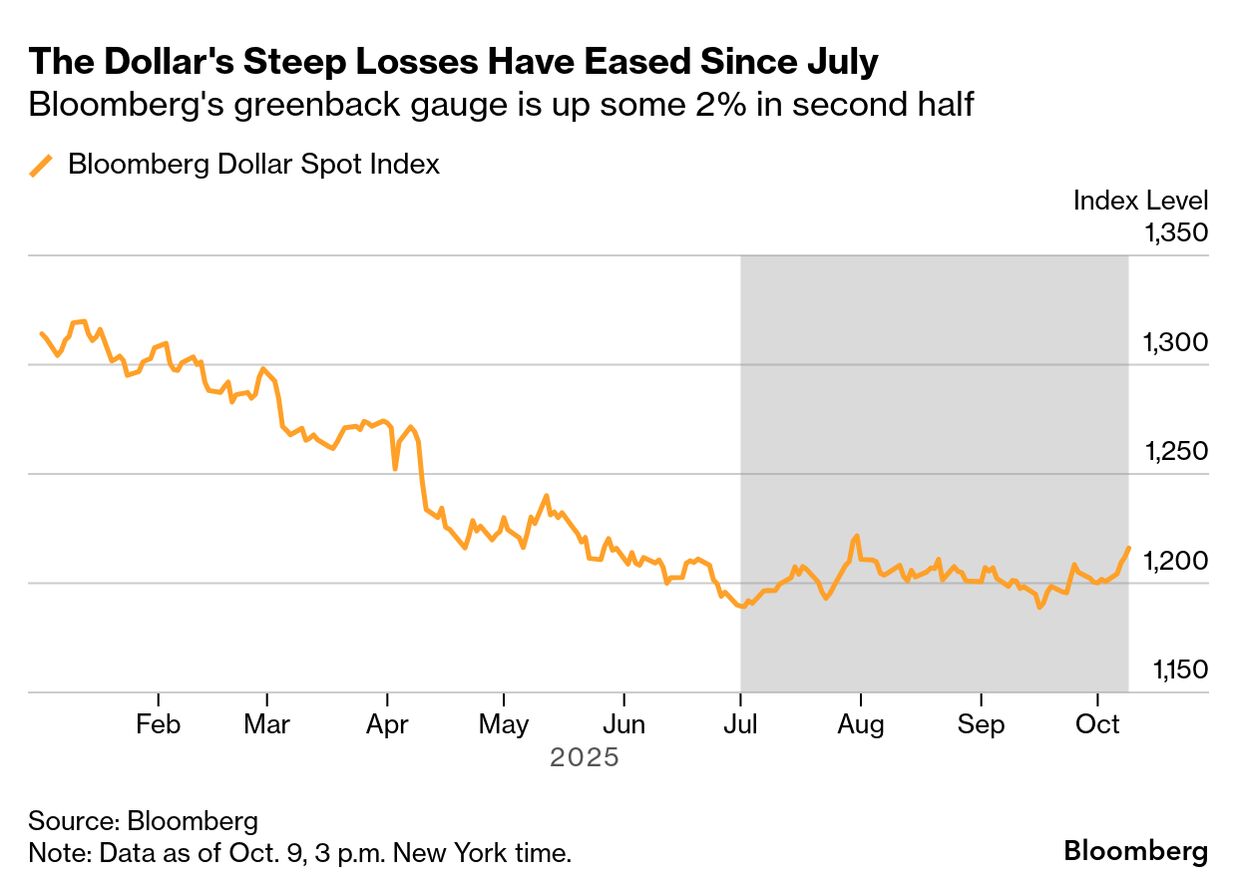

The is now up roughly 2% since mid-year, after its steepest first-half slide in decades. In early 2025, after President Donald Trump held off on applying across-the-board tariffs once he took office, the greenback slid in part on the view that inflation would be tame enough for the Fed to resume lowering rates.

The slump deepened with his rollout of sweeping levies in April, which fueled worries that foreign investors would amid the trade war. There was also speculation that the president favored a weaker dollar, which would help US exporters, on top of his , all of which amplified the bearish wave.

As it turned out, however, international investors haven’t shunned the US, although there are signs they’ve been to protect against dollar losses. The lure of US equities, led by megacap technology shares, has been too great. And overseas demand at Treasury auctions has been mostly solid.

While the latest Commodity Futures Trading Commission data show that hedge funds, asset managers and commodity trading advisers were still short the greenback as of late September, those positions are well below the peak reached at mid-year.

Hedge funds ramping up bullish option trades on the dollar into year-end are expressing that view against most Group-of-10 currencies, according to Mukund Daga , global head of currency options at Barclays Bank Plc.

Dollar Advances Toward Key Resistance Levels: Major Techs

There are also signs that options traders are paying more to hedge against the risk of a dollar rally than a decline. A measure of the difference in demand for bullish versus bearish bets shows traders are the most optimistic on the greenback since April. The appetite for dollar-bullish structures has exceeded that for bearish ones every day this week, Depository Trust & Clearing Corp. .

Where the dollar goes from here, of course, is anybody’s guess. The Fed’s next steps will play a major role.

Traders are pricing in roughly two quarter-point cuts by year-end and more next year. Yet recent commentary — including the of the central bank’s September meeting and from policymakers — suggests the trajectory is far from assured. While there are signs the job market is cooling, .

“Markets are now pricing in a full Federal Reserve cutting cycle,” said Mona Mahajan , head of investment strategy at Edward Jones. “They weren’t before, and that helps explain why the dollar has weakened so much, but some mean reversion is to be expected.”

A big complication for currency prognosticators is that the government shutdown has delayed crucial employment figures, though the Bureau of Labor Statistics is said to have staff to prepare a key inflation report. Evidence that labor-market weakness is building could revive the short-dollar trade, and some of the biggest banks on Wall Street still see more dollar losses in the coming months.

Another wrinkle for the dollar could be the so-called , as growing fiscal concerns around the biggest economies lead some investors to seek the perceived safety of Bitcoin and instead of major currencies.

A large part of the dollar downdraft earlier this year came from the view that a brightening outlook for non-US markets would lure investors. But politics in France and Japan have muddied that narrative.

Exchange rates measure relative values, and sentiment toward the yen has soured with the prospect of the likely ascendancy to Japan’s premiership of Sanae Takaichi , the new chief of the nation’s ruling party. Her policies are seen as fueling inflation and debt-funded stimulus, a scenario that pushed the yen to the weakest since February.

In France, meanwhile, President Emmanuel Macron ’s government remains , a fresh weight on the common currency, which has dropped to the lowest since August.

Given the situation in France and expectations of looser fiscal and monetary policy in Japan, the rally in the dollar against those two currencies may have legs, said Carol Kong , a strategist at Commonwealth Bank of Australia.

“The fact is, to use one of our old adages, the dollar is relatively the least dirty shirt in the laundry,” said Andrew Brenner , vice chairman at Natalliance Securities in New York. “Don’t expect a major dollar downside with both the yen and euro under pressure.”