China Signals Shift in Yuan Push as PBOC Drops Cautious Tone

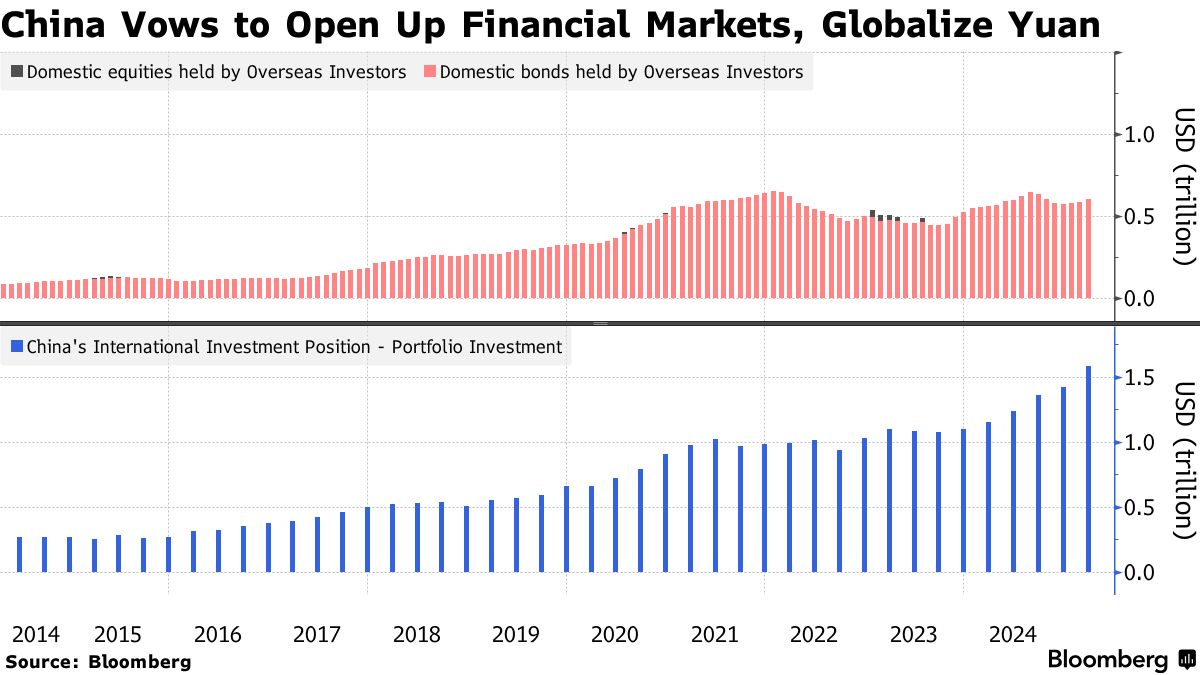

China’s central bank appears to be taking a more assertive stance in its push to expand the yuan’s role in the global monetary system.

The People’s Bank of China said late Friday that China will promote the yuan’s internationalization, expand the currency’s use in trade, deepen the two-way opening of financial markets in an orderly manner, and further develop the offshore yuan market.

The , issued after an implementation meeting for policies from the Communist Party Central Committee’s plenum, marked a shift from the cautious tone of recent years by dropping some of the usual qualifying words. In 2020, the CCP’s called for advancing the yuan’s role in “a prudent and steady manner,” a message with calls for progress “steadily, cautiously and on a solid foundation.”

“We anticipated that language on yuan internationalization,” said Ding Shuang , chief economist for Greater China & North Asia at Standard Chartered Bank. “The PBOC officials have become more this year about their ambition to promote the yuan as one of the leading global currencies to reduce reliance on the dollar, amid the global search for alternative safe assets.”

Officials’ latest pledges suggest Beijing is seizing a to advance its goals, as the dollar’s safe-haven status faces pressure from uncertain trade policies, fiscal woes and concerns over the Federal Reserve’s independence.

China may gradually open up its financial account further, supported by a strong current account and experience managing capital flows, Ding said. There’s also potential for a continued rise in the share of Chinese trade settled in yuan, he added.

Other plans listed by the PBOC include supporting the development of Shanghai and Hong Kong as international financial centers, continuing to build a cross-border yuan payment system described as “independent, controllable with multiple channels and a wide coverage,” and strengthening multilateral and bilateral monetary and financial cooperation.

A more detailed articulation of China’s yuan policies will be released in a separate document outlining the proposal for the 15th Five-Year Plan, expected a few days after the plenum.

“We’ve achieved some progress in yuan settlement in recent years,” Yu Yongding , a former member of the PBOC’s monetary policy committee, said during a panel at the Bund Summit in Shanghai on Saturday. “But to make the yuan an international reserve currency, the progress has been too slow.”

Read More: How a Weak Dollar Helps China Open Up Capital Flows: QuickTake