Argentina Investors Poised for Rally After Milei Landslide Win

Argentine assets are set to rally as President Javier Milei ’s strong showing in legislative elections beat even the most bullish of forecasts, easing investor concern his economic overhaul of the crisis-prone nation would stall.

With more than 90% of ballots counted, Milei’s party got 41% of the votes, winning 64 seats of the 127 up for grabs in the lower house of Congress and 13 of the 24 open Senate posts, according to data published by local electoral authorities. Markets had been forecasting the governing coalition would win about 30% of seats. The peso was already posting gains in the crypto market Sunday as the results were announced.

Read More:

“The scale of Milei’s victory ranks at the most optimistic end of pre-election expectations,” Alejo Czerwonko , chief investment officer for EM Americas at UBS Global Wealth Management. “His party now holds the political capital needed to accelerate structural reforms.”

The results should also help ease doubts on whether the South American nation will continue to receive crucial support from the US. Prior to the vote, the Trump administration signed a $20 billion swap line with Argentina’s central bank to help stabilize the peso, and was with a group of banks for an additional $20 billion financing package.

Trump had previously signaled that he could withdraw his backing if Milei’s agenda were to be defeated, telling reporters “if he wins we’re staying with him, and if he doesn’t win .”

‘Rush’

“I’d expect a nice recovery in asset prices tomorrow — led by dollar bonds,” Christine Reed , emerging market local currency debt portfolio manager at Ninety One in New York, said in an interview. “The local bond curve should also rally considerably.”

The peso should recover too, since “the market went too long US dollar into the election,” said Matias Montes , a strategist at EMFI Securities. “Everyone is going to rush to close positions.”

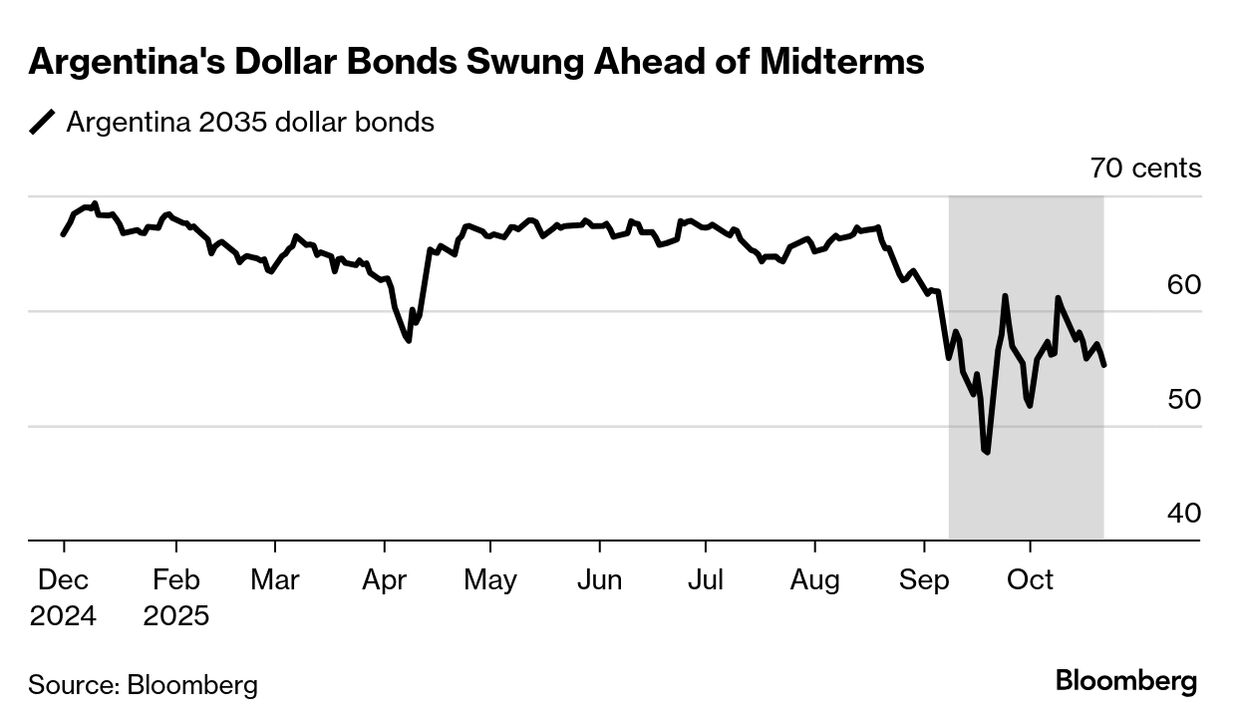

Milei’s ascent to power in 2023 unleashed a powerful across Argentina’s markets, lifting everything from stocks to sovereign bonds. The nation’s dollar debt has returned 144% since his election — trailing only Lebanon and Ecuador among emerging-market peers tracked by Bloomberg over the same period.

