Dollar Set for Worst Week Since June on Fed Bets, Bank Woes

The dollar fell for a fourth day, putting it on track for its biggest weekly drop in more than three months, amid dovish signals from Federal Reserve officials and fresh worries over US .

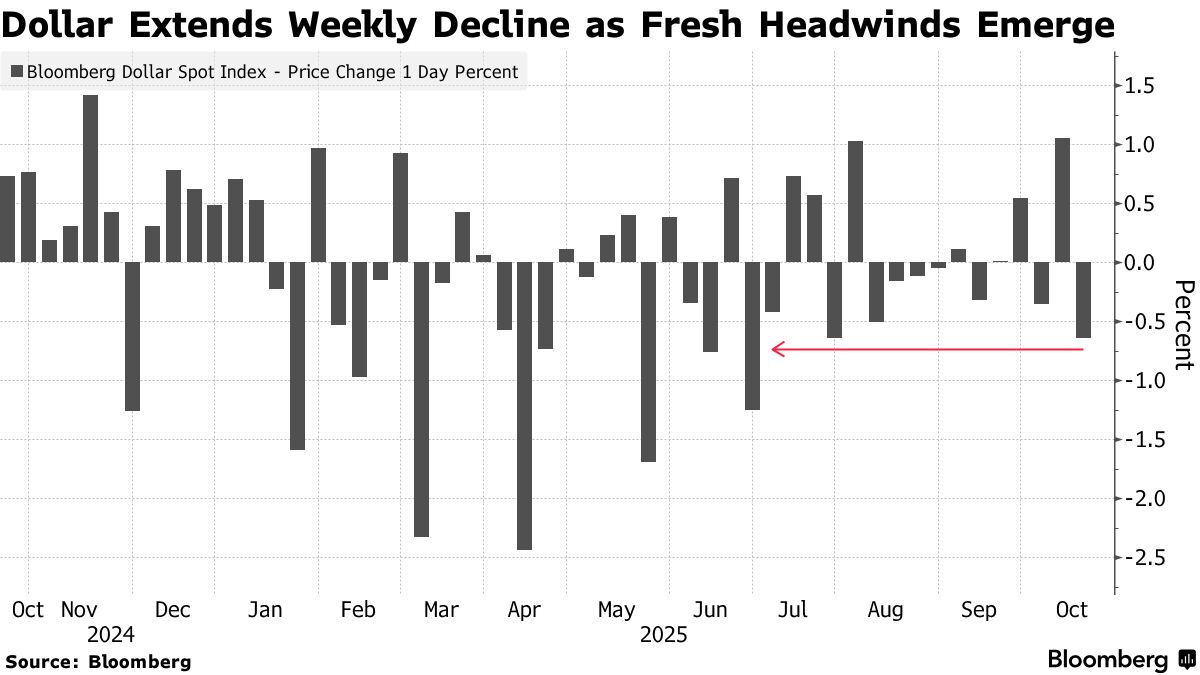

The Bloomberg Dollar Spot Index extended its weekly decline to 0.7%, its worst run since June, while Treasury two-year yields dropped to a six-week low. Traders boosted bets on Fed easing, and are now pricing 53 basis points of cuts by year-end versus 46 on Wednesday.

Fed Governor Christopher Waller said Thursday that officials can keep lowering interest rates in quarter-percentage-point increments to support a faltering labor market. Governor Stephen Miran , meanwhile, reiterated his view that a would be appropriate this month.

Even with the US government shutdown in its third week with little sign of resolution and a dearth of economic data, the Fed commentary spurred investors to add dovish exposure.

“The lack of economic data does not seem to be a problem for the Fed and we expect another 25-basis-point rate reduction at the October meeting,” Morgan Stanley economists led by Michael Gapen said in a note.

The dollar also softened as shares of regional lenders slumped on lending-standards concerns, and as political risks in Japan and France eased.

In options, near-term sentiment has turned more bearish over the next week, even as positioning still leans toward a stronger dollar into year-end.