China’s PBOC Vows Steps to Promote Use of Yuan Around the World

Chinese authorities to make it easier for onshore and overseas institutions to use the yuan, part of their push to promote the currency globally.

Beijing will support the yuan’s usage as a financing currency for foreign institutions and take measures to open up its financial markets, according to an article by a newspaper backed by the People’s Bank of China and published on the central bank’s social media account Friday. That would make cross-border trade more efficient and better serve the real economy, the report cited an unidentified PBOC official as saying.

The time is ripe for wider use of the yuan, as the international monetary system is becoming more diverse and there is increasing demand from various entities to use the Chinese currency, the official said.

Though short on details, the report is a clear signal of China’s commitment to internationalizing the yuan, given it was released shortly before top Communist Party officials meet later this month to lay out the road map for the country’s development over the next five years. The push comes as global investors look for alternatives to the dollar amid US interest-rate cuts and President Donald Trump’s tariff policies.

China aims to improve the transparency, standardization and predictability of its financial markets, while enhancing trading efficiency and liquidity, according to the article. It will also support the development of Shanghai as a global financial center and solidify Hong Kong’s role as an offshore yuan hub, the official said.

In recent months, policymakers have expanded access to China’s bond repurchase market, launched a payment system with Hong Kong and disclosed plans for some local investors to put more money into overseas assets. This year, the amount of money pouring in and out of China in search of investment opportunities is the value of goods and services traded for the first time ever.

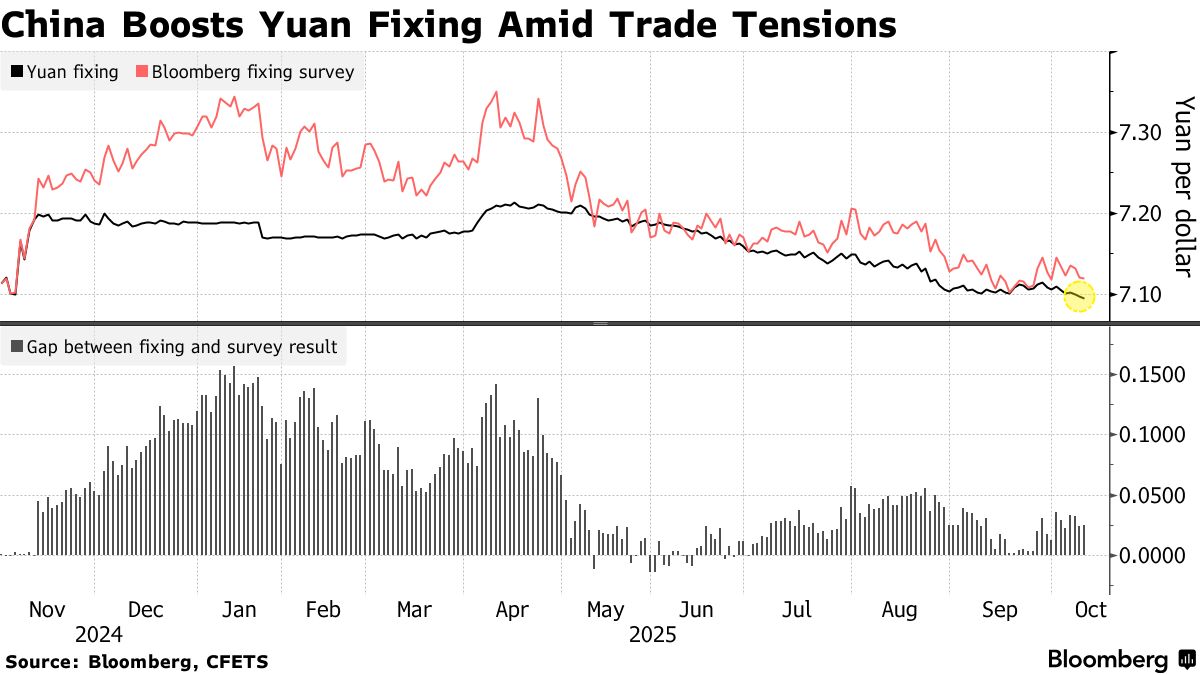

This week, the PBOC set a string of stronger-than-expected to support the yuan amid worsening trade tensions.

Despite the commitment, the yuan is still lagging the likes of the dollar and yen in terms of global usage, as it’s tightly managed by the PBOC with its daily reference rate and a trading band. The yuan’s interest-rate discount to the US remains wide.

“By suitably consolidating investment channels, we aim to attract more overseas institutions for orderly investment in the onshore market,” the article said.