Yuan Option Traders Brace for US-China Tension Lasting Into 2026

Escalating trade tensions between the US and China are spurring yuan traders to prepare for greater volatility lasting into early 2026.

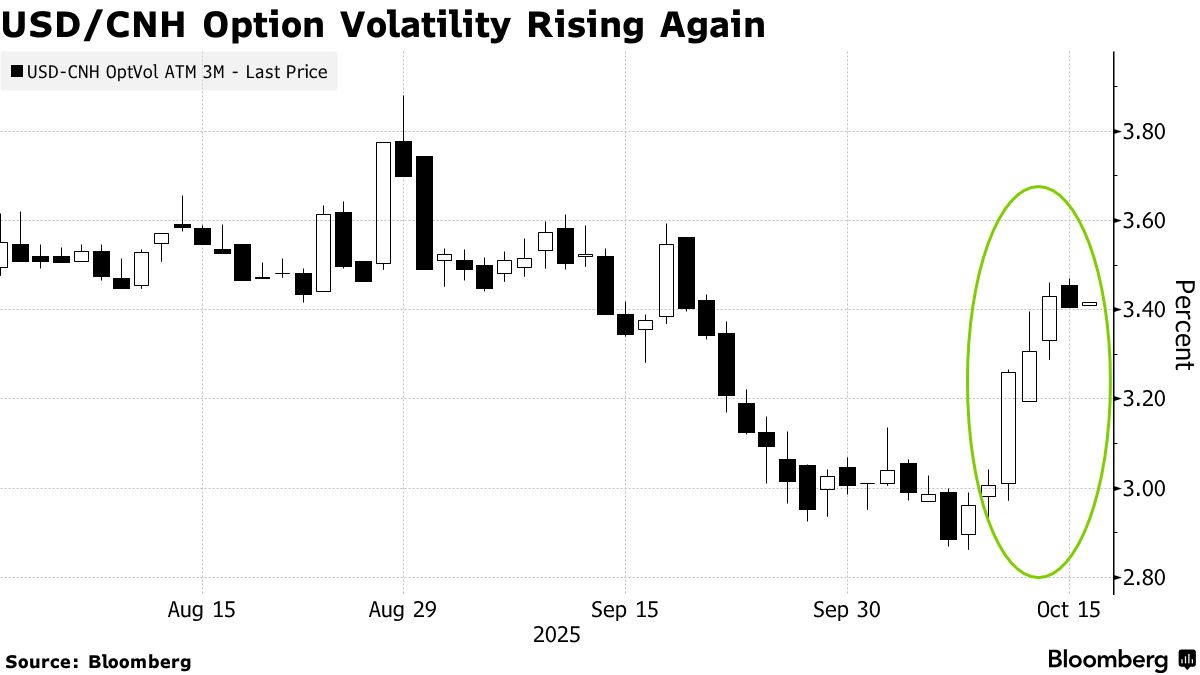

Demand for dollar-offshore yuan option contracts, which can be used to hedge or speculate on the pair’s future movement, has grown after a volley of restrictive trade measures from both Washington and Beijing. Volumes on Tuesday were the largest in four weeks, according to The Depository Trust & Clearing Corporation data.

“We have seen an increase in market demand for dollar-offshore yuan options,” said Nathan Sinclair , Hong Kong-based head of FX options Asia at Crédit Agricole CIB. “The demand has been particularly strong in the three-month tenor.”

Investors are positioning for more currency turbulence after a string of tit-for-tat — including China tightening export controls on and the US dramatically — seen by economists as bargaining chips ahead of a planned meeting between Donald Trump and Xi Jinping later this month. Also, a truce in the tariff fight is set to expire Nov. 10, unless extended.

Dollar-offshore yuan’s three-month implied volatility, a measure of its expected future movement during that time period, indicates there is a 77% probability the pair will trade in a range of 6.9433 to 7.2195 during that period. The pair was down 0.1% to 7.1231 on Thursday.

Dollar-offshore yuan risk reversals, which compare the cost of call options that gain value if the pair rises with that of put options that benefit if it falls, have been moving in favor of call options. This signals growing expectations the dollar will strengthen versus the Chinese currency in coming months.

“This has been driven both by unwinds of trades betting on offshore yuan strength as well as more demand for short-dated protection against offshore yuan weakness,” said Ruchir Sharma , London-based global co-head of FX options at Societe Generale SA. “The latter has been driven by recent headline noise around increased trade tensions and market nervousness ahead of the potential meeting between President Trump and President Xi.”