Gold Holds Near Record High on US-China Clash, Fed Rate-Cut Bets

Gold was steady near a record high as heightened US-China frictions and bets the Federal Reserve will ramp up monetary easing through the end of the year supported demand.

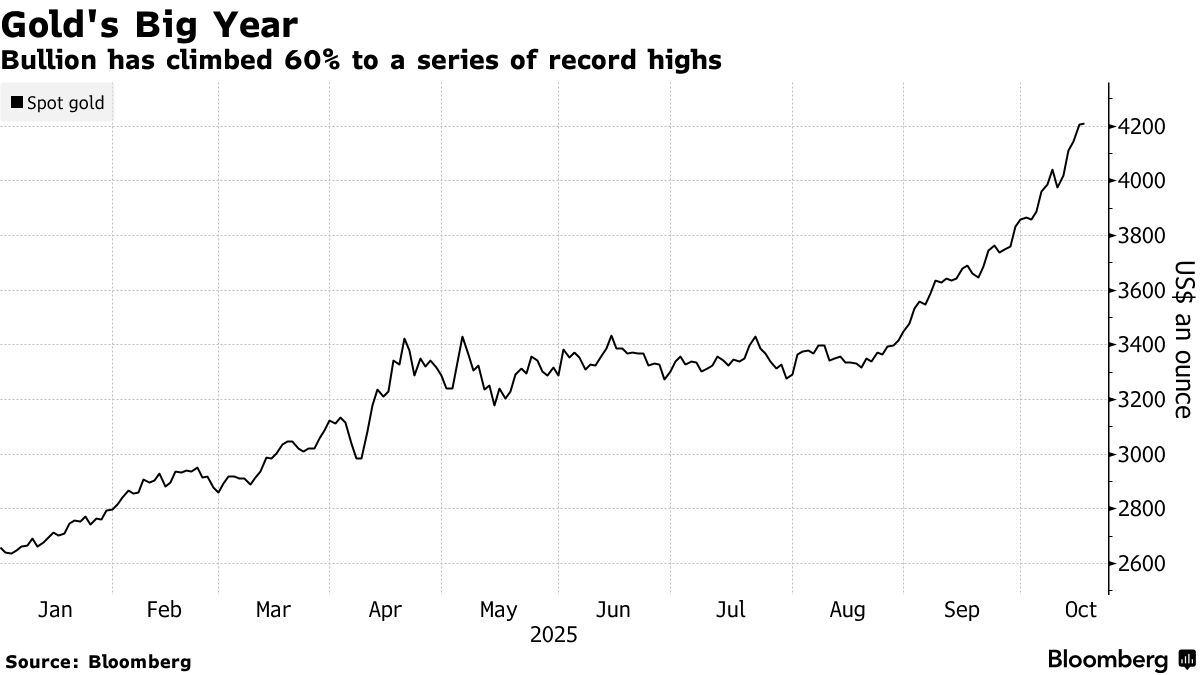

Bullion has risen almost 5% so far this week, touching a peak of $4,218.29 an ounce on Wednesday, as a breakneck rally underway since mid-August continued. The buying spree has spread to other precious metals, with silver surging 3.1% on Thursday as availability in the London market remained tight.

Traders are calling for at least one outsized US rate cut by year—end, while Fed Chair Jerome Powell signaled this week the central bank is on track to deliver another later this month. Lower borrowing costs tend to benefit precious metals, as they don’t pay interest.

President Donald Trump declared the US was now with China, spurring fears of prolonged damage to the global economy that could boost gold’s haven appeal, even as Treasury Secretary Scott Bessent proposed a longer pause before raising tariffs further.

The ongoing US government shutdown has also aided bullion, as has the so-called , where investors pull away from sovereign debt and currencies to protect themselves from runaway budget deficits. Enthusiastic has been another key pillar, underpinning a surge of around 60% in gold so far this year.

Read More:

Much of the gold rally “is being driven by physical buying, and if you look at central banks, they are going out and buying huge quantities,” said Saad Rahim , chief economist at Trafigura Group . Fears of debt sustainability and the prospect of lower rates have investors “looking to gold as a store of value and for safety,” he said.

Spot gold was steady at $4,209.11 an ounce as of 7:55 a.m. in Singapore. The dipped 0.1%, falling for a third day. Platinum was flat, while palladium edged higher.

The silver market, meanwhile, has been gripped by a lack of liquidity in London, sparking a worldwide hunt for the metal and driving benchmark prices to soar above futures in New York. Prices touched a record high above $53 an ounce this week and were little changed on Thursday.