Pound Falls as Investors Prepare for Economic Blow From Budget

The pound is coming under pressure as investors brace for potential tax rises and spending cuts in the upcoming UK budget that may exacerbate the economic slowdown.

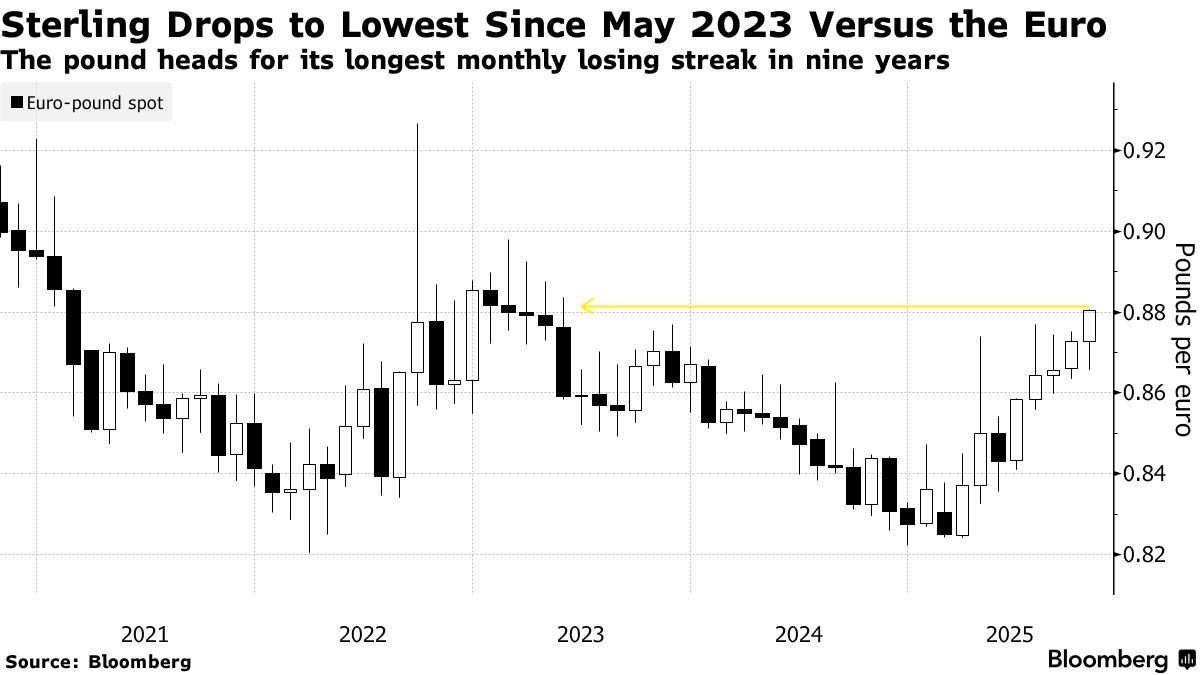

Sterling hit its weakest against the euro since 2023 on Wednesday and is on track for the longest monthly losing streak in nine years. Options pricing is the most bearish in three months and strategists at Nomura Holdings Inc, Wells Fargo & Co and Rabobank are predicting further losses.

The UK’s fiscal watchdog is to significantly downgrade its productivity growth forecast, making it harder for Chancellor Rachel Reeves to meet her fiscal rules at the Nov. 26 budget. A Barclays Plc analysis estimates she may need to impose £40 billion of spending cuts and tax increases, likely hitting economic growth.

A slowing economy increases the chances of rate reductions, which in turn undermine the appeal of the pound.

There’s a “heavy dose of gloom ahead of the budget,” said Jane Foley , head of FX strategy at Rabobank, who expects a “slow grind” higher in the euro-sterling exchange rate. Recent reports suggest more tax hikes and spending cuts “than many market participants would have been preparing for,” she said.

Reeves’ budget has been made more challenging by the Office for Budget Responsibility’s economic projections, which are expected to be gloomy. The fiscal watchdog has been too optimistic about the productivity of Britain’s economy in recent years and plans a negative correction.

Falling gilt yields in recent weeks are welcome news to the government, because they lower the interest is pays on its debt. But expectations of further Bank of England interest-rate cuts have hobbled sterling’s appeal compared with other countries.

On Wednesday, the euro rose above 88 pence for the first time in over two years. Meanwhile, sterling fell to its lowest level against the dollar since August at $1.3198.

