Ex-PBOC Adviser Makes Outlier Call for 2008-Style Mega Stimulus

China should let investment play a larger role in boosting the economy, a former central bank adviser said, breaking with the views of other prominent analysts by arguing in favor of a big infrastructure construction push.

While China’s policies are increasingly focused on promoting consumption-led growth, Yu Yongding is instead calling for a massive investment program in the next five-year planning period starting from 2026 with the goal of reviving domestic demand.

Yu, a former member of the monetary policy committee at the People’s Bank of China, proposes modeling it after the 4 trillion-yuan ($562 billion) stimulus package deployed in 2008.

“In a situation of inadequate demand, infrastructure investment delivers immediate economic results,” Yu said in an interview on the sidelines of the Bund Summit in Shanghai. “Measures to directly stimulate consumption have some effect. But even if intensified, they may not be enough to fill the gap in demand.”

The stimulus launched by China in 2008 to counter the global financial crisis was mainly used to fund infrastructure and represented about 12% of its gross domestic product at the time. A package on the same scale this time around would amount to some 16 trillion yuan relative to last year’s GDP .

The huge economic support provided almost two decades ago succeeded in preventing a recession with a construction boom that averted the threat of mass unemployment. But it also led to side effects, inflating a real estate bubble and leaving China burdened by a debt overhang.

For Yu, the role of trade as a driver of China’s economy is fading little by little and will diminish further in future. As he sees it, China should be able to boost household incomes by way of several initiatives including infrastructure projects — which would lead to more demand for building materials and construction work — and end up with a growth model more driven by internal demand than exports.

Wary of rising debt levels and wasteful investment, however, Chinese officials have since the pandemic refrained from adopting stimulus plans as ambitious as in 2008. And Yu’s views reveal a split among top economists over the best path forward if exports come under pressure.

A communique issued after a four-day conclave of the Communist Party’s Central Committee last week reiterated a pledge to boost consumption and investment but didn’t elaborate, leaving markets waiting for detailed policy guidance.

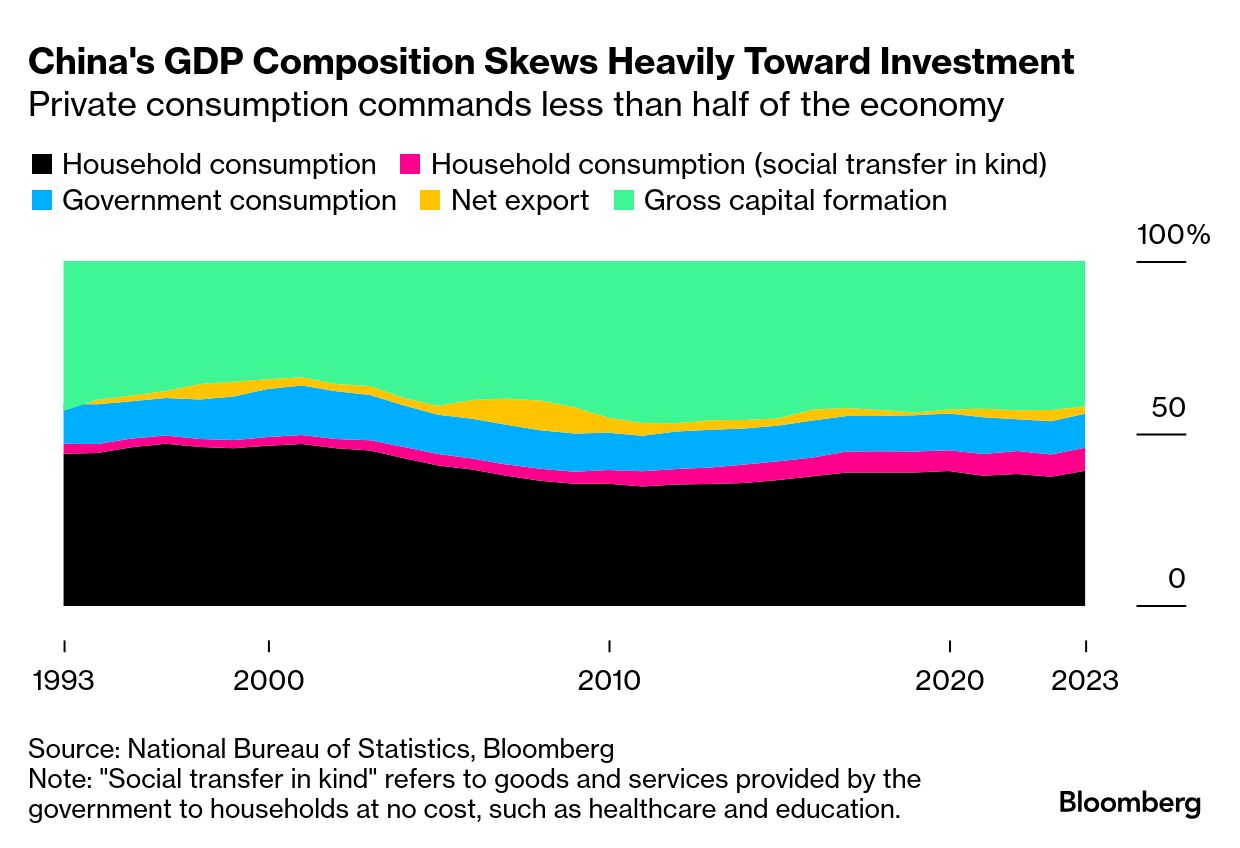

The mainstream view among economists now centers around making consumption — rather than investment — the primary growth driver.

Proponents of the position include Stephen Roach , former chairman of Morgan Stanley Asia, who’s that household consumption should account for half of China’s economy in the next decade, up from around 40% currently.