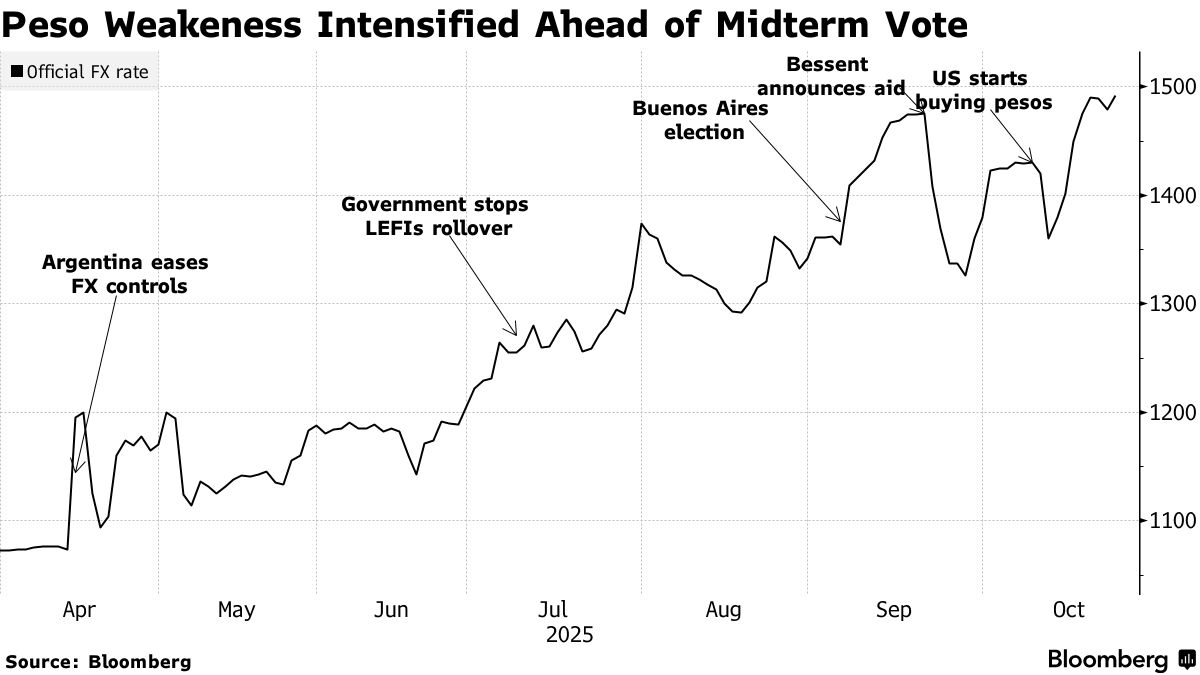

Those gains began to unravel last month after Milei’s poor showing at local election. Yields on sovereign notes due 2035 skyrocketed past 17%, while the currency slumped as much as 7% in a single session as investors questioned Milei’s ability to get enough support in Congress to push through his extensive economic agenda.

The unprecedented support from the US Treasury helped , but not reverse the negative sentiment. Conflicting statements from US and Argentine officials — often lacking much detail — further stoked .

Direct US intervention has kept the peso — key for Milei to keep from resurfacing — within the trading boundaries agreed to as part of Argentina’s latest deal with the International Monetary Fund back in April. While neither government has confirmed the size of the intervention, traders the US has spent more than $1 billion buying up pesos and offering dollars as Argentines flee to the greenback amid concerns of a devaluation.

But the peso has continued to , closing on Friday at 1,492 per dollar within cents of its weakest limit. While trading in the spot market doesn’t start until mid-morning, early indications on the crypto market showed it at 1,435 — which would indicate an advance of about 4.8%.

Milei and his party have “emerged as big winners with a renewed mandate,” said Kathryn Exum , co-head of sovereign research at Gramercy Funds Management. “With this win, governors and politicians should have willingness to work with Milei under the right conditions opening the possibility for reforms.”

Ahead of the vote, strategists at some of Wall Street’s main banks were betting Milei would get a third of the vote. That would be enough to secure the president’s veto powers and limit Congress from derailing his plans. For investors, US support combined with a more pragmatic, moderate shift from Milei could provide enough relief to the country’s battered currency.

The decisive victory puts Milei’s party “in good shape” to negotiate with other groups to pass the reforms, according to Joaquin Bagues, managing director at local broker Grit Capital Group.

“Let the party begin,” he said.