Cooling inflation is also helping the case for rate reductions. On Tuesday, the British Retail Consortium revealed that UK food prices posted the largest monthly drop since late 2020.

Goldman Sachs economists expect the BOE to cut rates next week, citing recent economic data. The Nov. 26 budget seems likely to deliver “a large, contractionary impulse to the economy,” they said.

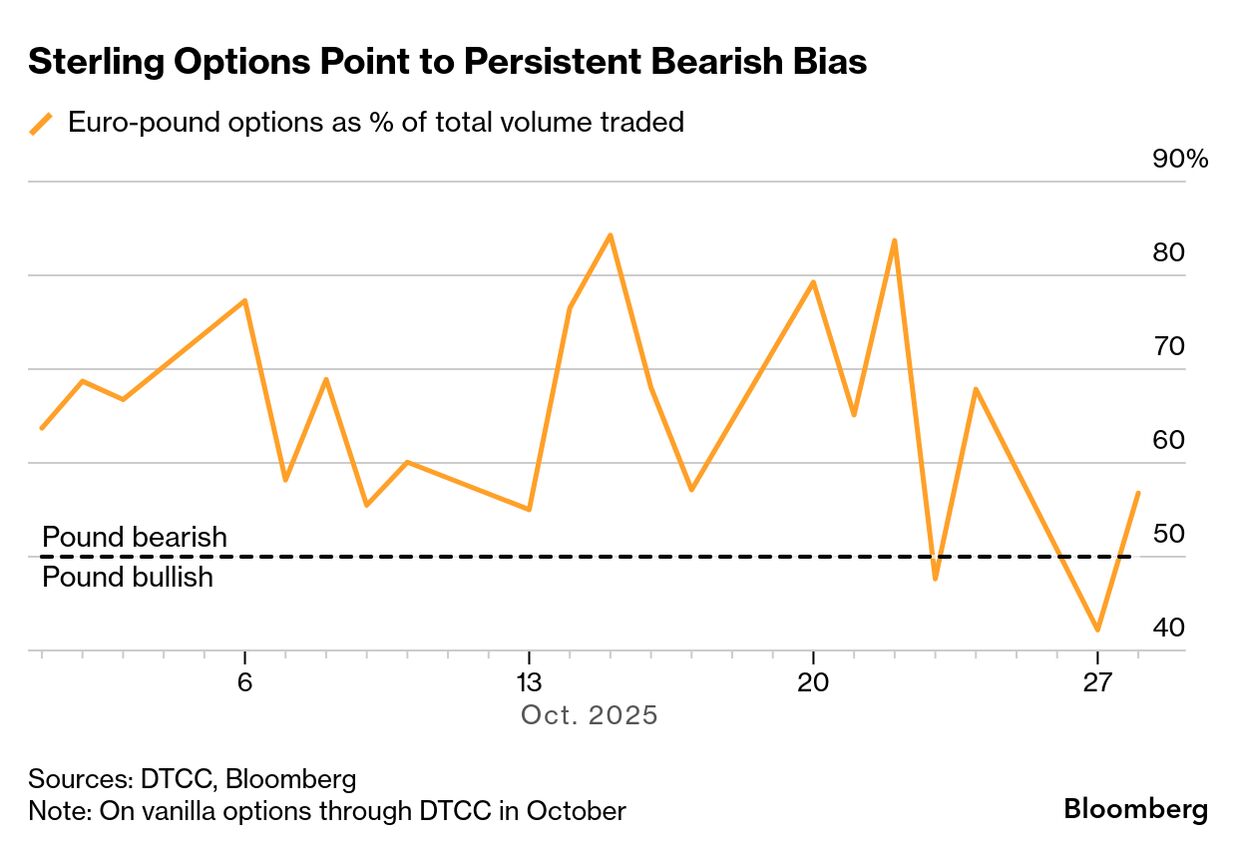

Options markets point to further pound weakness. So-called risk reversals, a closely watched gauge of positioning and sentiment, are most bearish the pound since July.

The cost of insuring against swings in sterling over the next month hit its largest premium relative to the euro since 2023. The premium began to rise after the tenor captured the period that includes the Nov. 26 budget.

Flows underscore traders’ conviction, with the pound dropping for a fifth month.

Options traded through the Depository Trust & Clearing Corporation in October show that nearly two-thirds of trades positioned for a stronger euro. Only two sessions in the month saw pound-bullish structures outweigh bearish ones.