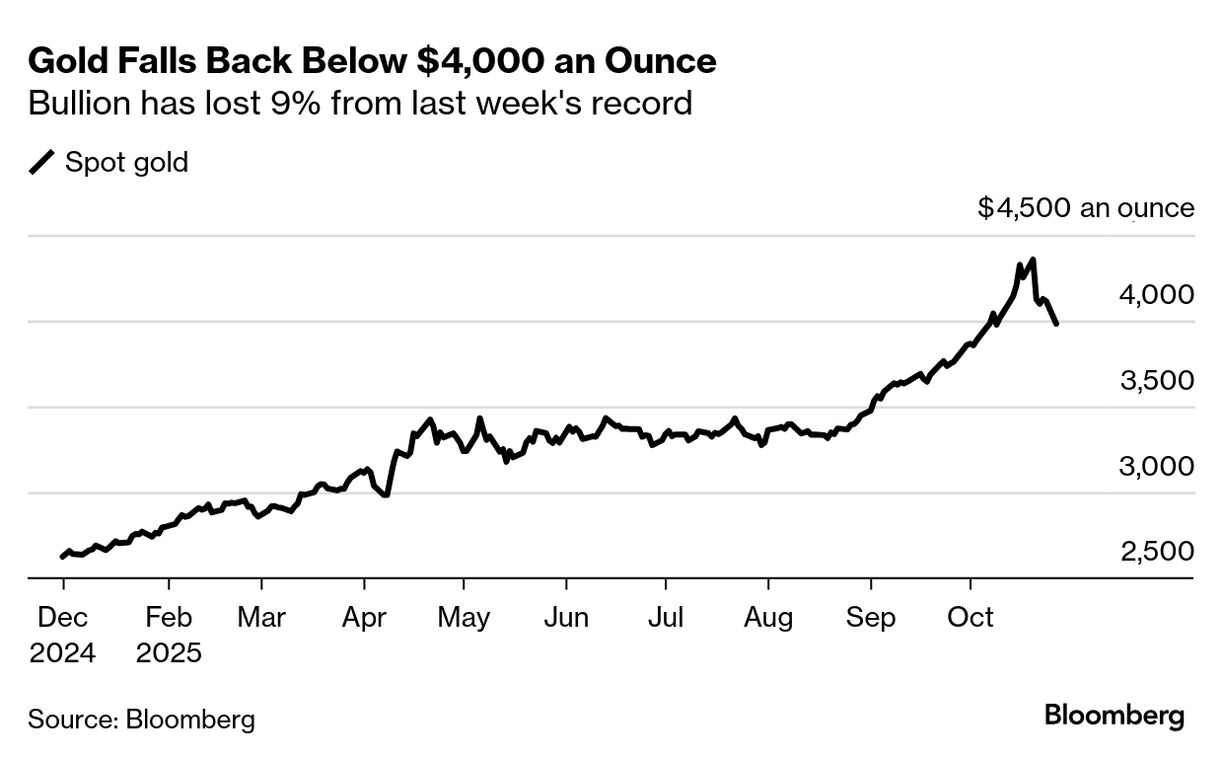

Gold Holds Below $4,000 as US-China Progress Damps Haven Demand

Gold steadied after plunging below $4,000 an ounce, as US-China trade talks weighed on demand for haven assets.

Bullion traded near $3,990 an ounce, following a 3.2% decline on Monday after negotiators from Washington and Beijing said they’d of agreements on issues including tariffs and export controls. Treasuries even as traders stuck to bets that the Federal Reserve is set to loosen monetary policy this week, with higher yields weighing on non-interest bearing gold.

Gold has slumped after hitting a record just above $4,380 an ounce last Monday following a blistering rally. It is still among this year’s best performing assets, with central-bank buying and the so-called debasement trade — in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits — providing support and attracting retail speculators.

“Crowded longs can unwind quickly when leveraged traders rush to lock in profits,” Chris Weston , head of research at Pepperstone Group Ltd., said in a note. “While gold continues to make lower lows and futures volumes remain elevated on down days, calling the bottom is a tough ask — requiring both skill and a bit of luck. For now, it makes more sense to let others do the hard work and tactically buy a rip after the dip.”

Read More:

President Donald Trump’s shift toward dealing-making with China and other countries, alongside changing price momentum in the gold market and a possible end to the US government shutdown, is set to propel the metal lower over the coming days and weeks, Citigroup Inc. analysts including Max Layton said in a Monday note. The analysts see bullion falling to $3,800 in the next three months.

Gold’s rapid rise this year — and its recent retreat — has been a hot topic of conversation at a precious metal conference run by London Bullion Market Association, which began on Sunday in Kyoto. Central bank demand isn’t as strong as it was, and a deeper correction might be welcomed by professional dealers, John Reade , market strategist at the World Gold Council, said on Monday at the event — the biggest annual gathering for the industry.

Meanwhile, Citigroup and Morgan Stanley are among banks preparing to challenge the dominance of JPMorgan Chase & Co. in the global gold market by seeking to offer vaulting services in London. The two banks are seeking to become clearing members for the market, , citing people familiar with the matter, who asked not to be identified as they weren’t authorized to speak publicly.

Read More:

Elsewhere, investors were also weighing a list of five finalists to succeed Fed Chair Jerome Powell — who is due to leave his post in May next year. Treasury Secretary Scott Bessent the candidate pool has narrowed to current Fed board members Christopher Waller and Michelle Bowman , former Fed Governor Kevin Warsh , White House National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder .

More immediately, Fed policymakers are widely expected to lower rates by 25 basis points at their two-day policy meeting, which concludes on Wednesday. That would be the second such move in a row. Lower borrowing costs tend to benefit precious metals, which do not pay interest.

Spot gold edged 0.1% higher to $3,985.27 an ounce as of 7:17 a.m. in Singapore. Silver steadied, after sliding 3.7% on Monday. Platinum and palladium were little changed.