Huang Yiping , a current PBOC policy committee member, said on the sidelines of the Shanghai conference that China should find a balance between investment and consumption given existing overcapacity pressures.

Despite better-than-expected growth so far this year, China’s economy faces a challenging period ahead.

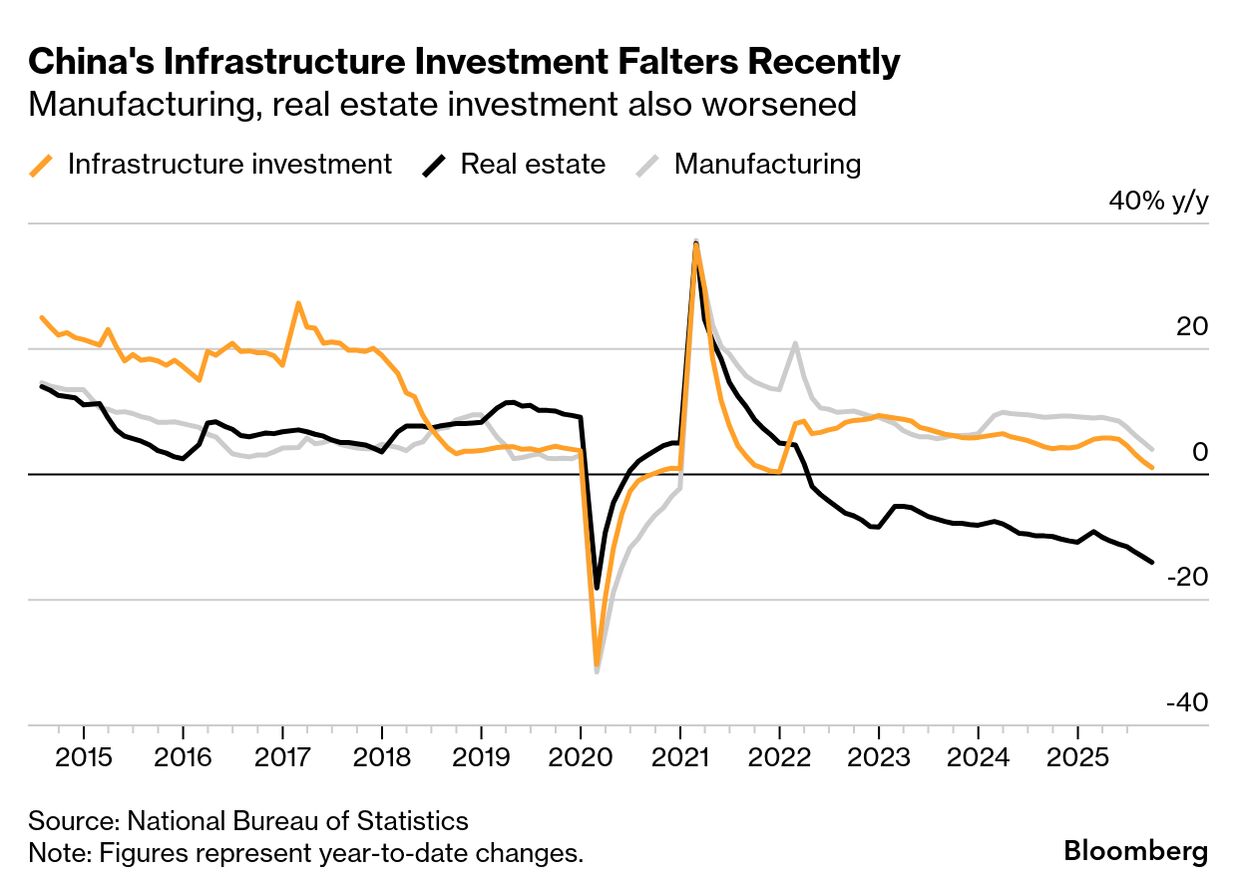

Economy-wide prices are set for the third straight year of declines, a deflationary cycle that threatens to stifle investment and drive down corporate revenues. Consumption also slowed in recent months as the impact of trade-in subsidies fades, while year-to-date investment shrank for the in September.

Yu, who sat on the monetary policy committee between 2004 and 2006, sees significant room for a rebound in infrastructure investment.

Key areas in need of capital include major construction projects, such as the in Tibet. Others range from underground pipeline upgrades to initiatives supporting high technology and service sectors like elderly care, he said.

Yu isn’t alone in seeing the potential for unleashing far more capital spending. Chinese think tank CF40 the need for at least 31 trillion yuan in public investment over the next five years.

And as consumer demand stagnates, China needs a catalyst to rev up growth.

China’s official goal of doubling the size of the economy by 2035 from 2020 levels means it needs to achieve an average annual growth of around 5%. That implies maintaining roughly the same clip of expansion as in the past two years — a relatively fast pace considering headwinds such as a shrinking population and a more hostile environment abroad.

Even though policies to boost the growth rate of consumption are appropriate, the economy will expand faster in the longer term if investment accounts for a higher share of GDP, Yu said.

China doubled its subsidies for consumer goods to 300 billion yuan this year from 2024, an effort that shored up spending by households.

But the impact of the program is diminishing, with retail sales growth slowing last month to just 3% from a year earlier. The nation’s auditors also uncovered the misuse of over 100 million yuan in funds allocated for subsidies across six provinces.

While acknowledging the importance of supporting consumption, Yu highlighted challenges such as slow income growth, weak expectations, and falling asset prices, which limit the effectiveness of direct stimulus measures.

“Countries with the highest consumption rates are often trapped in poverty,” he said, adding it’s more important to grow the overall economic pie.