Former FTX US Head Plans to Bring Key Crypto Feature to Stocks, Currencies

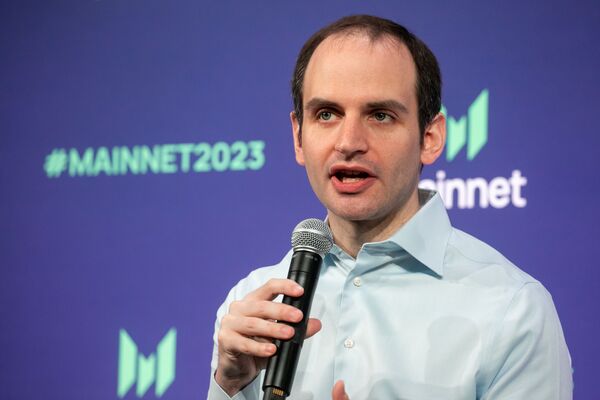

The former president of FTX US, Brett Harrison , is back with plans to bring a key force behind crypto market volatility to the more staid world of stocks and commodities trading: perpetual futures contracts.

While crypto venues regularly deal in these non-expiring contracts for digital assets, Harrison’s software startup Architect Financial Technologies plans to offer access for foreign currencies, interest rates, single stocks, stock indexes, metals, energy, and other commodities. The venture got approval to operate its new venue out of a regulated entity with the Bermuda Monetary Authority, according to Harrison.

“The market structure resembles that of modern, derivative assets, but it’s for traditional asset classes,” Harrison said in an interview. Eventually, the firm is looking to add more of these so-called perps, he said. “We have a long roadmap for launching perpetuals on emerging asset classes, like those that power the AI economy, including rare earth metals, renewable energy and data center compute costs.”

Perps have long been the engine of offshore crypto bets, powering massive trading volume on venues such as Binance and OKX. The contracts let traders make constant, leveraged bets on prices without ever taking delivery of the tokens, amplifying the crypto market’s wild swings. Retail traders have long embraced the products.

US regulators have yet to sign off on perpetuals, keeping all activity tied to crypto or traditional assets offshore. President Donald Trump’s deregulatory push has sparked optimism the asset class will soon be available.

At , the exchange to bring long-dated versions of perpetual Bitcoin and Ether futures to the US in November, pending regulatory approval.

Read more:

“It’s the perfect time to bring this type of innovation to traditional assets,” Harrison said.

Architect’s perpetual exchange, AX, will operate around the clock, giving investors global access to the contracts at all times, according to Harrison. The firm plans to take both regular fiat currency, as well as US dollar-based stable coins as collateral so it can transact even when the traditional wire system is closed, Harrison said.

The venue is operated by the firm’s Bermuda-based affiliate, Architect Bermuda Ltd. with a Bermuda regulatory license.

Harrison is building Architect based on his experience working at both an exchange and high-frequency trading firms. He was at FTX US for 17 months, stepping down in September of 2022 prior to the collapse of the crypto empire. Before that he spent time at market maker Citadel Securities and quantitative trading firm Jane Street Group, where he first worked with Sam Bankman-Fried .

The Chicago-based Architect is in the middle of it’s Series-A funding round for new backers, according to Harrison. The firm has raised $17 million from investors including Coinbase Ventures and Circle Ventures. Anthony Scaramucci and the SALT Fund where he’s chairman were also investors.