The Great Debasement Trade Is Mostly Just Hype

It now has a formal name: “ .” It’s a catchy term for all manner of investor hairpulling about runaway deficits and the dollar’s threatened primacy — and an apparent flight for refuge that means shunning sovereign debt and related currencies, and snapping up precious metals, crypto coins and other shiny stuff instead.

Finance bigwigs including Ray Dalio, Ken Griffin and Jamie Dimon have all made worried noises. But many are either regular Cassandras or run hedge funds with an interest in talking up so-called momentum trades, where you bet that already overheated assets like gold will keep soaring.

Though I love a good yarn, much of this is hyperbole — so far, anyway — mixed in with a few justifiable fears about out-of-control government spending.

To start from the top, the dollar’s doing fine. Having appreciated 3% in the past month, it remains above its 40-year average. It still commands the lion’s share of currency trading and global central bank reserves, even if international investors are hedging more exposure. US equities remain in touching distance of all-time highs. The idea of debasement is doing a lot of heavy lifting here.

Gold’s price may have risen 50% this year, but that doesn’t mean there’s been a comparable surge in its use as a reserve asset. US Treasuries, meantime, have actually enjoyed net inflows from foreign investors attracted by their higher yields. And while cryptocurrencies have been on a tear, a brutal price crash last weekend ought to remind more gullible investors that this remains the Wild West with scant protection.

Speculators love gold and bitcoin but could they really replace major securities markets and currencies? Neither earns an income, they’re hard to cash out of and cost money to hold.

The initial surge in gold was almost certainly triggered by certain central banks, led by China, noting the seizure of Russian reserves in 2022. Recent gains are much more about speculation as momentum traders pile in. Silver’s 70% leap since April is part catch-up to gold, but it’s also been fueled by fears about a lack of market liquidity in London.

This is not a macroeconomic portent of doom. Sensible central bank reserve managers won’t be swapping relative safety for assets at the top of a bull run.

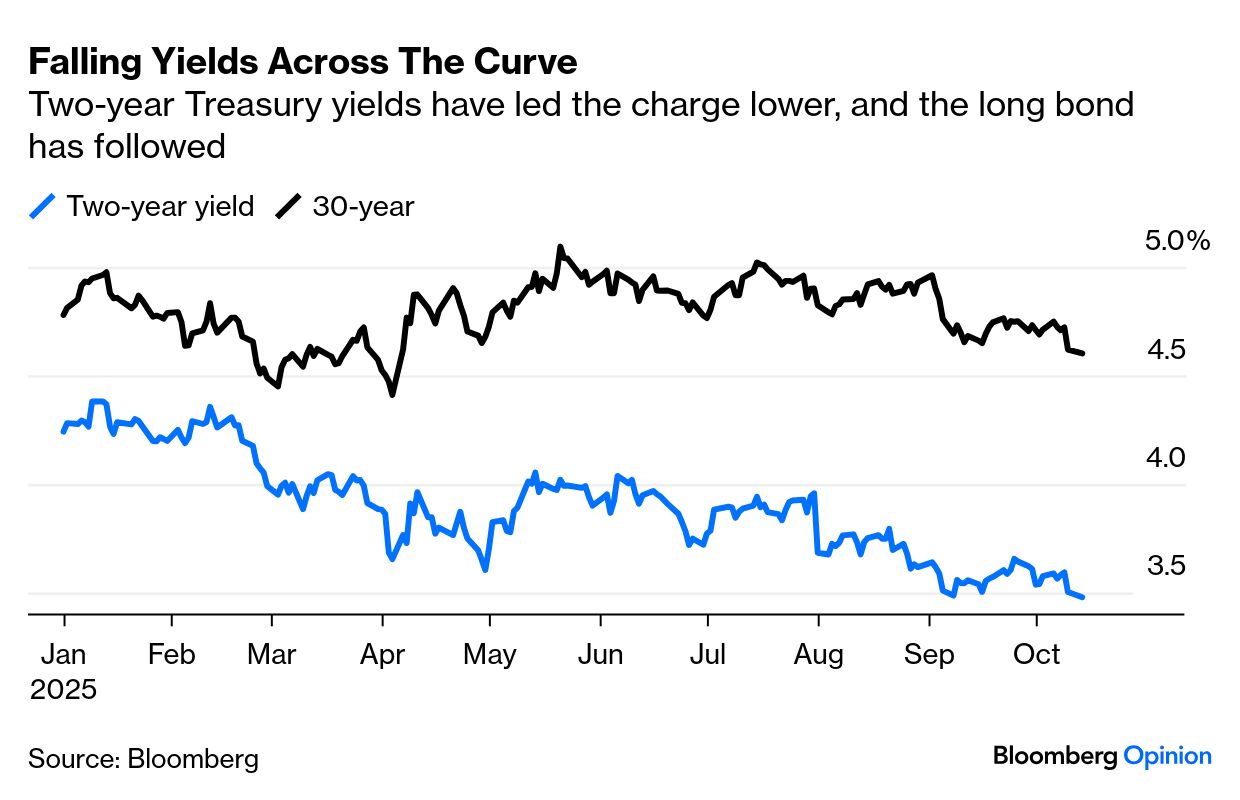

A cursory look at recent yields on longer-term sovereign bonds doesn’t offer much support to debasement trade fans either. Thirty-year US Treasury yields are 50 basis points below their 5.1% peak in May. While that’s still far higher than the near-zero rates during the pandemic stimulus period, the tide’s turning. Two-year US Treasury yields are the lowest for three years.

If the Federal Reserve cuts its official rates again on Oct. 29, as is almost completely priced into futures, yields on other maturities will likely fall too. Nor is it certain that lower central bank rates will fuel inflation. After all, US tariff hikes have barely fed through to consumer prices so far.

Even in the much-maligned UK, yields on long-term gilts are 30 basis points below their highs. Japanese ultra-long yields remain close to their peaks but that’s largely down to unusual political turmoil. Similarly, for all the government strife in France, the country’s 30-year yield is still below Italy’s. This isn’t yet heralding another euro zone crisis.

None of this should encourage complacency. The gap between two-year and 30-year US Treasury yields is still about 100 basis points wider than a year ago, showing investors remain dubious about the longer run. Governments have to act on such clear signals that wild spending will no longer be tolerated. Notice has been served.

And yet higher yields on longer maturities are more about investor reluctance to add to their positions rather than a wholesale exodus. Government debt managers are adapting, selling more short-term debt. That will continue to be the trend.

Ultimately, digital coins and precious metal can’t offer the comfort of state-stamped debt. The promise of shoring things up in a crisis still holds — as the Fed showed with its rapidly created after Silicon Valley Bank’s collapse. The prevailing fiat monetary system has learned how to look after itself.

Web readers, click . Or subscribe to .

To contact the author of this story: at

To contact the editor responsible for this story: at